Descartes (DSGX) Acquires Aerospace Software Developments

Descartes Systems DSGX recently announced the acquisition of Aerospace Software Developments (“ASD”). DSGX paid approximately €57 million ($61 million) to acquire ASD, a deal settled with €54 million paid upfront from DSGX’s cash reserves. The acquisition is projected to be completed in DSGX’s fourth-quarter fiscal 2025.

Based in Dublin, Ireland, ASD is a software company that builds mission-critical applications based on modern RFID technology, specifically engineered for the Aerospace and Aviation market sector. The cutting-edge technology aids the air logistics community in tracking assets by excluding manual tasks and adhering to multiple airline regulations more seamlessly via asset tagging and tracking.

ASD designs premium customs declaration software solutions for logistics services providers (LSPs) and shippers. It offers its customs filing solutions under the brand, Thyme-IT, which aids importers, exporters and LSPs to meet Irish regulatory standards for imports and exports efficiently and securely.

Further, DSGX highlighted that the integration of its Global Logistics Network (“GLN”) with ASD’s rich Irish customs domain expertise and modern multi-country customs technology platform is likely to prove complementary to its existing product footprint.

GLN solution was designed to aid shippers, carriers and LSPs in managing the entire lifecycle of shipments.

Also, the company expects the airline community to gain from the integration of ASD’s RFID-based solutions with Descartes’ CORE BLE real-time tracking platform.

Strategic acquisitions have played a pivotal role in top-line expansion for the company. In March 2024, the company acquired OCR Services, Inc., specializing in global trade compliance solutions and content. OCR’s controlled export data is instrumental in broadening DSGX’s vast global trade content library for customers and partners, including SAP and Oracle.

Some other notable acquisitions in the recent past are Localz (2023), GroundCloud (2023) and Supply Vision (2023).

Headquartered in Waterloo, Canada, DSGX provides on-demand, software-as-a-service logistics solutions across the globe. Continued momentum in real-time visibility, Global Trade Intelligence and routing and scheduling solutions are driving its top-line growth.

For fiscal 2024, DSGX reported revenues of $572.9 million, up 18% from fiscal 2023.

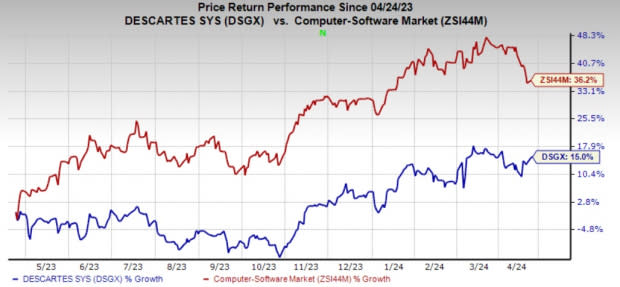

At present, DSGX carries a Zacks Rank #2 (Buy). Shares of the company have gained 15% compared with the sub-industry’s growth of 36.2%.

Image Source: Zacks Investment Research

Other Stocks to Consider

Pinterest PINS, sporting a Zacks Rank #1 (Strong Buy) at present, delivered a trailing four-quarter average earnings surprise of 37.42%. In the last reported quarter, it delivered an earnings surprise of 3.92%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Pinterest is increasingly establishing a unique value proposition to advertisers that could provide a competitive advantage in the long haul. Through various innovations, it continues to dramatically improve the advertising platform, which appears to be one of the best ad platforms for consumer discretionary brands looking for ways to reach customers and stretch smaller ad budgets.

NVIDIA Corporation NVDA, currently carrying a Zacks Rank #2, delivered a trailing four-quarter average earnings surprise of 20.18%. In the last reported quarter, it delivered an earnings surprise of 13.41%.

NVIDIA is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit. Over the years, the company’s focus evolved from PC graphics to AI-based solutions that support high-performance computing, gaming and virtual reality platforms.

Arista Networks, Inc. ANET, sporting a Zacks Rank #1 at present, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 17.5% and delivered an earnings surprise of 13.3%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

The Descartes Systems Group Inc. (DSGX) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance