CVS Health Corporation (NYSE:CVS) Is About To Go Ex-Dividend, And It Pays A 0.8% Yield

CVS Health Corporation (NYSE:CVS) stock is about to trade ex-dividend in 4 days time. This means that investors who purchase shares on or after the 23rd of October will not receive the dividend, which will be paid on the 4th of November.

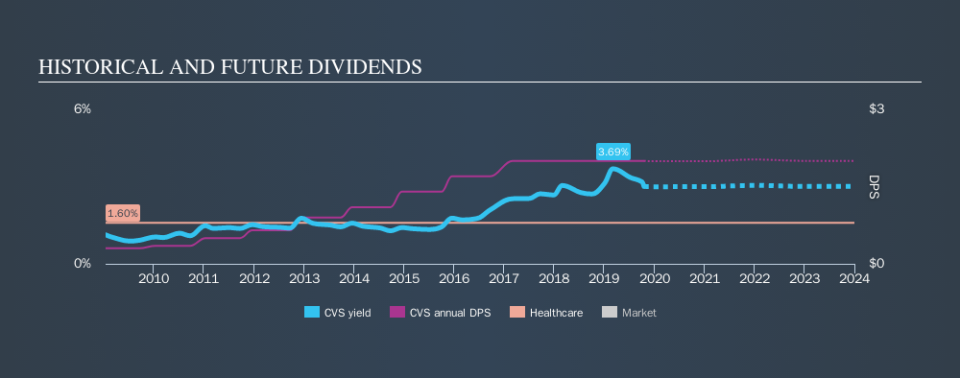

CVS Health's upcoming dividend is US$0.5 a share, following on from the last 12 months, when the company distributed a total of US$2.0 per share to shareholders. Looking at the last 12 months of distributions, CVS Health has a trailing yield of approximately 3.0% on its current stock price of $66.5. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. We need to see whether the dividend is covered by earnings and if it's growing.

Check out our latest analysis for CVS Health

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. CVS Health is paying out an acceptable 55% of its profit, a common payout level among most companies. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Thankfully its dividend payments took up just 28% of the free cash flow it generated, which is a comfortable payout ratio.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. It's not encouraging to see that CVS Health's earnings are effectively flat over the past five years. It's better than seeing them drop, certainly, but over the long term, all of the best dividend stocks are able to meaningfully grow their earnings per share.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. CVS Health has delivered 21% dividend growth per year on average over the past ten years.

The Bottom Line

Has CVS Health got what it takes to maintain its dividend payments? The payout ratios appear reasonably conservative, which implies the dividend may be somewhat sustainable. Still, with earnings basically flat, CVS Health doesn't stand out from a dividend perspective. All things considered, we are not particularly enthused about CVS Health from a dividend perspective.

Wondering what the future holds for CVS Health? See what the 24 analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance