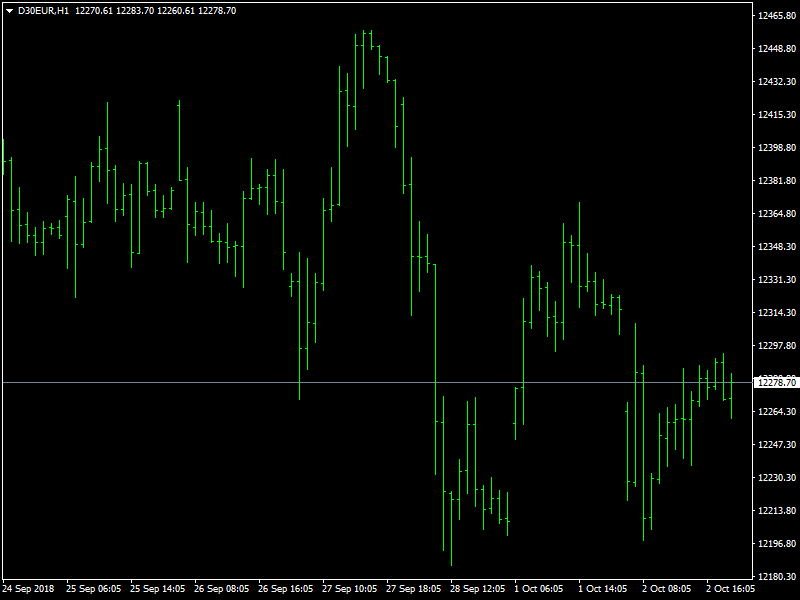

DAX Index Daily Price Forecast – DAX Still Building Base

The DAX continues to consolidate in what, in our view, is a phase as the bulls build up some momentum for the next push higher. The world over, many of the markets seem to be ranging and in consolidation as the bulls and the bears come to terms with all the developments that have happened over the last few weeks in the economies of the various countries. The world economic order seems to have changed with Trump being bent on supporting the domestic industries in the US and looking to impose a lot of charges and duties and taxes on many of the cheap imports from China and other parts of the world.

DAX Still in Consolidation

There is also a re-negotiation of the NAFTA agreement with Canada and all these developments have shaken up the way that trade has been done all over the world over the last several years. This is bound to have an impact on the companies and the markets in the long term and it is up to the traders to see how best that they can gauge the impact and move their trades accordingly. We are in that kind of tricky phase at this point of time and we believe that this is likely to get sorted out in the short term and once that is done, we should see the markets begin to digest that and move ahead once again.

Of course, this may not hold true for all the markets as some of the countries are likely to be more affected than the others but this will be known only as time progresses as the true depth of all the duties and the hikes would be known only then. As far as Germany is concerned, the impact has been minimal so far though the impact from the Brexit and the uncertainty around that is likely to be more than the impact from the actions of the US and Trump as well. Germany has a pretty strong economy with its foundations based on manufacturing and it wouldnt be easy for the economy to be shaken.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance