Did Changing Sentiment Drive Fluence's (ASX:FLC) Share Price Down By 47%?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Fluence Corporation Limited (ASX:FLC) shareholders should be happy to see the share price up 23% in the last quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. After all, the share price is down 47% in the last three years, significantly under-performing the market.

Check out our latest analysis for Fluence

Fluence isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

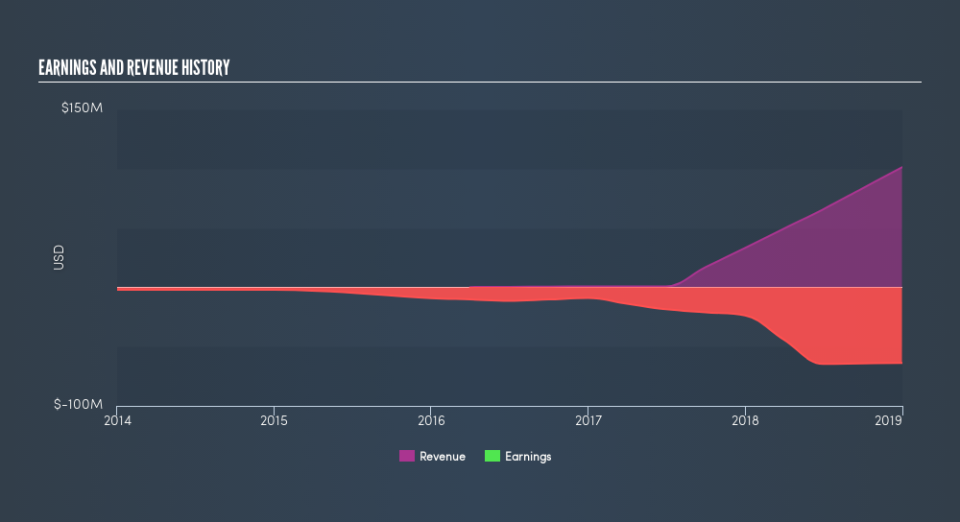

In the last three years, Fluence saw its revenue grow by 127% per year, compound. That's well above most other pre-profit companies. While its revenue increased, the share price dropped at a rate of 19% per year. That seems like an unlucky result for holders. It's possible that the prior share price assumed unrealistically high future growth. Before considering a purchase, investors should consider how quickly expenses are growing, relative to revenue.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Dive deeper into the earnings by checking this interactive graph of Fluence's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Fluence shareholders have gained 18% (in total) over the last year. This recent result is much better than the 19% drop suffered by shareholders each year (on average) over the last three. The optimist would say this is evidence that the stock has bottomed, and better days lie ahead. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Fluence by clicking this link.

Fluence is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance