Diamondback (FANG) to Report Q3 Earnings: What's in Store?

Diamondback Energy, Inc. FANG is set to report third-quarter 2019 results on Tuesday Nov 5, after the closing bell.

The current Zacks Consensus Estimate for the to-be-reported quarter is pegged at earnings of $1.73 on revenues of $1.05 billion.

Let’s delve into the factors that might have influenced the company’s performance in the September quarter.

Factors at Play

Last year’s twin acquisitions of Energen Corporation and Ajax Resources transformed Diamondback into one of the leading Permian Basin oil producers, driving significant production growth. This trend has most likely continued in the third quarter. As such, the company’s production volumes for the period to be reported are estimated to average 286,386 barrels of oil equivalent per day (BOE/d), suggesting an increase of 132.8% from the year-ago output of 122,975 BOE/d.

However, the company’s upcoming results might further reflect the impact of weaker realized crude prices from the year-ago reported level. The Zacks Consensus Estimate for third-quarter average crude price realization stands at $52 per barrel, implying a 7.14% decline from $56 a year ago. The Zacks Consensus Estimate for natural gas prices is pegged at $1.05 per thousand cubic feet, hinting at a decrease from the prior-year reported realization of $1.90.

While significant output growth is expected to have boosted Diamondback’s third-quarter 2019 earnings, weaker year-over-year commodity prices might have dented overall results.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Diamondback this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But this is not the case here.

Earnings ESP: Diamondback has an Earnings ESP of -1.06%, which represents the percentage difference between the Most Accurate Estimate and the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Diamondback currently has a Zacks Rank #3 (Hold).

Highlights of Q2 Earnings & Surprise History:

Diamondback reported second-quarter results, witnessing a comprehensive miss. Weaker-than-expected natural gas price realizations caused this underperformance. The company posted adjusted net income per share of $1.70, lagging the Zacks Consensus Estimate of $1.74 but increasing from the year-ago figure of $1.59.

Meanwhile, this Permian pure play’s total revenues of $1,021 million missed the Zacks Consensus Estimate of $1,035 million but soared nearly 94% year over year.

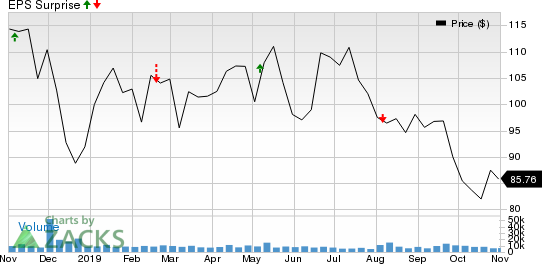

As far as earnings surprises are concerned, this independent oil and gas exploration & production company’s earnings missed the Zacks Consensus Estimate in two of the trailing four quarters, the average miss being -3.88%. This is depicted in the graph below:

Diamondback Energy, Inc. Price and EPS Surprise

Diamondback Energy, Inc. price-eps-surprise | Diamondback Energy, Inc. Quote

Stocks to Consider

While earnings beat looks uncertain for Diamondback, here are some companies from the energy space worth considering on the basis of our model, which shows that these have the right combination of elements to surpass estimates in the upcoming quarterly reports:

NuStar Energy L.P. NS has an Earnings ESP of +47.01% and a Zacks Rank of 3. This master limited partnership is scheduled to release earnings on Nov 5. You can see the complete list of today’s Zacks #1 Rank stocks here.

Oasis Midstream Partners LP OMP has an Earnings ESP of +15.85% and is Zacks #3 Ranked. This Houston-based midstream company engaged in crude gathering, stabilization, blending and transportation services is scheduled to release earnings on Nov 5.

Parsley Energy, Inc. PE has an Earnings ESP of +1.06% and is a #3 Ranked stock. This Texas-based independent oil and natural gas company is scheduled to release earnings on Nov 5.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.5% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NuStar Energy L.P. (NS) : Free Stock Analysis Report

Diamondback Energy, Inc. (FANG) : Free Stock Analysis Report

Parsley Energy, Inc. (PE) : Free Stock Analysis Report

Oasis Midstream Partners LP (OMP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance