Cutting Debt and Expanding Content Power Warner Bros. Discovery's Turnaround

Warner Bros. Discovery Inc. (NASDAQ:WBD) is leading innovator in the direct-to-consumer realm, making significant strides with its streaming service, Max.

Embarking on a global journey with ad-supported diversifications, the company is on a mission to redefine entertainment access, marking its digital territory with an expanding global footprint.

The stock is down by about 25% for the year, a period in which stocks have remained positive owing to a resilient economy and prospects of interest rate cuts by the U.S. Federal Reserve. Several catalysts have triggered the sell-off and underperformance of the media conglomerate. At the top of the list are disappointing earnings results that have raised doubts about the company's ability to generate long-term value. After delivering significant drops in revenue, Warner Bros. Discovery has also endured the market's wrath by plunging into an operating loss in the past year.

Nevertheless, the company is confronting these challenges with strategic content, aggressive debt reduction and ad-supported streaming, aiming for a turnaround in the competitive entertainment landscape.

Company hits 98 million subscribers with key franchises, spearheading content innovation and global expansion

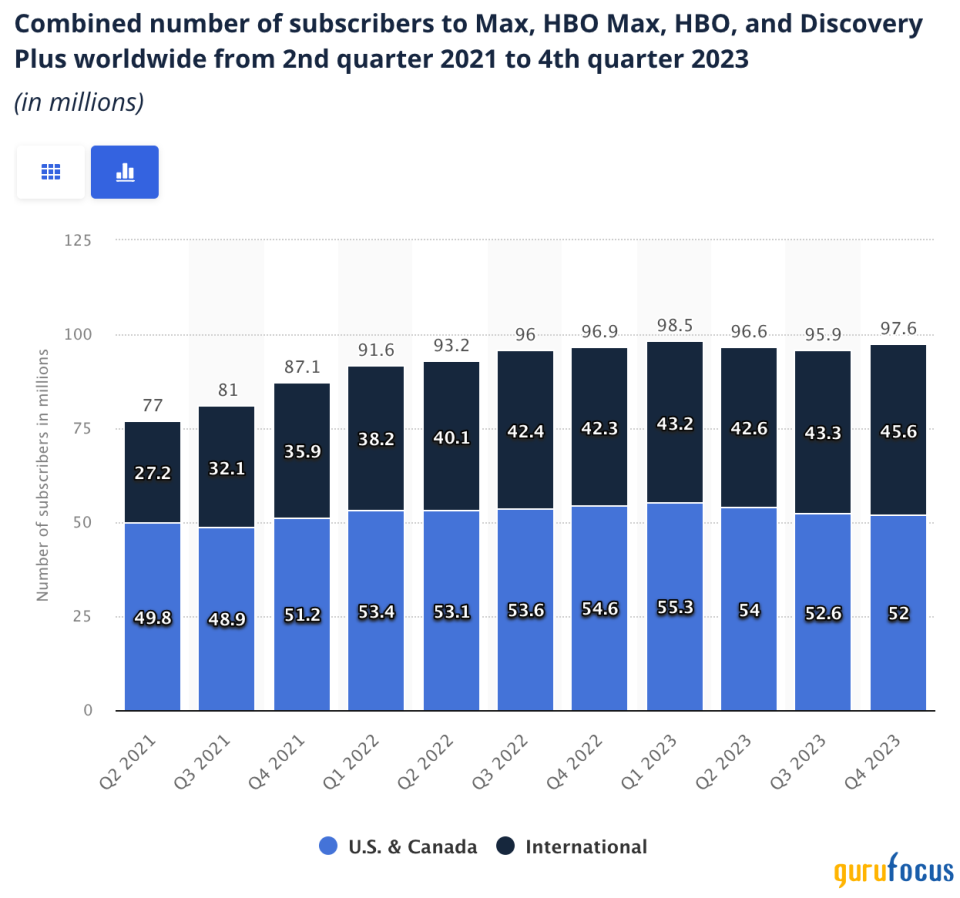

Despite market headwinds, Warner Bros. Discovery's direct-to-consumer segment shines bright, boasting a robust subscriber base that climbed to 98 million by the fourth quarter of 2023 thanks to strategic acquisitions like BluTV and aggressive global expansion. This subscriber surge is more than a numerical victory; it's a testament to the company's acute strategic foresight and digital prowess.

Additionally, Warner Bros. Discovery has adeptly positioned its intellectual properties to outperform competitors. Franchises like "Game of Thrones" and "Dune" have captivated audiences and driven significant engagement, underscoring the strategic value of compelling content in winning the streaming wars.

The ambitious expansion plans for the Dune and DC universes reflect its commitment to narrative depth and fan engagement. By diversifying its content offering, Warner Bros. Discovery aims to captivate a broader audience base, transcending beyond its traditional HBO fanbase.

According to the personal finance expert Leo Smigel, Warner Bros. Discovery, to fuel growth, is placing significant emphasis on DTC streaming services, particularly through the eagerly anticipated merger of HBO Max and Discovery+. Expanding its extensive content library and attracting new subscribers are pivotal for success in a fiercely competitive market.

As Warner Bros. Discovery continues to chart its course in the ever-evolving entertainment landscape, its strategic investments and innovative approaches herald a new era of growth and competition. From strategic mergers and global expansions to a nuanced content distribution strategy, the company is not just participating in the streaming wars, but poised to lead them.

Moreover, Warner Bros. Discovery is set to tackle password sharing on its streaming platform, aiming for a late 2024 to 2025 start. At the Morgan Stanley Technology, Media & Telecom conference, J.B. Perrette, Warner Bros. Discovery's president and CEO of global streaming and games, highlighted the move as a growth opportunity, drawing inspiration from Netflix Inc.'s (NASDAQ:NFLX) successful crackdown.

While this can be a significant revenue boost, Perrette remains cautious about comparing Max's potential impact to Netflix's due to differences in market tenure and subscriber base. Warner Bros. Discovery, which achieved a rare streaming profit among Hollywood media conglomerates in 2023, seeks to maintain profitability through global expansion, enhancing its advertising tier and improving its content offerings, including new seasons of high-profile series. This strategy comes after a period of content scarcity, exacerbated by strikes and other challenges.

Therefore, these initiatives enhance revenue streams and bolster platform engagement, setting a precedent for strategic content sharing in the streaming ecosystem.

Source: Statista

Boosting Ebitda, slashing debt and pursuing growth in challenging times

Warner Bros. Discovery's venture into ad-supported streaming options signifies a pivotal shift in its monetization strategy. This diversifies its revenue streams and caters to a broader audience spectrum, offering more flexible viewing options. With a $2.2 billion Ebitda boost in 2023 attributed to this initiative, the company is rewriting the playbook on profitable streaming.

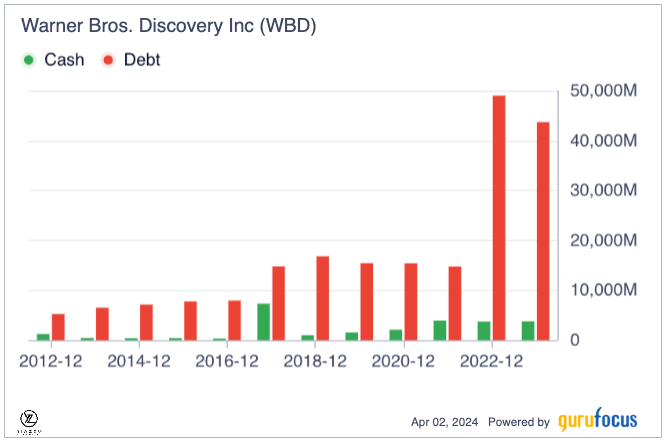

The company's turnaround strategy includes addressing its substantial debt issue, which reached $50 billion, surpassing its market value. Efforts to reduce this burden have seen Warner Bros. Discovery pay off $1.2 billion in debt in the fourth quarter and a total of $5.4 billion over the past year.

Facing about $5 billion in debt maturing in 2024, Warner Bros. Discovery has initiated a cost-reduction campaign to generate cash for further debt repayment and is considering extending the maturity dates for some bonds. Despite the challenge posed by current high interest rates, the company anticipates a stronger financial standing as rates are expected to stabilize in the next couple of years.

With a debt portfolio standing at $44 billion, Warner Bros. Discovery has undertaken an aggressive debt reduction strategy, showcasing not just financial prudence but also operational resilience. This action has alleviated its financial burden and reassured stakeholders of its commitment to sustainable growth.

Finally, the company's ability to navigate a challenging interest rate environment and manage its debt obligations effectively underscores its operational efficiency. This strategic focus extends beyond debt management, encompassing a holistic approach to capturing growth opportunities in the direct-to-consumer business, maximizing ad revenue and exploring strategic mergers and acquisitions.

Stock trapped in a downward spiral amid short-seller domination

The stock is currently trading at the lower end of its 52-week range of between $8 and $16 as it struggles to power and find support above the $9 level, as all the technical indicators have turned bearish.

Shares are trading below the 200-day moving average, affirming it is deep in bear territory with short sellers in control. Bouncebacks inside the bearish channel have only offered opportunities for short sellers to come into the fold and push the stock lower, as depicted by recent price action. Inside the bearish channel, Warner Bros. Discovery continues to make lower highs and lower lows, affirming the downtrend.

Likewise, the Moving Average Convergence and Divergence MACD indicator is below zero, signaling the stock is in a downtrend. While the fast-moving average has moved above the slow-moving average, signaling a buildup in buying pressure and causing the stock to rise, the stock remains bearish and has a downtrend as it has yet to break out of the bearish channel.

Source: TradingView

A high-debt, high-reward bet on content mastery and financial resilience

Warner Bros. Discovery operates with one of the most leveraged balance sheets, recording $44 billion in debt and a market capitalization of about $21 billion. Nevertheless, the company remains well-positioned to pay down all its upcoming maturities because of an aggressive restructuring drive that continues to trigger exponential free cash flow growth.

Analysts expect the company's profitability to improve amid the reduction of interest expenses and operational costs. Warner Bros offers an attractive risk-reward for dip buyers looking to capitalize on a battered valuation after the pullback over the past three years.

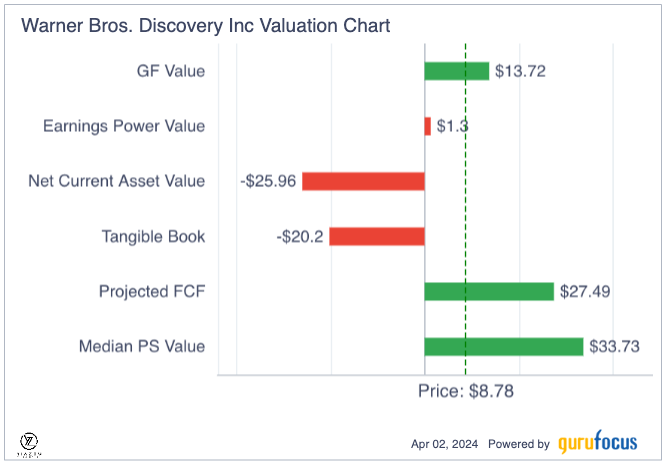

The company trades with a price-sales ratio of 0.51, one of the lowest in the sector, underlining the small amount of dollars investors have to pay for each sale that it generates. The stock also appears undervalued while trading with an enterprise value-to-revenue ratio of 1.48.

Warner Bros. Discovery's valuation presents an intriguing case of market behavior where the stock appears undervalued, trading at 2.74 times EV/Ebitda despite maintaining profitability through mergers and cost-cutting measures. This valuation suggests the market is anticipating a terminal decline in profits, which overlooks its core asset, its extensive and valuable content library, including world-class franchises.

Given its position as a premier content company, Warner Bros. Discovery has significant potential to further leverage and monetize its library. Despite potential challenges from the weakening pay-TV market, ongoing integration and changes in content consumption habits, the stock trading at a 28.70% free cash flow yield highlights its attractiveness as an undervalued investment with robust content assets.

Takeaway

The company's strategic efforts in content innovation and aggressive debt reduction, including tackling password sharing and expanding globally, aim to counteract these challenges. With substantial subscriber growth, leveraging its rich content library and addressing a high debt load, Warner Bros. Discovery is positioned to transform its competitive stance in the entertainment industry, highlighting a strategic pivot toward sustainable growth and operational efficiency amidst a volatile market.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance