Dell Technologies' Dividend Hike, FCF Make the Stock Look Cheap

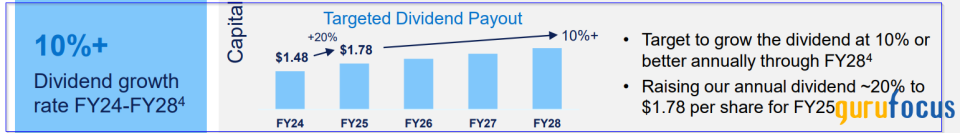

On Feb. 29, Dell Technologies Inc. (NYSE:DELL) released its earnings for the fiscal year ending Feb. 2, 2024. It also announced a 20% hike in its dividend to $1.78 per share. This gives the stock a 1.59% dividend yield based on its price of $112.11 on March 22.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

As a result, the stock looks very interesting now to value investors for several reasons.

First, Dell plans on growing the dividend per share by 10% annually for the next four years.

Source: Dell Q4 2024 earnings deck.

The company also says it will return at least 80% of its free cash flow to shareholders. That will include buybacks. As a result, we can forecast that its buybacks are likely to rise.

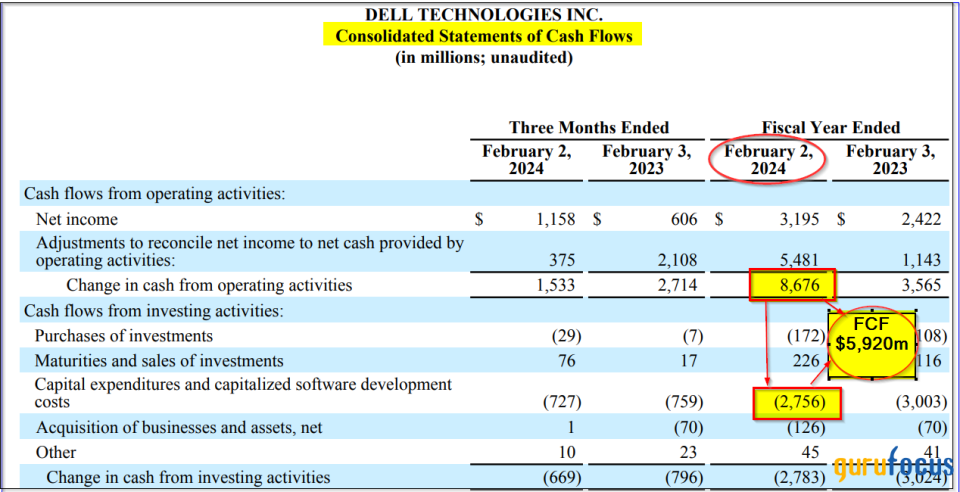

Source: Dell Q4 2024 earnings deck.

Buybacks are likely to increase

Last fiscal year, Dell generated $5.92 billion in free cash flow. This is calculated by deducting $2.75 billion in capital expenditures and capitalized software costs from its operating cash flow of $8.67 billion.

Source: Dell Technologies Free cash flow calculation from its Cash Flow Statement

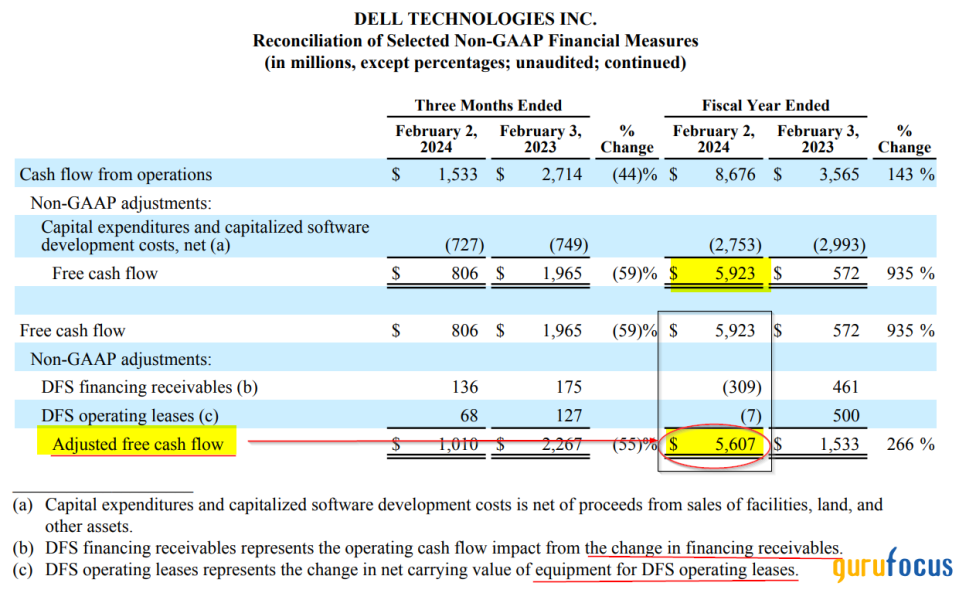

However, the company has a table showing the adjusted free cash flow is slightly lower:

Source: Dell's FY Q4 2024 Financial Statements

Dell adjusted its FCF calculation by deducting several working capital items it feels are one-time changes. This lowered the FCF calculation to $5.60 billion for the year.

Payouts to shareholders could increase

From this adjusted FCF, Dell spent $2.08 billion on share buybacks and $1.07 billion on dividends (at the old rate). In other words, its return of capital payments totaled $3.15 billion for the year. That can be seen in the rest of the cash flow statement.

Source: Dell FY 2024 Cash Flow Statement

So Dell's return of capital payout ratio is 56.20% (i.e., $3.152 billion / $5.607 billion adjusted FCF).

Higher buybacks likely

As a result, Dell's commitment to pay out 80% of its FCF could lead to higher stock buyback activity. Here is how that works out.

First, let's assume its FCF stays level. As a result, total shareholder payouts are as follows:

80% return goal: 0.80 x $5.607 billion adjusted FCF

= $4.486 billion in dividends and buybacks

Next, we can calculate how much shareholder payouts will increase:

$4.486 billion Existing Payouts

= $4.486 billion Existing buybacks ($2.08 billion) and new dividend costs

We know the new dividend will be 20% higher this year, so the new dividend cost is:

$1.072 billion x 1.20, or $1.286 billion

As a result, the new shareholder payouts will be:

$2.08 billion BB + $1.286 billion (higher dividend) = $3.366 billion

Therefore,, the revised step above implies payouts will increase by $1.1 billion.

= $4.48 billion - $3.336 billion = $1.116 billion additional shareholder payouts

This means Dell's stock buybacks could increase to $3.19 billion, or by 54%.

$1.116 billion (new shareholder payouts) +$2.08 billion (prior BB level) = $3.196 billion new buybacks, and

$3.196 billion / $2.08 billion -1 = 53.7% higher

Therefore, after increasing the dividend by 20% to $1.28 billion this year, the combined shareholder returns will climb to $3.36 billion, assuming FCF stays flat.

In other words, buybacks could become 60% of the total $5.6 billion in adjusted free cash flow. Moreover, if its FCF grows, Dell's buybacks could increase even further.

Higher FCF could push buybacks even higher

Last year Dell made an adjusted FCF margin of 6.34%, which is calculted as:

$5.607 billion adj. FCF / $88.425 billion = 0.0634

Moreover, the company now says it expects to return to growth this year. Analysts project revenue will rise to $93.53 billion for the year ending January 2025, and their projections for the following year are $99.37 billion.

So, on average, sometime in the next 12 months Dell could be on a run rate of $96.45 billion in revenue. That implies it could end up generating over $6.10 billion in next 12-month free cash flow:

$96.45 billion NTM revenue x 0.0634 = $6.115 billion in FCF

This is 9% higher than its existing $5.6 billion in adjusted FCF. Moreover, this also implies buybacks could soar by 20%. Here is why.

First, let's assume the dividend cost rises another 10% to $1.42 billion:

$1.286 billion cost this year x 1.10 = $1.414 billion

Next, assuming an 80% payout ratio, total payouts of adjusted FCF will be $4.89 billion:

$6.115 billion adjusted NTM FCF x 80% = $4.892 billion

Therefore, this implies stock buybacks will be almost $3.5 billion:

$4.892 billion payouts - $1.414 billion dividend cost = $3.477 billion buybacks

This represents an increase in buybacks of 8.80% expected this year and 67% higher than the buybacks last year:

The bottom line is that shareholders of Dell can expect a massive increase in stock buybacks.

Valuation increase possible

Moreover, if we assume the stock ends up with a 6% FCF yield (that the market gives it a 6% yield if 100% of the FCF were to be paid out as a dividend), it could rise significantly.

$6.115 billion in NTM FCF estimate / 0.06 = $101.9 billion market cap

That represents a potential increase in the stock's market value of 26.50%:

$101.9 billion estimated market cap / $80.55 billion market cap today -1 = +26.5%

That implies Dell could rise to $141.92 per share:

$112.19 x 1.265 = $141.92 per share price target

The bottom line is that Dell stock, with its 1.48% dividend, growing FCF, higher buybacks and potential 26% higher valuation is very attractive to existing shareholders and value investors.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance