The Death Of A Stockbroker

The world of investing has been evolving rapidly over the past 2 decades, and brokers’ commissions continue to shrink. The latest development in the brokerage market is the move to commission-free trading. The largest public e-brokers in the US, Charles Schwab SCHW, E-Trade ETFC, and TD Ameritrade AMTD, announced last week that they would be offering no-fee trades in a move that will change the investment landscape from here on out.

Evolution of Brokers

Stockbrokers used to be the kings of Wall Street, and one of the only ways that the common folk could invest their money into the markets. Stockbrokers would take a sizable chunk from every trade and risked nothing in doing so.

The internet age changed everything for the public equity market. Stocks transformed from being a slip declaring company ownership to a ticker on a screen. The digitizing stock market made trading as easy as a click of the mouse.

The internet has almost entirely eliminated the need for stockbrokers. Now anyone can buy and sell shares or even make more complicated trades with options using just their smartphones.

Robinhood’s no-fee, no minimum deposit product offering has driven the younger generation back into the equity markets. Millennials are tied to their smartphones, and Robinhood’s mobile born application caters perfectly to new investors.

Robinhood has started a cultural shift in investing with the average account holding between $1,000 and $5,000, but over 4 million users. This platform has been able to take control of a sizable portion of the broker market.

Robinhood is a privately owned company that is backed by a number of venture capitalist companies. In its latest round of funding in July, the firm was valued at $7.6 billion. There have been rumors circulating that Robinhood is planning to go public soon, but nothing official has been announced.

Big broker stocks have all been getting destroyed this year as investors are more apt to take long positions in passive index funds as well as Robinhood’s attractive “free” trading offering taking business. The race to the lowest trading fees is over as all the major brokers dropped commissions to zero last week.

Investors were not happy with this decision, and e-broker stocks substantially sold off. Since the zero-commission announcement SCHW is down 15%, AMTD broke 27%, and ETFC fell 15%.

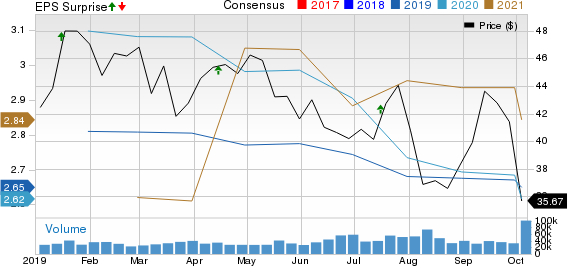

The Charles Schwab Corporation Price, Consensus and EPS Surprise

The Charles Schwab Corporation price-consensus-eps-surprise-chart | The Charles Schwab Corporation Quote

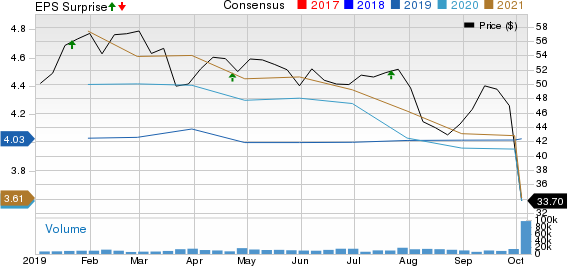

TD Ameritrade Holding Corporation Price, Consensus and EPS Surprise

TD Ameritrade Holding Corporation price-consensus-eps-surprise-chart | TD Ameritrade Holding Corporation Quote

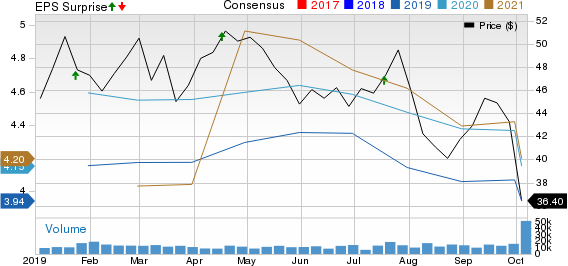

E*TRADE Financial Corporation Price, Consensus and EPS Surprise

E*TRADE Financial Corporation price-consensus-eps-surprise-chart | E*TRADE Financial Corporation Quote

The gap down that this announcement caused was icing on the cake of a disappointing year. Both SCHW and AMTD fell to Zacks Rank #5 (Strong Sell) after this announcement.

The brokers are hoping that this commission-free structure will attract more customers and they will be able to profit on margin yields, idle cash, and premium features. It is all going to come down to product offerings. I see consolidation in this field moving forward and potentially larger downsides to the ones that aren’t able to successfully acquire more market share.

Take Away

Free-trading across the board is great news for retail investors like us (unless you own one of these brokerage stocks). This will likely also create more liquidity for stocks as more small investors enter the market. The barriers to enter the markets have dropped to zero, and an increasing number of millennials are dipping their toes in the financial markets.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.6% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TD Ameritrade Holding Corporation (AMTD) : Free Stock Analysis Report

E*TRADE Financial Corporation (ETFC) : Free Stock Analysis Report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance