The Cue Energy Resources (ASX:CUE) Share Price Has Gained 138%, So Why Not Pay It Some Attention?

Unless you borrow money to invest, the potential losses are limited. But if you pick the right stock, you can make a lot more than 100%. Take, for example Cue Energy Resources Limited (ASX:CUE). Its share price is already up an impressive 138% in the last twelve months. It's also good to see the share price up 35% over the last quarter. Also impressive, the stock is up 78% over three years, making long term shareholders happy, too.

View our latest analysis for Cue Energy Resources

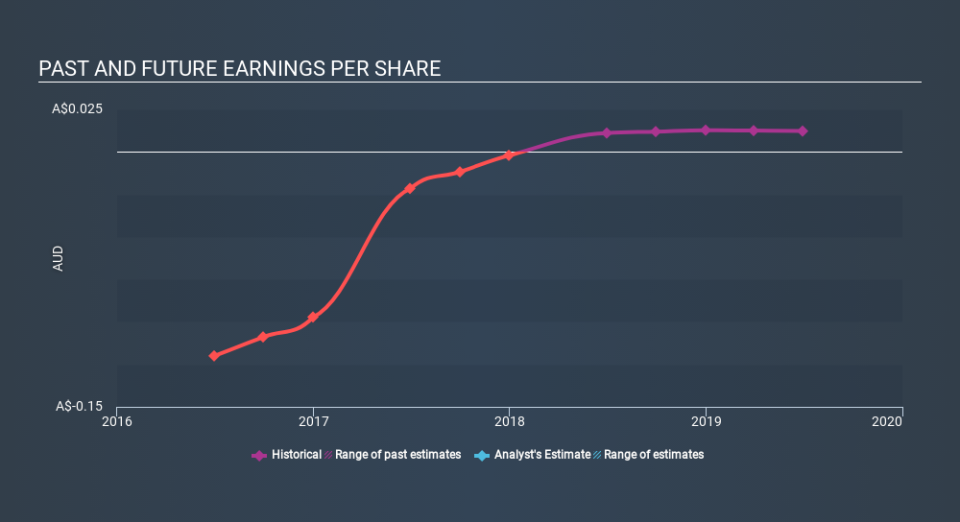

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Cue Energy Resources was able to grow EPS by 10% in the last twelve months. The share price gain of 138% certainly outpaced the EPS growth. This indicates that the market is now more optimistic about the stock.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Cue Energy Resources's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Cue Energy Resources shareholders have received a total shareholder return of 138% over one year. That gain is better than the annual TSR over five years, which is 12%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Cue Energy Resources , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance