The ‘very convenient’ shopping centre staple set to disappear

Between late 2016 to March 2020, the number of ATMs in Australia fell by 15 per cent to 28,000 machines, and that trend is set to continue, according to the Reserve Bank of Australia (RBA).

In a new paper, the RBA found that while most Australians would be inconvenienced by no access to a cash point or ATM, the humble machines’ days are numbered.

“While the majority of high cash users stated that their access to cash services is currently convenient, the economic incentives for the private sector to provide cash access points is likely to come under increasing pressure as the share of cash payments in the economy declines,” authors James Caddy, Luc Delaney and Chay Fisher wrote in the 2019 Consumer Payments Survey.

“Accordingly, an important issue is whether consumers have access to and familiarity with newer technologies necessary to use electronic payments.”

Also read: This form of payment will disappear in Australia soon, RBA confirms

Also read: Here's why Australia shouldn't go completely cashless

The cross-demographic survey found that 78 per cent of Australians carry cash in their wallet, slightly lower than the 80 per cent in 2016, with most carrying cash due to merchant acceptance. The average amount carried is $45.

At the same time, the number of people who don’t carry any cash in their wallets increased from 8 per cent in 2013 to 22 per cent in 2016 - a “notable development”, the RBA said.

And as shops continue to transition to digital payments, that trend is expected to continue, raising challenges for Australians who prefer to use cash.

Nearly all (90 per cent) who accessed cash from an ATM or cash point, like a supermarket, described their access as “convenient or very convenient”, with the discussion paper noting that access to technology underpinning newer payment methods like tap and go, online banking and mobile banking “may be challenging for a significant share of high cash users”, who skew older in age.

“Around half of high cash users did not regularly access the internet, and a similar amount reported having no mobile internet access. In contrast, 95 per cent of low cash users regularly accessed the internet, and a similar share reported having mobile internet access.”

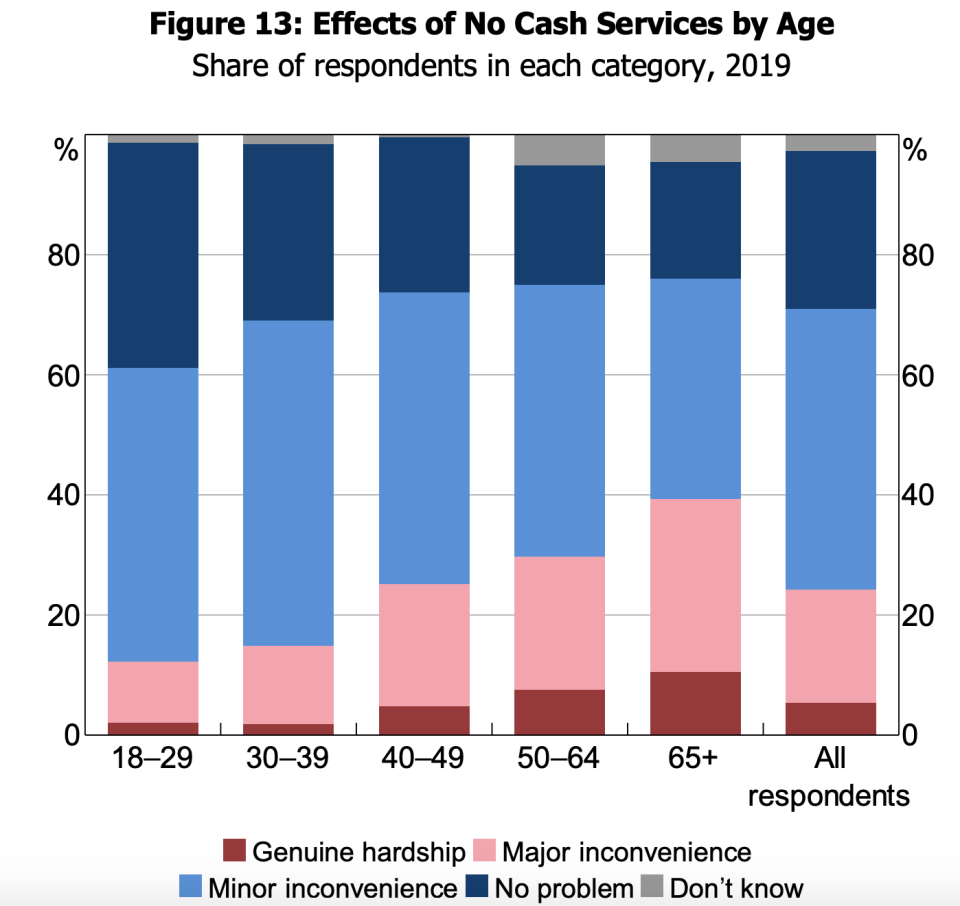

And while 73 per cent of Australians said that being unable to access an ATM or cash point would cause a minor inconvenience at most, 40 per cent of those older than 65 said the removal of the services would cause them difficulty.

Covid-19 also sped up the transition, with another 2,151 ATMs in Australia removed between April and June, according to the Australia Payments Network.

However, the value of cash withdrawals from ATMs has increased in recent months. Withdrawals hit a low point in April, before continuing to climb into July.

“These numbers represent a vote of confidence in cash and a strong statement that Australians want to keep their right to access and use cash,” said Tim Wildash, CEO of independent ATM network, Next Payments.

Wildash called for a more measured approach to removing ATMs, arguing that removing the cash points and bank branches “hurts communities, shopping centres and the economy”.

Want to take control of your finances and your future? Join the Women’s Money Movement on LinkedIn and follow Yahoo Finance Australia on Facebook, Twitter and Instagram.

Yahoo Finance

Yahoo Finance