Did You Manage To Avoid BHCC Holding's (HKG:1552) Painful 51% Share Price Drop?

The nature of investing is that you win some, and you lose some. Anyone who held BHCC Holding Limited (HKG:1552) over the last year knows what a loser feels like. To wit the share price is down 51% in that time. Because BHCC Holding hasn't been listed for many years, the market is still learning about how the business performs. The falls have accelerated recently, with the share price down 25% in the last three months. But this could be related to the weak market, which is down 16% in the same period.

See our latest analysis for BHCC Holding

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate twelve months during which the BHCC Holding share price fell, it actually saw its earnings per share (EPS) improve by 10%. It could be that the share price was previously over-hyped.

The divergence between the EPS and the share price is quite notable, during the year. But we might find some different metrics explain the share price movements better.

In contrast, the 17% drop in revenue is a real concern. Many investors see falling revenue as a likely precursor to lower earnings, so this could well explain the weak share price.

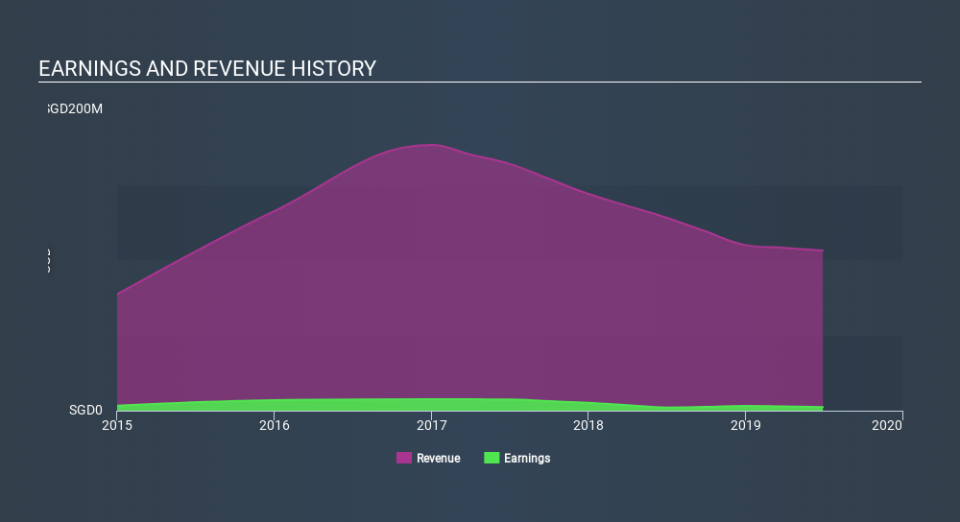

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

BHCC Holding shareholders are down 51% for the year, even worse than the market loss of 17%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. The share price decline has continued throughout the most recent three months, down 25%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for BHCC Holding (of which 2 are significant!) you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance