Danaher (DHR) Q1 Earnings Beat, Biotechnology Sales Dip Y/Y

Danaher Corporation’s DHR first-quarter 2024 adjusted earnings (excluding 47 cents from non-recurring items) of $1.92 per share surpassed the Zacks Consensus Estimate of $1.72. The bottom line declined 27.1% year over year.

Danaher’s net sales of $5.8 billion outperformed the consensus estimate of $5.6 billion. However, the metric declined 2.5% year over year due to lower core sales in the Biotechnology segment.

Organic sales in the quarter decreased 4%. Foreign-currency translations and acquisitions had a positive impact of 0.5% and 2.0%, respectively, on quarterly sales.

Segmental Discussion in Q1

On Sep 30, 2023, Danaher completed the separation of its Environmental & Applied Solutions segment. It currently operates under the operating segments discussed below.

Revenues from the Life Sciences segment totaled $1.7 billion, up 2% year over year. We expected the Life Sciences segment’s revenues to be $1.6 billion. Core sales dipped 3% year over year. Acquisitions/divestitures led to a 6% increase in sales. Operating profit was $235 million for the quarter, down 26.8% year over year.

Revenues from the Diagnostics segment totaled $2.5 billion, up 6.5% year over year. Our estimate for revenues in the quarter was $2.4 billion. Core sales increased 7.5% year over year. Foreign currency had a positive impact of 1%. Operating profit was $830 million for the quarter, up 22.6% on a year-over-year basis.

Revenues from the Biotechnology segment totaled $1.52 billion, down 18% year over year. Our estimate for the quarter was $1.54 billion. Core sales dropped 17% for the segment. Operating profit was $325 million for the quarter, down 45.5% year over year.

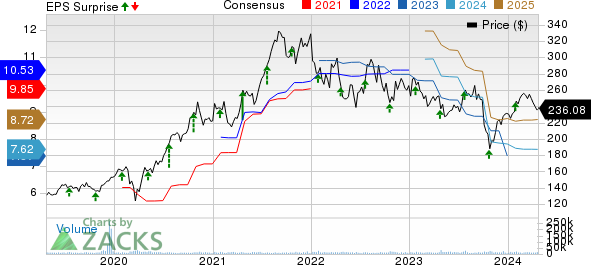

Danaher Corporation Price, Consensus and EPS Surprise

Danaher Corporation price-consensus-eps-surprise-chart | Danaher Corporation Quote

Margin Profile

In the first quarter, Danaher’s cost of sales increased 1% year over year to $2.3 billion. Gross profit of $3.5 billion fell 4.8% year over year. The gross margin in the quarter was 60.2% compared with 61.6% in the year-ago quarter.

Selling, general and administrative expenses of $1.8 billion recorded an increase of 2% on a year-over-year basis. Research and development expenses were $368 million, up 1.3% year over year.

Danaher’s operating profit in the reported quarter dropped 13.5% year over year to $1.3 billion. Operating margin decreased to 22.6% from 25.5% in the year-ago quarter.

Balance Sheet and Cash Flow

Exiting the first quarter, DHR had cash and equivalents of $7 billion compared with about $5.9 billion in 2023 end. Long-term debt was $16.4 billion at the end of the reported quarter compared with $16.7 billion at the end of December 2023.

Danaher generated net cash of $1.7 billion from operating activities in the first three months of 2024 compared with $1.9 billion in the previous year’s quarter. Capital expenditures totaled $291 million in the same period, up 9.4% year over year. Adjusted free cash flow was $1.4 billion in the first three months of 2024 compared with $1.5 billion in the year-ago period.

In the first three months of 2024, DHR paid out dividends of $177 million, up 13.2% on a year-over-year basis.

Outlook

For the second quarter of 2024, Danaher expects adjusted core revenues from continuing operations to decline in mid-single digits on a year-over-year basis.

The same is anticipated to decrease in low-single digits on a year-over-year basis in 2024.

Zacks Rank & Stocks to Consider

Danaher presently carries a Zacks Rank #3 (Hold). Some better-ranked companies are discussed below:

Applied Industrial Technologies, Inc. AIT presently sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter average earnings surprise of 10.4%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for AIT’s fiscal 2024 earnings has increased 1% in the past 60 days. The stock has gained 19.5% in the past six months.

Atmus Filtration Technologies Inc. ATMU presently carries a Zacks Rank #2 (Buy) and a trailing four-quarter earnings surprise of 20.3%, on average.

ATMU’s earnings estimates have increased 7.7% for 2024 in the past 60 days. Shares of Atmus Filtration have risen 52.6% in the past six months.

Carlisle Companies Incorporated CSL carries a Zacks Rank of 2. CSL delivered a trailing four-quarter average earnings surprise of 7.6%.

In the past 60 days, the Zacks Consensus Estimate for CSL’s 2024 earnings has increased 3.8%. The stock has risen 53.3% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Danaher Corporation (DHR) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Carlisle Companies Incorporated (CSL) : Free Stock Analysis Report

Atmus Filtration Technologies Inc. (ATMU) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance