Core Scientific Inc. (CORZ) Reports Remarkable Fiscal Q1 2024 Results, Surpassing Revenue ...

Net Income: $210.7 million, significantly improved from a net loss of $0.4 million in the same period last year, surpassing estimates of $50.7 million.

Revenue: $179.3 million, up 48.6% year-over-year, exceeding estimates of $154.67 million.

Earnings Per Share (EPS): Not explicitly stated, but implied significant improvement given the substantial increase in net income.

Adjusted EBITDA: Increased to $88.0 million from $40.3 million in the prior year, indicating enhanced operational efficiency.

Cash Position: Ended the quarter with $98.1 million in cash and cash equivalents, demonstrating a strengthened balance sheet.

Bitcoin Mining: Earned 2,825 self-mined bitcoin, establishing a record as the highest among North American publicly listed miners.

Infrastructure Expansion: Managed approximately 745 megawatts of infrastructure, marking the largest owned infrastructure footprint among publicly listed miners in North America.

On May 8, 2024, Core Scientific Inc. (NASDAQ:CORZ), a leading player in the blockchain and AI infrastructure sector, announced its financial outcomes for the first quarter of 2024, revealing substantial improvements across key financial metrics. The company released these details in its 8-K filing.

Company Overview

Core Scientific Inc operates primarily through two segments: Equipment Sales and Hosting, and Mining. The company offers blockchain infrastructure and hosting services, alongside engaging in digital asset mining. It generates revenue through consumption-based contracts and by operating its own equipment in blockchain transaction processing, for which it earns digital currencies.

Financial Performance Highlights

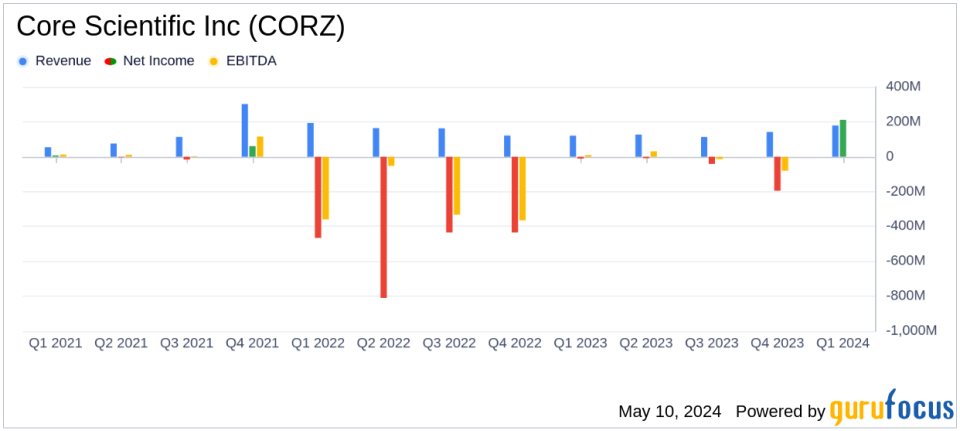

The fiscal first quarter of 2024 was marked by a net income of $210.7 million, a dramatic turnaround from a net loss of $0.4 million in the same period last year. This improvement includes a significant gain on extinguishment of prior obligations amounting to $143.8 million. Total revenue reached $179.3 million, up from $120.7 million year-over-year, driven by a 134% increase in the price of bitcoin and enhanced mining efficiency.

Operating income saw a substantial rise to $55.2 million from $7.6 million in the prior year's first quarter. The adjusted EBITDA also increased significantly to $88.0 million, up from $40.3 million, reflecting robust operational efficiency and revenue growth.

Operational Achievements

During the quarter, Core Scientific mined 2,825 bitcoins, making it the top self-mining company in North America. The total operational hash rate stood at 25.5 EH/s, with self-mining at 19.3 EH/s and hosting at 6.2 EH/s. The company also expanded its hosting capacity by delivering 16 MW of infrastructure to a high-performance computing customer ahead of schedule and deployed 28,400 new S19j XP miners.

Strategic Developments and Future Outlook

CEO Adam Sullivan highlighted the strategic advancements made in the quarter, including debt reduction, cash position improvement, and deployment of new generation miners. Looking ahead, Core Scientific plans to transform over 500 megawatts of its operational infrastructure to host high-performance computing, capitalizing on the strong demand for data center capacity.

Financial Health and Investments

The balance sheet was strengthened, ending the quarter with $98.1 million in cash and cash equivalents. The company also retired $19 million in obligations shortly after the quarter ended, further solidifying its financial position.

Analysis and Industry Position

The reported earnings significantly surpassed the estimated earnings per share of $0.13 and estimated net income of $50.70 million for the quarter, showcasing Core Scientific's strong market position and operational success. The company's focus on efficiency and strategic expansion has positioned it well within the competitive landscape of digital asset mining and blockchain infrastructure.

For detailed investor insights and the future corporate strategy, Core Scientific will host a conference call and live webcast, which can be accessed through their investor relations page.

Core Scientific's impressive Q1 performance not only underscores its leadership in the blockchain and digital mining sectors but also reflects a well-executed strategy in a dynamic market environment, promising continued growth and innovation.

Explore the complete 8-K earnings release (here) from Core Scientific Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance