Copart (CPRT) Q3 Earnings Top Estimates on Higher Sales

Copart, Inc. CPRT reported third-quarter fiscal 2024 (ended Apr 30, 2024) adjusted earnings per share of 39 cents, topping the Zacks Consensus Estimate of 38 cents on higher-than-expected service revenues and vehicle sales. The bottom line also increased 8.3% year over year. The online auto auction leader generated revenues of $1.13 billion, beating the Zacks Consensus Estimate of $1.1 billion. The top line increased 10.3% from the year-ago reported figure.

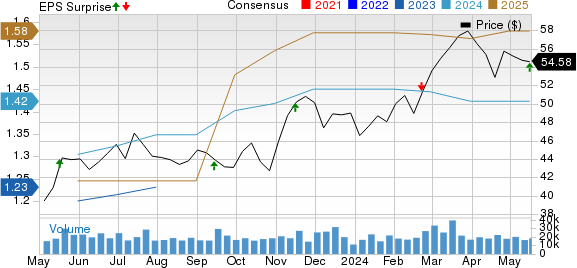

Copart, Inc. Price, Consensus and EPS Surprise

Copart, Inc. price-consensus-eps-surprise-chart | Copart, Inc. Quote

Key Tidbits

Copart’s fiscal third-quarter service revenues came in at $947 million, which increased from $847 million recorded in the year-ago period and also outpaced the Zacks Consensus Estimate of $929 million. Service revenues accounted for 84% of total revenues. Vehicle sales totaled $180.6 million in the quarter, which grew from the prior year’s level of $174.6 million and beat the Zacks Consensus Estimate of $179 million.

While yard operations expenses rose 13.9% year over year to $391.3 million, the cost of vehicle sales was up 2.2% to $162.8 million. Yard depreciation and amortization came in at $45.8 million, up 8.4% year over year. Yard stock-based compensation declined 19.3% to $1.8 million.

Gross profit was up 8.7% year over year to $525.5 million. General and administrative expenses rose 45.4% from the prior-year quarter to $76.2 million. Total operating expenses rose 14.5% to $690 million.

Operating income rose to $437.2 million from $418.9 million recorded in the year-ago quarter amid high sales despite the rise in expenses. Net income also shot up 19% year over year to $382.1 million.

Copart had cash, cash equivalents and restricted cash of $1.09 billion as of Apr 30, 2024, compared with $957.4 million as of Jul 31, 2023. Long-term debt and other liabilities were $427,000 at the end of the reported quarter.

Net cash from operating activities during the quarter under review totaled $496 million. Capex during the quarter was $87.8 million.

Zacks Rank & Key Picks

Copart currently carries a Zacks Rank #3 (Hold). A few better-ranked players in the auto sector include Blue Bird Corp. BLBD, Oshkosh Corp. OSK and General Motors GM.

The Zacks Consensus Estimate for BLBD’s fiscal 2024 earnings and sales implies a year-over-year growth of 155% and 17.3%, respectively. The consensus mark for Blue Bird’s 2024 and 2025 EPS has moved north by 63 cents and 69 cents, respectively, over the past seven days. This school bus manufacturer currently sports a Zacks Rank #1 (Strong Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Oshkosh’s 2024 earnings and sales implies a year-over-year growth of 11% and 10%, respectively. The consensus mark for OSK’s 2024 and 2025 EPS has moved north by 72 cents and 68 cents, respectively, over the past 30 days. This automotive equipment supplier currently sports a Zacks Rank #1.

The Zacks Consensus Estimate for GM’s 2024 earnings and sales implies year-over-year growth of 22.4% and 1.7%, respectively. The consensus mark for General Motors’ 2024 and 2025 EPS has moved north by 32 cents and 29 cents, respectively, over the past seven days. This legacy automaker currently carries a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Motors Company (GM) : Free Stock Analysis Report

Copart, Inc. (CPRT) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

Blue Bird Corporation (BLBD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance