How Confident Are Insiders About Mount Gibson Iron Limited (ASX:MGX)?

Mount Gibson Iron Limited, together with its subsidiaries, engages in the mining, exploration, crushing, development, transportation, and sale of hematite iron ore deposits in Australia. Mount Gibson Iron’s insiders have invested more than 28.66 million shares in the small-cap stocks within the past three months. Generally, insiders buying more shares in their own firm sends a bullish signal. The MIT Press (1998) published an article showing that stocks following insider buying outperformed the market by 4.5%. However, these signals may not be enough to gain conviction on whether to invest. I’ve analysed two possible reasons driving the insiders’ decision to ramp up their investment of late. Check out our latest analysis for Mount Gibson Iron

Who Are Ramping Up Their Shares?

More shares have been bought than sold by Mount Gibson Iron insiders in the past three months. In total, individual insiders own over 8.74 million shares in the business, which makes up around 0.80% of total shares outstanding.

Is This Consistent With Future Growth?

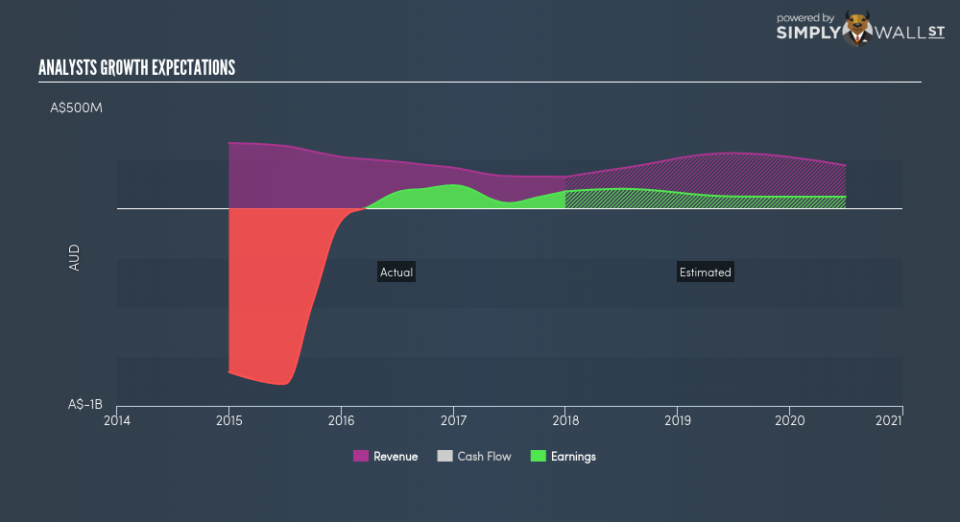

At first glance, analysts’ earnings expectations of -31.60% over the next three years illustrates poor outlook for the company, however, this is contrary to the signal company insiders are sending with their net buying activity. Delving deeper into the line items, Mount Gibson Iron is expected to experience an impressive double-digit top-line growth next year, which has not been passed down into earnings expectation given its negative growth of -7.09%. This indicates high levels of cost growth compared to revenues, which is typical during a period of investment and growth in the company. This seems to be supported by insiders’ conviction evidenced by their net buying activities. Or else they may simply deem the company as undervalued by the market based on future growth it could produce.

Did Stock Price Volatility Instigate Buying?

An alternative reason for recent trades could be insiders taking advantage of the share price volatility. A correlation could mean directors are trading on market inefficiencies based on their belief of the company’s intrinsic value. In the past three months, Mount Gibson Iron’s share price reached a high of A$0.47 and a low of A$0.36. This suggests reasonable volatility with a change of 30.56%. Perhaps not a significant enough movement to warrant transactions, thus motivation may be a result of their belief in the company in the future or simply personal portfolio rebalancing.

Next Steps:

Mount Gibson Iron’s net buying tells us the stock is in favour with some insiders, however, earnings expectations tell a different story, whilst a moderate share price movement could provide incentive to buy now. However, while insider transactions could be a helpful signal, it is definitely not sufficient on its own to make an investment decision. there are two key aspects you should further examine:

Financial Health: Does Mount Gibson Iron have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

Other High Quality Alternatives : Are there other high quality stocks you could be holding instead of Mount Gibson Iron? Explore our interactive list of high quality stocks to get an idea of what else is out there you may be missing!

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance