Crude Oil Price Update – Edging Toward Upside Breakout Over $53.19 but Needs Catalyst

December West Texas Intermediate Crude Oil futures finished slightly higher last week after posting a strong rally on Friday.

There is an upside bias in the market, but crude oil lacks a catalyst to trigger an acceleration to the upside. Helping to underpin prices is the market’s move toward a rebalance of support and demand.

I suspect the catalyst for a breakout to the upside will be the announcement of an extension of the OPEC-led program to reduce production, trim the global supply glut and stabilize prices.

Weekly Technical Analysis

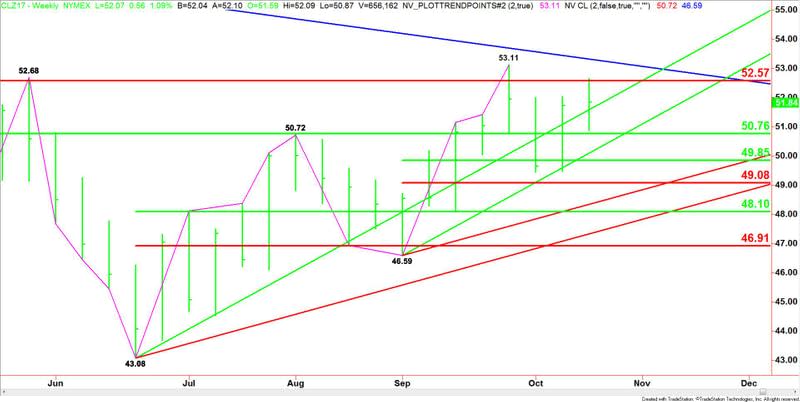

The main trend is up according to the weekly swing chart. A trade through $53.11 will signal a resumption of the uptrend. This could fuel a rally into the next main top at $55.02.

The main range is $58.44 to $43.08. Its retracement zone is $50.76 to $52.57. The market has been straddling this zone for four weeks. Trader reaction to this zone will likely determine the longer-term direction of the crude oil market.

The short-term range is $46.59 to $53.11. Its retracement zone is $49.85 to $49.08. This zone has provided support for two out of the last three weeks.

The intermediate range is $43.08 to $53.11. Its retracement zone at $48.10 to $46.91 is the next support area.

The way the retracement levels are layered on the weekly chart suggests an extremely solid support base has been formed. This means it’s going to be difficult to change the trend to down. It also means there is enough support for a strong rally.

Weekly Forecast

Based on Friday’s close at $51.84 and last week’s price action, the direction of the market is being controlled by the Fibonacci level at $52.57 and the 50% level at $50.76.

A sustained move over $52.57 will signal the presence of buyers. This could drive the market into a high at $53.11 and a long-term downtrending angle at $53.19.

The angle at $53.19 is the trigger point for an acceleration into the next main top at $55.02.

A sustained move under the 50% level at $50.76 will indicate the presence of sellers. This could trigger a labored break with potential targets at $50.59, $49.85, $49.08 and $48.59.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance