Cullen/Frost Bankers Inc (CFR) Q1 Earnings: Aligns with EPS Projections Amidst Challenges

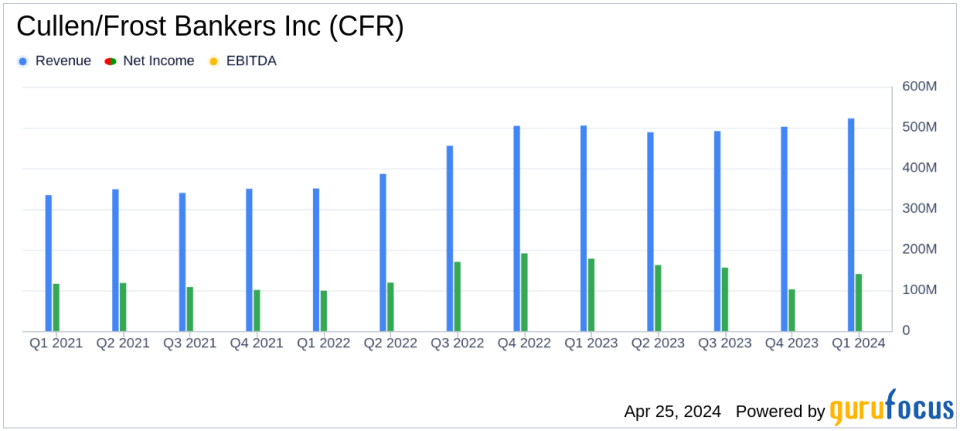

Net Income: Reported at $134.0 million for Q1 2024, falling short of the estimated $137.36 million.

Earnings Per Share (EPS): Achieved $2.06 per diluted share, below the estimate of $2.12, with an adjusted EPS of $2.15 after excluding FDIC special assessment impacts.

Revenue: Net interest income on a taxable-equivalent basis was $411.4 million, down 3.4% year-over-year and below the estimated $515.99 million.

Loan Growth: Average loans increased by $1.8 billion or 10.4% compared to Q1 2023, totaling $19.1 billion.

Deposits: Average deposits decreased by $2.0 billion or 4.8% year-over-year to $40.7 billion.

Non-Interest Income: Grew by 5.8% to $111.4 million, driven by increases in trust and investment management fees and service charges on deposit accounts.

Non-Interest Expense: Rose by 14.4% to $326.2 million, with a significant part of the increase attributed to a special FDIC assessment.

On April 25, 2024, Cullen/Frost Bankers Inc (NYSE:CFR) disclosed its first quarter results through an 8-K filing, revealing a net income available to common shareholders of $134.0 million. This figure was slightly impacted by a $7.7 million addition to the estimated FDIC special assessment. Adjusting for this, the net income would have been approximately $140.1 million. The earnings per share (EPS) for the quarter stood at $2.06, closely aligning with analyst estimates of $2.12 when adjusted for the FDIC assessment, which would bring the EPS to $2.15.

Cullen/Frost Bankers Inc, a prominent financial holding company, offers a broad range of banking services along with trust and investment management, insurance, and brokerage across Texas. With assets totaling $49.5 billion as of March 31, 2024, the company emphasizes organic growth and strategic expansion to bolster its market presence.

Financial Performance Overview

The company's net interest income on a taxable-equivalent basis was $411.4 million, marking a decrease of 3.4% from the previous year. Despite this, average loans saw a significant increase of 10.4% year-over-year, totaling $19.1 billion. However, average deposits decreased by 4.8% to $40.7 billion. Notably, non-interest income experienced a rise, totaling $111.4 million, up 5.8% from the first quarter of 2023, driven by increases in trust and investment management fees and service charges on deposit accounts.

Non-interest expenses were reported at $326.2 million, up 14.4% from the previous year, primarily due to higher salaries and wages, which aligns with the company's expansion efforts in key Texas markets. The credit loss expense for the quarter was $13.7 million with net charge-offs of $7.3 million.

Challenges and Strategic Moves

The first quarter saw Cullen/Frost grappling with a slight dip in net interest income and a reduction in total deposits. The additional FDIC special assessment also temporarily skewed expense figures. Despite these challenges, the bank's strategic focus on organic growth and expansion, particularly in Austin, has positioned it well for future stability and growth. The opening of new locations and the increase in loan disbursements reflect a proactive approach to capturing market opportunities.

Capital and Liquidity

Cullen/Frost maintains robust capital ratios, well above the Basel III minimum requirements, with a Common Equity Tier 1 (CET1) ratio of 13.41% and a Total Risk-Based Capital Ratio of 15.35%. These strong capital levels provide a cushion against potential financial shocks and support the bank's growth initiatives.

Dividends and Forward Outlook

The board declared a second-quarter cash dividend of $0.92 per common share, underscoring its commitment to returning value to shareholders. The stability of dividends, combined with strategic operational expansions, paints a promising picture for Cullen/Frost's trajectory in the competitive Texas banking landscape.

As Cullen/Frost continues to navigate through economic fluctuations and market dynamics, its focus on maintaining a strong capital base and expanding its service offerings is expected to drive sustained growth and profitability.

Explore the complete 8-K earnings release (here) from Cullen/Frost Bankers Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance