CONMED (CNMD) Q1 Earnings and Revenues Surpass Estimates

CONMED Corporation CNMD reported first-quarter 2020 adjusted earnings per share of 51 cents, which beat the Zacks Consensus Estimate of 44 cents by 15.9%. However, the bottom line declined 10.5% from the year-ago quarter.

The New York-based medical products manufacturer reported revenues of $214 million, down 2% on a year-over-year basis and 0.7% at constant currency (cc). Nonetheless, the top line surpassed the Zacks Consensus Estimate by 2.6%.

Segment Details

Orthopedic Surgery

Revenues in the segment totaled $99.3 million, down 12.4% from the year-ago quarter.

On a domestic and on international basis Orthopedics revenues fell 18.2% and 8.7%, respectively, from the prior-year levels.

General Surgery

Revenues in the segment amounted to $114.7 million, up 9.2% year over year.

Domestically, General Surgery sales improved 14% year over year but international sales declined 0.8%.

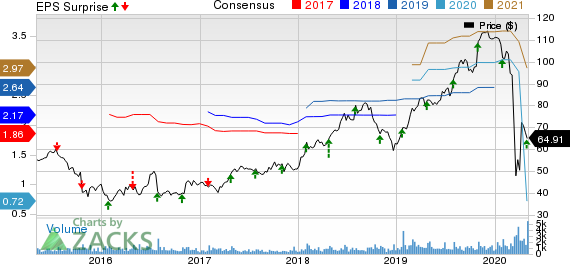

CONMED Corporation Price, Consensus and EPS Surprise

CONMED Corporation price-consensus-eps-surprise-chart | CONMED Corporation Quote

Sales by Geography

In the reported quarter, sales in the United States amounted to $118.8 million, up 1.5% year over year. International sales declined 6.1% to $95.2 million.

Margins

Gross profit in the quarter totaled $119.1 million, down 1.9% year over year. Per management, adjusted gross margin was 55.7%, contracting 10 bps.

Operating income came in at $13.2 million, up 13.2% year over year. Operating margin was 6.2%, up 90 bps year over year.

Financial Condition

Cash flow from operations for the three months ended Mar 31, 2020, was 3.7 million compared with ($3.9) million at the year-end 2019.

As of Mar 31, 2020, long-term debt at the end of the year was $772.6 million, up 2.3% sequentially.

2020 Guidance

Due to the uncertainty surrounding the extent and magnitude of the COVID-19 pandemic, management has decided to withdraw its previously announced 2020 guidance. It further added that it cannot furnish a reliable outlook at this moment.

Wrapping Up

CONMED exited the first quarter on a solid note, wherein earnings and revenues beat the respective estimates. The company’s core unit — General Surgery — continues to drive the top line. Expansion in margins is a positive.

The company generated around $6.2 million of sales from the Buffalo Filter buyout between Jan 1 and Feb 11.

Meanwhile, the company’s high long-term debt remains a concern. Further, its Orthopedic Surgery unit exhibited weak performance in the quarter under review. The company also witnessed a decline in international sales in the quarter. Additionally, CONMED operates in a highly competitive environment, especially with respect to the General Surgery business.

Zacks Rank

CONMED currently has a Zacks Rank #5 (Strong Sell).

Key Picks

Some better-ranked stocks in the broader medical space are Exact Sciences Corporation EXAS, Aphria Inc. APHA and Pacific Biosciences of California, Inc. PACB, each carrying a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Exact Sciences’s first-quarter 2020 revenues is pegged at $350.2 million, suggesting a whopping year-over-year improvement of 116.1%. The same for EPS stands at a loss of 60 cents, indicating an improvement of 9.1% from the prior-year quarter.

The Zacks Consensus Estimate for Aphria’s fourth-quarter fiscal 2020 revenues is $100.3 million, suggesting growth of 4.4% from the year-earlier reported figure.

The Zacks Consensus Estimate for Pacific Biosciences’ first-quarter 2020 revenues is pegged at $20.1 million, suggesting year-over-year improvement of 22.3%. The same for loss stands at 15 cents, indicating year-over-year improvement of 25%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CONMED Corporation (CNMD) : Free Stock Analysis Report

Exact Sciences Corporation (EXAS) : Free Stock Analysis Report

Pacific Biosciences of California, Inc. (PACB) : Free Stock Analysis Report

Aphria Inc. (APHA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance