Did Changing Sentiment Drive Mammoth Energy Services's (NASDAQ:TUSK) Share Price Down A Painful 92%?

Mammoth Energy Services, Inc. (NASDAQ:TUSK) shareholders should be happy to see the share price up 18% in the last month. But that is meagre solace when you consider how the price has plummeted over the last year. Specifically, the stock price nose-dived 92% in that time. So the rise may not be much consolation. Only time will tell if the company can sustain the turnaround.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for Mammoth Energy Services

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

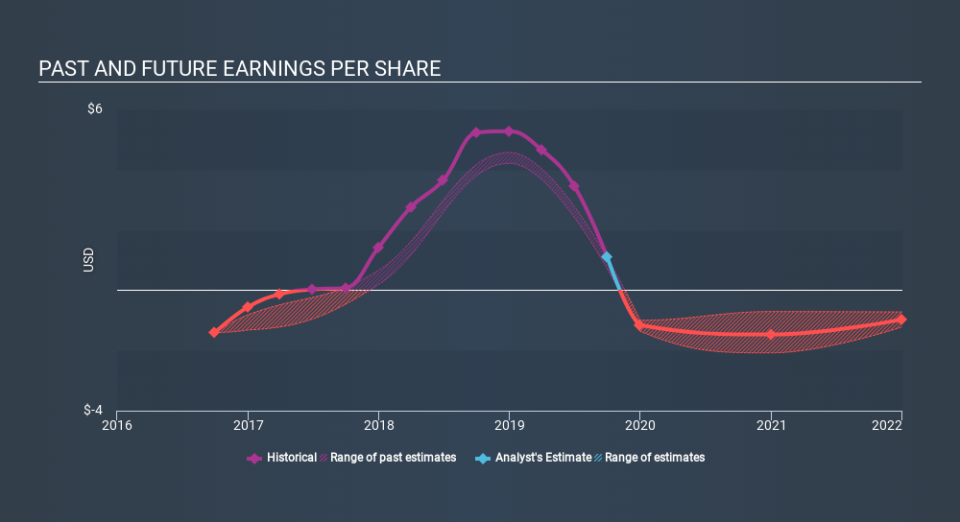

Unhappily, Mammoth Energy Services had to report a 79% decline in EPS over the last year. We note that the 92% share price drop is very close to the EPS drop. Therefore one could posit that the market has not become more concerned about the company, despite the lower EPS. Instead, the change in the share price seems to reduction in earnings per share, alone.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Mammoth Energy Services has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Mammoth Energy Services's financial health with this free report on its balance sheet.

A Different Perspective

Mammoth Energy Services shareholders are down 92% for the year, but the broader market is up 28%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Shareholders have lost 53% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. If you would like to research Mammoth Energy Services in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance