CVS Health (CVS) Q2 Earnings Top Estimates, 2020 View Up

CVS Health Corporation's CVS second-quarter 2020 adjusted earnings per share (EPS) of $2.64 increased 39.7% year over year and exceeded the Zacks Consensus Estimate by 36.8%. The adjusted EPS figure takes into account certain integration costs pertaining to the buyout of Aetna and asset amortization costs along with other adjustments.

On a reported basis, the company’s earnings of $2.26 per share improved 51.7% year over year.

Total revenues in the second quarter rose 3% year over year to $65.34 billion. The top line also beat the Zacks Consensus Estimate by 1.9%.

Quarter in Detail

Pharmacy Services revenues were up a marginal 0.1% to $34.89 billion in the reported quarter. Growth was sluggish as year-over-year improvements in specialty pharmacy and brand inflation were largely offset by client losses and continued price compression.

Total pharmacy claims processed rose 3.4% on a 30-day equivalent basis, attributable to strong net new business, partially offset by reduced new therapy prescriptions on lower provider visits.

Revenues from CVS Health’s Retail/LTC were up 1% year over year to $21.66 billion. In the quarter, favorable pharmacy drug mix, growth in retail pharmacy prescription volume and brand inflation were partially offset by continued reimbursement pressure, the impact of recent generic introductions, decreased long-term care prescription volume and lower front store revenues.

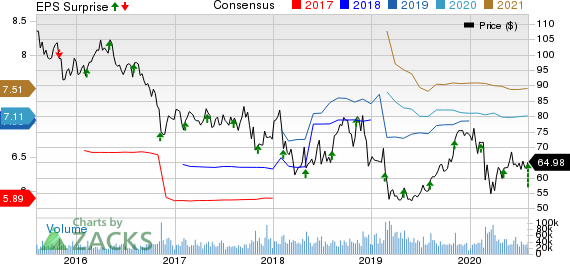

CVS Health Corporation Price, Consensus and EPS Surprise

CVS Health Corporation price-consensus-eps-surprise-chart | CVS Health Corporation Quote

Front store revenues decreased 4.6% year over year on reduced customer traffic in the retail pharmacies due to shelter-in-place orders. Prescriptions filled too dropped 1.1% on a 30-day equivalent basis on reduced new therapy prescriptions due to lower provider visits through the second quarter and decreased long-term care prescription volume. This was partially offset by the continued adoption of patient care programs.

Within Health Care Benefits segment, the company registered revenues worth $18.47 billion in the second quarter, up 6.1% year over year. The improvement was primarily driven by membership growth in the Health Care Benefits segment's government products and favorable impact of the reinstatement of the HIF (Health Insurer Fee) for 2020. This was partially offset by the absence of the financial results of Aetna's standalone Medicare Part D prescription drug plans (PDPs) and membership declines in Commercial insured products.

Margin

Gross profit improved 17.4% to $13.3 billion. Gross margin expanded 250 basis points (bps) to 20.4% in spite of 0.1% decline in total cost of product sold and benefit costs. Operating margin in the quarter under review grew 191 bps to $7.16 billion on a 40.5% rise in operating profit to $4.68 billion.

Outlook

CVS Health raised its 2020 adjusted EPS and cash flow guidance.

Adjusted EPS is expected in the band of $7.14-$7.27 (from the earlier band of $7.04-$7.17). The Zacks Consensus Estimate for 2020 earnings is pegged at $7.11.

Full-year operating cash flow is expected in the range of $11 billion-$11.5 billion compared with the earlier projection of $10.5 billion-$11.0 billion.

Further, the company projects higher utilization in its Health Care Benefits segment in the second half of 2020 than in the first half and continued significant COVID-19 related investments in the remainder of the year.

Our Take

CVS Health ended the second quarter on a promising note with both earnings and revenues surpassing the respective Zacks Consensus Estimate. The COVID-19 pandemic affected second-quarter revenues in the Retail/LTC and Pharmacy Services segments as new therapy prescriptions reduced due to lower provider visits as well as front store revenues due to shelter-in-place orders. However, the year-over-year revenue rise was primarily driven by strong underlying core growth across all segments.

Particularly, the year-over-year improvement in the top line was fueled by strong growth in the company’s recently-introduced Health Care Benefits segment. Increased guidance amid the pandemic scenario is another positive.

Zacks Rank and Key Picks

CVS Health currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader medical space are West Pharmaceutical Services, Inc. WST, Thermo Fisher Scientific Inc. TMO and Hologic, Inc. HOLX.

West Pharmaceutical reported second-quarter 2020 adjusted EPS of $1.25, beating the Zacks Consensus Estimate by 37.4%. Net revenues of $527.2 million outpaced the consensus estimate by 6.9%. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Thermo Fisher, a Zacks Rank #2 (Buy) company, reported second-quarter 2020 adjusted EPS of $3.89, beating the Zacks Consensus Estimate by 45.7%. Revenues of $6.92 billion outpaced the consensus mark by 0.1%.

Hologic reported third-quarter fiscal 2020 adjusted EPS of 75 cents, which surpassed the Zacks Consensus Estimate by 108.3%. Net revenues of $822.9 million exceeded the Zacks Consensus Estimate by 37.1%. It currently sports a Zacks Rank #1.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

CVS Health Corporation (CVS) : Free Stock Analysis Report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance