Conduent Inc (CNDT) Q1 2024 Earnings: Revenue Exceeds Expectations, Adjusted EBITDA Aligns with ...

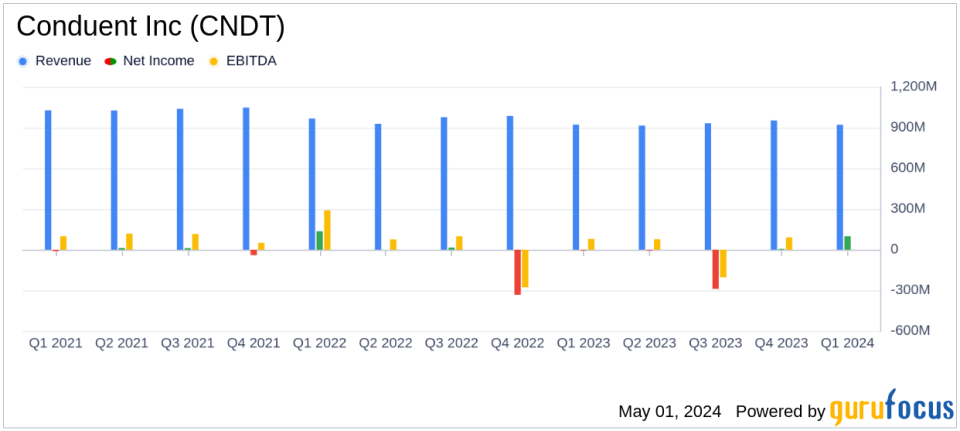

Revenue: Reported at $921M, nearly unchanged year-over-year, marginally exceeding estimates of $895.5M.

Pre-tax Income: Surged to $127M from a loss of $8M in the prior year, indicating significant financial improvement.

GAAP Net Income: Turned positive at $99M compared to a loss of $6M in Q1 2023, marking a substantial recovery.

Adjusted EBITDA: Decreased to $69M from $90M year-over-year, with margin contracting by 230 basis points to 7.5%.

GAAP Diluted EPS: Improved dramatically to $0.46 from a loss of $0.04 per share in the previous year.

Adjusted Diluted EPS: Recorded a loss of $0.09, deteriorating from break-even in the year-ago quarter.

Cash Flow from Operating Activities: Declined to a negative $37M from negative $12M, reflecting increased cash outflows.

On May 1, 2024, Conduent Inc (NASDAQ:CNDT) announced its financial results for the first quarter of 2024, revealing a performance that saw revenue surpassing analyst expectations. The detailed earnings report, disclosed in their 8-K filing, highlighted a revenue of $921 million against the estimated $895.5 million, marking a slight year-over-year decrease but still topping forecasts.

Conduent Inc, a leading provider of business process services, operates across diverse sectors including Healthcare, Transportation, and Government Services, primarily in the United States. The company's expertise in analytics, automation, and transaction-intensive processing positions it uniquely in the market, catering to a wide range of industry needs.

Financial Performance and Strategic Highlights

The quarter witnessed a significant turnaround in pre-tax income, which stood at $127 million compared to a loss of $8 million in the same quarter the previous year. This improvement was largely attributed to gains from the transfer of the BenefitWallet portfolio. However, the Adjusted EBITDA of $69 million reflected a 23.3% decline from the previous year, with the margin compressing to 7.5% from 9.8%.

Conduent's strategic maneuvers included the closure of sales in its Curbside Management and Public Safety businesses and the ongoing transactions related to the BenefitWallet portfolio, expected to conclude in Q2 2024. These moves are part of a broader rationalization aimed at capital efficiency and future growth.

Despite these positives, the company faced challenges in cash flow, with operating activities showing a negative $37 million, worsening from a negative $12 million year-over-year. Adjusted Free Cash Flow also deteriorated, marking a 62% increase in outflows.

Operational and Market Challenges

CEO Cliff Skelton commented on the quarter as a "continued reflection of progress in our portfolio performance," despite acknowledging timing issues and variations across business segments. The company's diverse portfolio helped mitigate some segment-specific softness, particularly in Government services.

"2024 represents what we believe to be the trough in our growth turnaround. With strong client relationships and partnerships with leading technology firms like Microsoft and Oracle, we are on track with our 3-year strategic plan," stated Skelton.

This period also saw Conduent reinforcing its technological capabilities, notably collaborating with Microsoft on innovations using Azure OpenAI Services and streamlining processes with Oracle Cloud solutions.

Looking Ahead

For the full year 2024, Conduent anticipates revenues between $3.6 billion and $3.7 billion, slightly under the 2023 figure of $3.722 billion. The Adjusted EBITDA margin is projected to be between 8% and 9%, aiming for an improvement in operational efficiency.

The company's strong liquidity position, with nearly $1.0 billion available, supports its strategic initiatives and share repurchase program, which saw 4.8 million shares repurchased in the quarter.

As Conduent continues to navigate its turnaround strategy amidst a challenging operational landscape, its focus on strategic partnerships, portfolio optimization, and technological advancements positions it to potentially enhance shareholder value and customer satisfaction in the evolving digital services sector.

Explore the complete 8-K earnings release (here) from Conduent Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance