Despite Its High P/E Ratio, Is Pujiang International Group Limited (HKG:2060) Still Undervalued?

This article is for investors who would like to improve their understanding of price to earnings ratios (P/E ratios). To keep it practical, we'll show how Pujiang International Group Limited's (HKG:2060) P/E ratio could help you assess the value on offer. Looking at earnings over the last twelve months, Pujiang International Group has a P/E ratio of 21.02. That is equivalent to an earnings yield of about 4.8%.

See our latest analysis for Pujiang International Group

How Do I Calculate A Price To Earnings Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Share Price (in reporting currency) ÷ Earnings per Share (EPS)

Or for Pujiang International Group:

P/E of 21.02 = CN¥2.920 ÷ CN¥0.139 (Based on the year to December 2019.)

(Note: the above calculation uses the share price in the reporting currency, namely CNY and the calculation results may not be precise due to rounding.)

Is A High P/E Ratio Good?

A higher P/E ratio means that buyers have to pay a higher price for each CN¥1 the company has earned over the last year. That isn't necessarily good or bad, but a high P/E implies relatively high expectations of what a company can achieve in the future.

Does Pujiang International Group Have A Relatively High Or Low P/E For Its Industry?

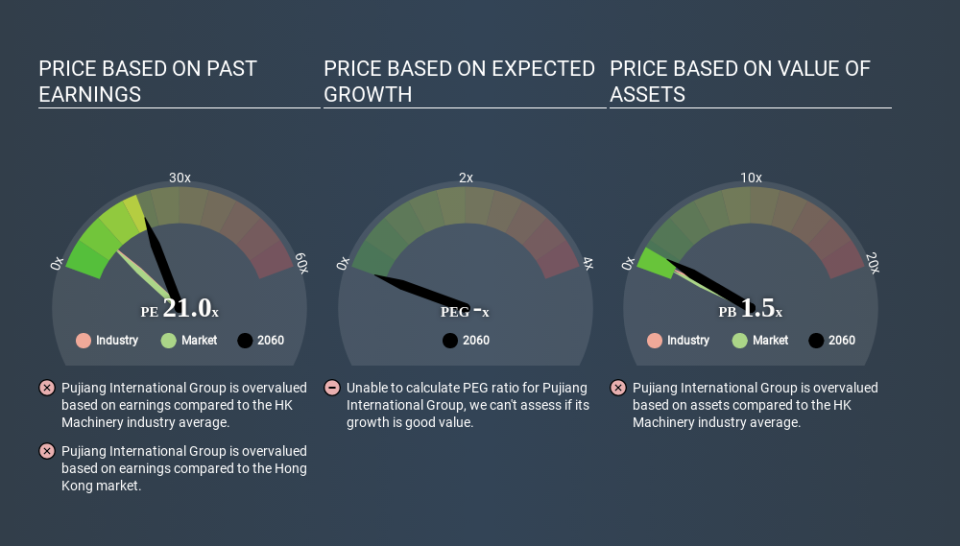

We can get an indication of market expectations by looking at the P/E ratio. You can see in the image below that the average P/E (9.9) for companies in the machinery industry is lower than Pujiang International Group's P/E.

Pujiang International Group's P/E tells us that market participants think the company will perform better than its industry peers, going forward. Clearly the market expects growth, but it isn't guaranteed. So investors should delve deeper. I like to check if company insiders have been buying or selling.

How Growth Rates Impact P/E Ratios

Generally speaking the rate of earnings growth has a profound impact on a company's P/E multiple. If earnings are growing quickly, then the 'E' in the equation will increase faster than it would otherwise. Therefore, even if you pay a high multiple of earnings now, that multiple will become lower in the future. Then, a lower P/E should attract more buyers, pushing the share price up.

Pujiang International Group shrunk earnings per share by 28% over the last year.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

One drawback of using a P/E ratio is that it considers market capitalization, but not the balance sheet. That means it doesn't take debt or cash into account. In theory, a company can lower its future P/E ratio by using cash or debt to invest in growth.

While growth expenditure doesn't always pay off, the point is that it is a good option to have; but one that the P/E ratio ignores.

Pujiang International Group's Balance Sheet

Pujiang International Group's net debt is 23% of its market cap. This could bring some additional risk, and reduce the number of investment options for management; worth remembering if you compare its P/E to businesses without debt.

The Bottom Line On Pujiang International Group's P/E Ratio

Pujiang International Group has a P/E of 21.0. That's higher than the average in its market, which is 9.6. With modest debt but no EPS growth in the last year, it's fair to say the P/E implies some optimism about future earnings, from the market.

When the market is wrong about a stock, it gives savvy investors an opportunity. If the reality for a company is better than it expects, you can make money by buying and holding for the long term. We don't have analyst forecasts, but shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with modest (or no) debt, trading on a P/E below 20.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance