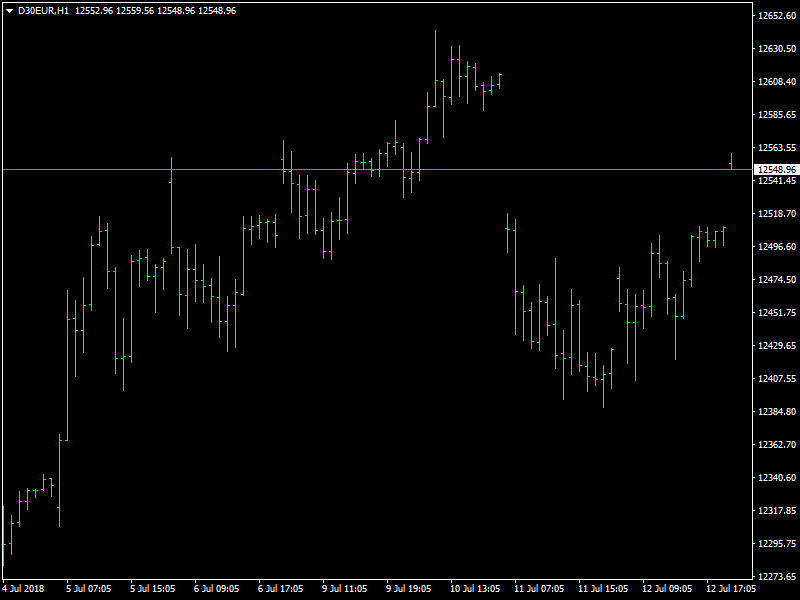

DAX Index Forecast – DAX Consolidates and Awaits Direction

The DAX index had a pretty quiet day which is understandable considering the fact that the global markets were quite mixed through the day. Some of the major stock indices were negative while some others were positive and a combination of this and the fact that there were no major fundamental or economic news around the world kept the markets quiet.

DAX Consolidates

The trade war that is going on between the US and China mainly, with the other countries set to join in, in due course of time, seems to be the theme that is dominating the markets at this point of time. There is also the ongoing tussle between the US and the NATO region as well and this is also casting a shadown on the markets and that is why we believe that, with the fundamentals loaded in favor of the bears, there is a lot of pressure on the markets.

With this in mind, we have been advising the traders to go short on the DAX index whenever the prices move higher. The Asian stock markets seems to have escaped the attack with most of them continuing to trade in a strong manner over the last few weeks as the impact of the trade war on them, except for China, is expected to be minimal. The US stock indices have also been doing well as the US-first policy is likely to benefit the local companies. It is the Eurozone and China which is likely to get affected by this and that is why we are seeing the DAX trade under pressure.

Looking ahead to the rest of the day, there is not much by way of economic or fundamental data from any part of the world today. But the global markets seem to be in a risk on mode at this point of time and hence we can expect a strong opening to the DAX for today which is then likely to lead to some consolidation and ranging.

This article was originally posted on FX Empire

More From FXEMPIRE:

Price of Gold Fundamental Daily Forecast – Rising U.S. Dollar Could Spike Gold Prices to $1230.70

Oil Price Fundamental Daily Forecast – IEA Warning on Spare Capacity Continues to Underpin Prices

China: Imports Miss, Exports Top Estimates while Surplus with U.S. Grew in June

Silver Price Forecast – Silver markets find demand early on Thursday

Yahoo Finance

Yahoo Finance