Is DexCom's (NASDAQ:DXCM) Share Price Gain Of 287% Well Earned?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. For instance, the price of DexCom, Inc. (NASDAQ:DXCM) stock is up an impressive 287% over the last five years. It's also good to see the share price up 46% over the last quarter.

Check out our latest analysis for DexCom

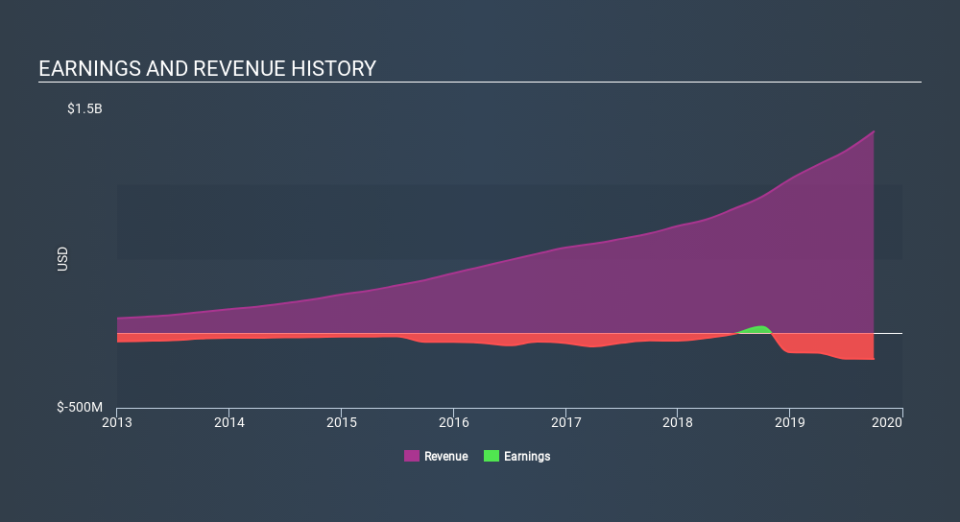

Because DexCom is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years DexCom saw its revenue grow at 31% per year. That's well above most pre-profit companies. Meanwhile, its share price performance certainly reflects the strong growth, given the share price grew at 31% per year, compound, during the period. This suggests the market has well and truly recognized the progress the business has made. To our minds that makes DexCom worth investigating - it may have its best days ahead.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

DexCom is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think DexCom will earn in the future (free analyst consensus estimates)

A Different Perspective

We're pleased to report that DexCom shareholders have received a total shareholder return of 73% over one year. That gain is better than the annual TSR over five years, which is 31%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Before spending more time on DexCom it might be wise to click here to see if insiders have been buying or selling shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance