Danaher Corp (DHR) Q1 2024 Earnings: Mixed Results Amid Market Challenges

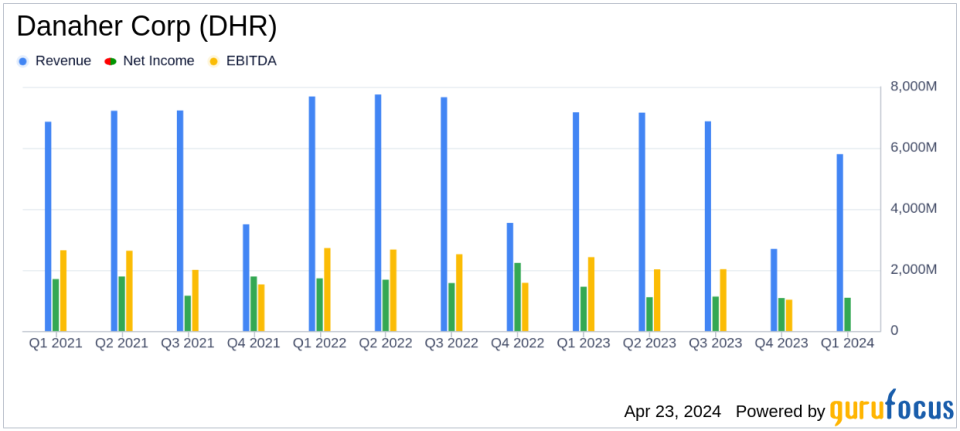

Reported Revenue: $5.8 billion, down 2.5% year-over-year, falling short of estimates of $5.622 billion.

Net Income: $1.1 billion, below the estimated $1.276 billion.

Earnings Per Share (EPS): Reported at $1.45, falling short of the estimated $1.71.

Operating Cash Flow: Recorded at $1.7 billion with free cash flow at $1.4 billion.

Non-GAAP Adjusted EPS: $1.92, reflecting adjustments for amortization and other non-recurring items.

Outlook: Forecasts a mid-single-digit decline in non-GAAP core revenue year-over-year for Q2 2024 and a low-single-digit decline for full year 2024.

On April 23, 2024, Danaher Corp (NYSE:DHR) disclosed its financial outcomes for the first quarter ended March 29, 2024, through an 8-K filing. The company reported a net income of $1.1 billion, translating to $1.45 per diluted share. Adjusted for non-GAAP measures, earnings per share stood at $1.92, surpassing the analyst estimate of $1.71. However, revenue fell short of expectations, totaling $5.8 billion against the forecasted $5.622 billion, marking a 2.5% year-over-year decline.

Company Overview

Founded in 1984, Danaher transformed from a real estate organization into a powerhouse in manufacturing scientific instruments and consumables. Focused on life sciences and diagnostics, the company has evolved through strategic mergers, acquisitions, and divestitures, including the recent divestiture of its environmental and applied solutions group, Veralto.

Financial Performance and Market Challenges

Danaher's revenue decline was primarily attributed to a 4.0% decrease in non-GAAP core revenue, reflecting challenges in the market. Despite these hurdles, the company's operating cash flow was robust, reaching $1.7 billion with a free cash flow of $1.4 billion. President and CEO Rainer M. Blair highlighted the improving order trends in bioprocessing and gains in market share in the molecular diagnostics business at Cepheid as key drivers behind the better-than-expected earnings and cash flow.

Future Outlook and Strategic Focus

Looking ahead, Danaher anticipates a mid-single-digit decline in non-GAAP core revenue for Q2 2024 and a low-single-digit decline for the full year. The company remains committed to leveraging the Danaher Business System to build a strong foundation for long-term performance and to make significant improvements in human health.

Detailed Financial Analysis

The income statement reveals a decrease in gross profit from $3.662 billion in Q1 2023 to $3.487 billion in Q1 2024. Operating profit also saw a reduction from $1.517 billion to $1.312 billion year-over-year. Despite these declines, the company managed to maintain a strong earnings profile, primarily due to effective cost management and innovation in its product offerings.

Danaher's balance sheet remains solid with significant cash flows supporting its strategic initiatives and operational needs. The company's focus on high-margin diagnostics and life sciences sectors is expected to sustain its financial health in the face of market volatility.

Investor and Analyst Perspectives

During the earnings call, Blair expressed confidence in the company's strategy and its ability to navigate market fluctuations effectively. Analysts are cautiously optimistic about Danaher's ability to maintain its market leadership in diagnostics and life sciences, despite the anticipated revenue declines.

For detailed financial figures and future projections, investors and stakeholders are encouraged to review the full earnings report and supplementary materials available on Danahers website.

Conclusion

While Danaher faces challenges in a fluctuating market, its strategic focus and robust financial discipline enable it to exceed earnings expectations and maintain a strong cash flow. The company's commitment to innovation and market expansion sets a solid groundwork for future growth and stability.

Explore the complete 8-K earnings release (here) from Danaher Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance