David Nierenberg's Strategic Moves: A Closer Look at Mr. Cooper Group's Impact in Q1 2024

Insights from the Latest 13F Filing

David Nierenberg (Trades, Portfolio), the mind behind Nierenberg Investment Management Company and its D3 Family of Funds, recently unveiled his investment strategies for the first quarter of 2024 through the latest 13F filing. A Yale alumnus with a keen focus on undervalued micro-cap growth companies, Nierenberg's approach often involves active participation in the management of the firms he invests in. His latest moves provide valuable insights into his investment philosophy and strategy.

Key Position Increases

During the first quarter, David Nierenberg (Trades, Portfolio) made significant additions to several of his stock holdings:

Eastern Bankshares Inc (NASDAQ:EBC) saw an impressive increase of 400,000 shares, bringing the total to 446,088 shares. This adjustment, which represents an 867.9% increase in share count, had a 3.07% impact on the current portfolio, totaling $6,147,090 in value.

KBR Inc (NYSE:KBR) also experienced a notable rise with an additional 20,100 shares, bringing the total to 50,710. This adjustment represents a 65.66% increase in share count, with a total value of $3,228,200.

Summary of Sold Out Positions

Nierenberg also decided to exit completely from several positions in this quarter:

First Foundation Inc (NYSE:FFWM) was completely sold off with 93,555 shares, impacting the portfolio by -0.54%.

Build-A-Bear Workshop Inc (NYSE:BBW) saw a complete liquidation of 17,110 shares, causing a -0.24% impact on the portfolio.

Key Position Reductions

Reductions were also part of Nierenberg's Q1 strategy:

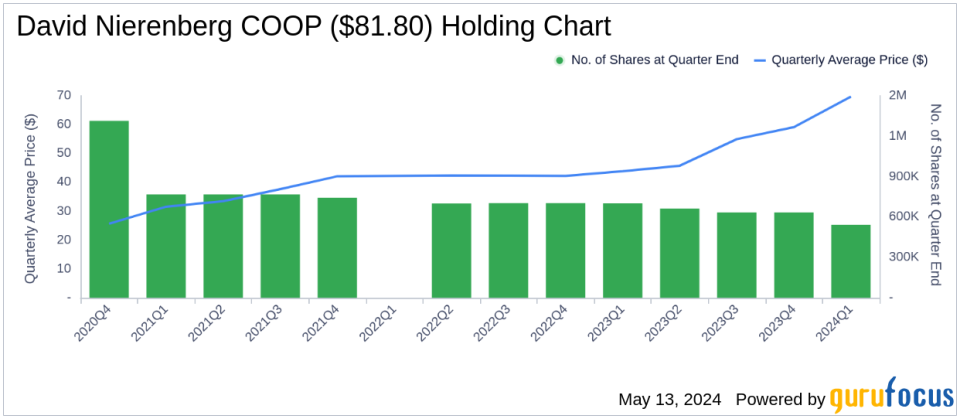

Mr. Cooper Group Inc (NASDAQ:COOP) saw a reduction of 91,340 shares, resulting in a -14.43% decrease in shares and a -3.57% impact on the portfolio. The stock traded at an average price of $69.71 during the quarter and has returned 15.68% over the past 3 months and 25.66% year-to-date.

AppLovin Corp (NASDAQ:APP) was reduced by 12,000 shares, marking a -61.37% reduction in shares and a -0.29% impact on the portfolio. The stock traded at an average price of $52.95 during the quarter and has returned 85.49% over the past 3 months and 113.32% year-to-date.

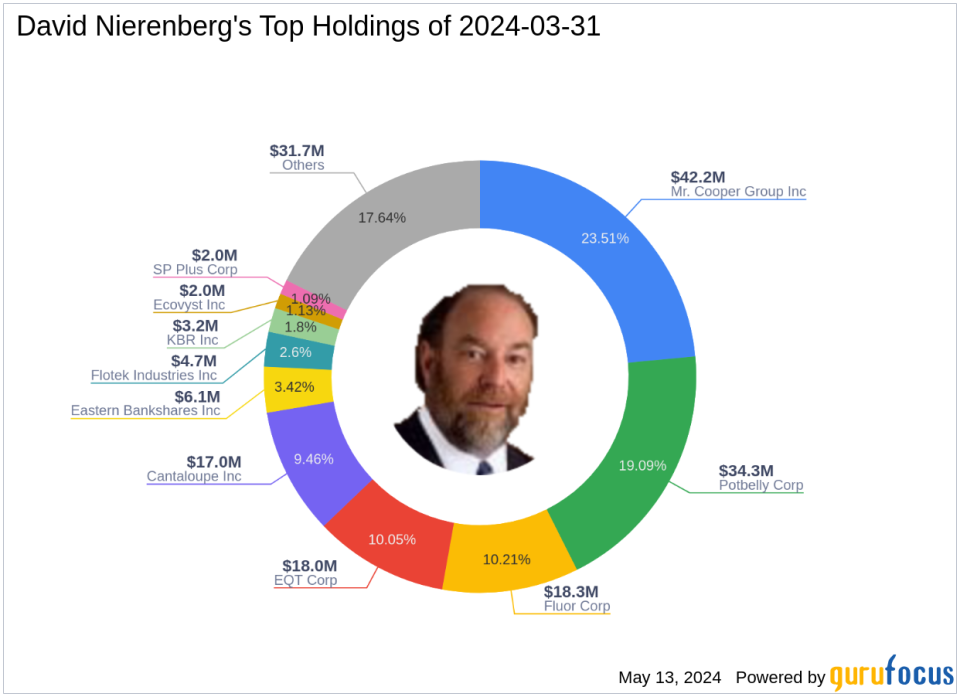

Portfolio Overview

As of the first quarter of 2024, David Nierenberg (Trades, Portfolio)'s portfolio included 44 stocks. The top holdings were notably concentrated in several sectors:

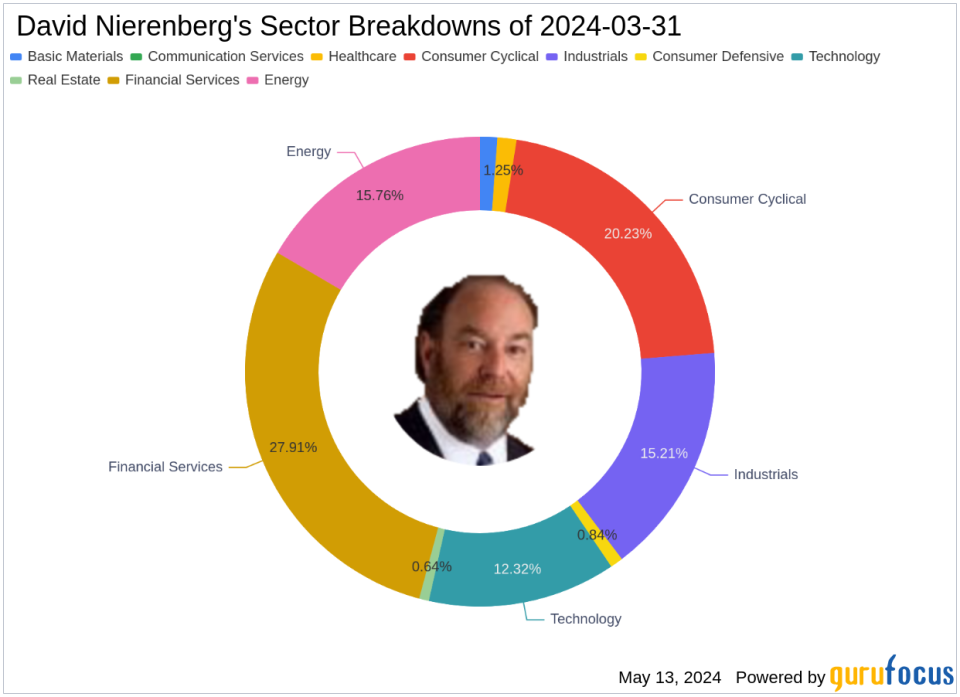

23.51% in Mr. Cooper Group Inc (NASDAQ:COOP), 19.09% in Potbelly Corp (NASDAQ:PBPB), 10.21% in Fluor Corp (NYSE:FLR), 10.05% in EQT Corp (NYSE:EQT), and 9.46% in Cantaloupe Inc (NASDAQ:CTLP). These investments span across 9 of the 11 industries, including Financial Services, Consumer Cyclical, Energy, Industrials, Technology, Healthcare, Basic Materials, Consumer Defensive, and Real Estate.

This detailed analysis of David Nierenberg (Trades, Portfolio)s Q1 2024 investment maneuvers highlights his strategic adjustments and ongoing commitment to capitalizing on undervalued opportunities in the micro-cap sector. His moves, particularly with Mr. Cooper Group Inc, reflect a calculated approach to portfolio management that balances both increases and decreases in holdings to optimize investment outcomes.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance