Crude Oil Prices May Turn Volatile on OPEC Commentary

DailyFX.com -

Talking Points:

Crude oil prices may see catch-up volatility on OPEC comments

Gold prices look to speech from UK PM May for direction cues

Less-than-full commitment to “hard Brexit” may send gold lower

Crude oil prices are off to a quiet start as trading resumes following futures market closures for the Martin Luther King Jr Day holiday yesterday. Brent crude – the European benchmark that did trade yesterday while the US-based WTI remained offline – did next to nothing absent participation from North America.

Activity may pick up however as markets parse comments from the sidelines of the World Future Energy Summit in Abu Dhabi, a gathering of industry bigwigs including top-tier OPEC officials. Even without fresh fodder, the markets may have enough material to inspire volatility.

Saudi Energy Minister Khalid Al-Falih said yesterday that extending the supply cut deal past mid-year is likely unnecessary, which might have weighed on prices if not for the holiday. That may mean that a degree of catch-up is in order today, although new headlines may overshadow those already in the rearview.

Gold prices managed to hold onto gains scored amid swelling “hard Brexit” fears at the start of the trading week. The spotlight is now on UK Prime Minister Theresa May, who is set to deliver what is being billed as the most significant Brexit strategy speech yet.

If she confirms that withdrawal from the single market is now an objective, sentiment may sour anew and offer gold a further lift. Follow-through may be limited however as markets consider that a Supreme Court decision this month may put the power to trigger Brexit in the hands of Parliament and not the Prime Minister.

Alternatively, Mrs May might establish a more nuanced position, affirming the administration’s readiness to accept “hard Brexit” rather than spelling out a preference for that outcome. Such an approach may make yesterday’s fireworks appear overdone and spur retracement, putting the yellow metal under pressure.

Where will gold and crude oil prices go in the first quarter of 2017? See our forecasts here!

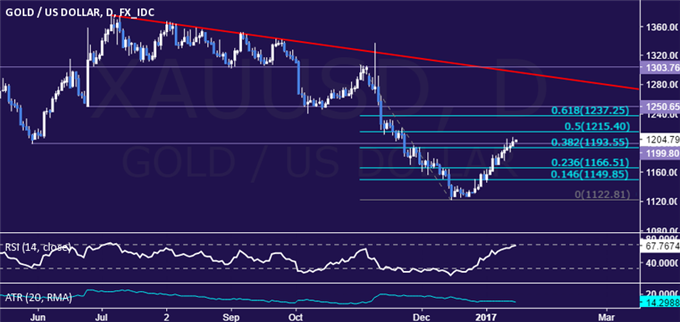

GOLD TECHNICAL ANALYSIS – Gold prices managed to secure a breach resistance in the 1193.55-99.80 area (38.2% Fibonacci retracement, May 30 low), opening the door for at test of the 50% level at 1215.40. A further push beyond that aims for the 1237.25-1250.65 zone (61.8% Fib, double bottom). Alternatively, a turn back below 1193.55 targets the 23.6%retracement at 1166.51.

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices are struggling to build upside follow-through after recovering from support above the $50/bbl figure but a Bullish Engulfing candlestick pattern still argues for gains. From here, a break above the 23.6% Fibonacci expansionat 53.75 confirmed on a daily closing basis exposes the 55.21-65 area (swing high, 38.2% level). Alternatively, a reversal below resistance-turned-support at 52.44 targets the 50.25-69 zone (38.2% Fib retracement, January 10 low).

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance