CubeSmart (CUBE) Q1 2024 Earnings: Aligns with EPS Projections Amidst Market Challenges

Net Income: Reported at $94.5 million, falling short of estimates of $111.03 million.

Earnings Per Share (EPS): Recorded at $0.42, meeting the estimated EPS of $0.42.

Revenue: Details not provided, unable to compare with the estimated $242.36 million.

Same-Store Net Operating Income (NOI): Decreased by 1.9% compared to the first quarter of 2023.

Physical Occupancy: Same-store physical occupancy decreased to 90.4% from 91.7% year-over-year.

Development Activity: Invested $55.7 million out of a total anticipated $94.2 million in joint venture development properties.

Quarterly Dividend: Declared at $0.51 per common share, paid on April 15, 2024.

On April 25, 2024, CubeSmart (NYSE:CUBE) announced its first-quarter results for the year, detailing a period of strategic acquisitions and development amidst a challenging market environment. The company released its findings in an 8-K filing which provides a comprehensive view of its financial health and operational direction.

CubeSmart, a leading real estate investment trust in the United States, specializes in the acquisition, ownership, and management of self-storage facilities. With a substantial presence in key states such as Florida, Texas, California, New York, and Illinois, the company's portfolio primarily generates revenue through tenant rentals, which are mostly contracted on a flexible month-to-month basis.

Financial Performance Overview

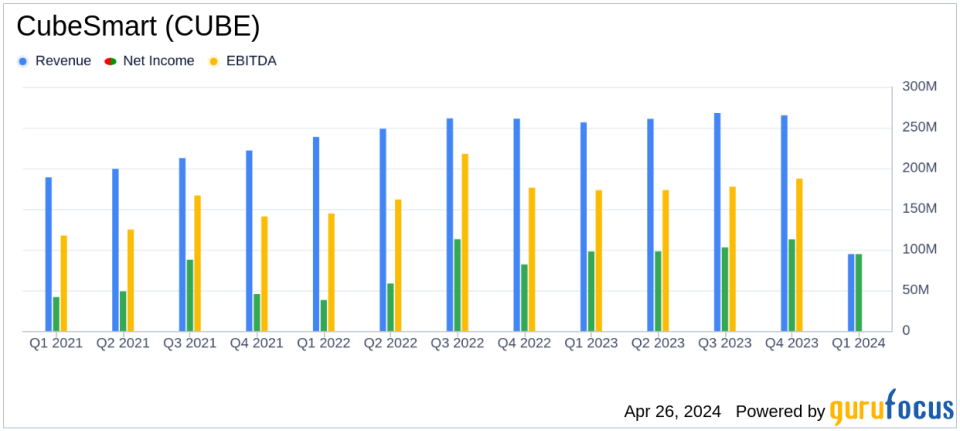

For Q1 2024, CubeSmart reported a net income of $94.5 million, a slight decrease from $97.6 million in the same quarter the previous year. The diluted earnings per share (EPS) for the quarter stood at $0.42, aligning with analyst estimates but showing a slight decrease from the $0.43 reported in Q1 2023. The company's Funds from Operations (FFO), as adjusted, reached $146.4 million, with a per diluted share value of $0.64, marking a 1.5% decrease from the previous year.

Operational Highlights and Challenges

CubeSmart's operational strategy in the quarter included notable acquisition activities, such as the purchase of a two-store portfolio in Connecticut for $20.2 million. The company also continued its development projects with four joint venture properties under construction, anticipated to enhance its competitive edge in high-barrier-to-entry markets.

Despite these expansions, the company faced challenges in its same-store portfolio, which saw a 1.9% decrease in Net Operating Income (NOI) compared to Q1 2023. This was primarily due to a 5.0% increase in operating expenses and a slight dip in occupancy rates from 91.7% in Q1 2023 to 90.4% in Q1 2024.

Strategic Developments and Market Positioning

The first quarter also saw CubeSmart grow its third-party management platform, adding 68 stores, which now total 860 stores under management. This expansion is part of CubeSmart's broader strategy to leverage its brand and operational expertise to generate additional revenue streams.

President and CEO Christopher P. Marr highlighted the positive trends in urban markets and the ramp-up of marketing campaigns aimed at strengthening the company's position for the upcoming summer rental season. CFO Tim Martin reiterated the company's 2024 financial outlook, projecting a fully diluted EPS of $1.69 to $1.79 and an FFO per share, as adjusted, of $2.59 to $2.69.

Financial Health and Future Outlook

CubeSmart's balance sheet remains robust, with a decrease in interest expenses due to lower average outstanding debt balances and reduced interest rates. The company's proactive management of its debt portfolio and strategic capital allocation supports its ongoing growth initiatives and dividend payments, evidenced by the recent quarterly dividend of $0.51 per common share paid on April 15, 2024.

In conclusion, CubeSmart's first quarter of 2024 reflects a resilient business model capable of navigating market fluctuations while pursuing growth through strategic acquisitions and development projects. As the company continues to execute its operational strategies and optimize its portfolio, it remains well-positioned to meet its financial targets for the year, offering potential value for investors looking for stable returns in the real estate sector.

Explore the complete 8-K earnings release (here) from CubeSmart for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance