Comfort Systems USA Inc (FIX) Surpasses Q1 Earnings and Revenue Estimates

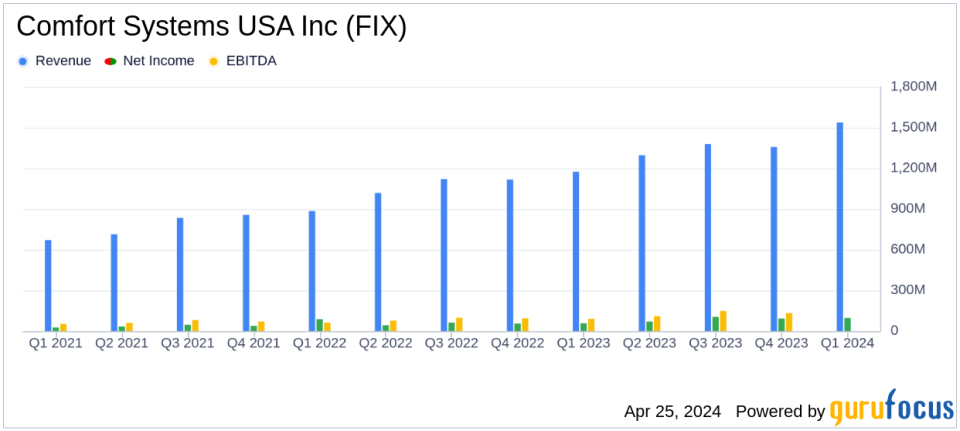

Revenue: Reported $1.54 billion, up 30.9% year-over-year, surpassing estimates of $1.48 billion.

Net Income: Reached $96.3 million, a significant increase from $57.2 million in the prior year, exceeding estimates of $73.34 million.

Earnings Per Share (EPS): Achieved $2.69 per diluted share, comfortably above the estimate of $2.01 and last year's $1.59.

Operating Cash Flow: Increased to $146.6 million from $126.9 million in the previous year, indicating strong cash generation capabilities.

Backlog: Grew to $5.91 billion as of March 31, 2024, up from $5.16 billion at the end of the previous quarter, showing robust future revenue potential.

Free Cash Flow: Improved to $122.6 million, up from $111.0 million in the same quarter last year, reflecting enhanced financial flexibility.

Dividends: Declared a dividend of $0.250 per share, an increase from $0.175 per share last year, demonstrating commitment to shareholder returns.

On April 25, 2024, Comfort Systems USA Inc (NYSE:FIX) released its 8-K filing, announcing a significant outperformance in its first-quarter results. The company reported a net income of $96.3 million or $2.69 per diluted share, comfortably surpassing the analyst estimates of $2.01 per share and a net income of $73.34 million. Revenue for the quarter stood at $1,537.0 million, also exceeding expectations of $1,480.26 million.

Comfort Systems USA, a leading provider in the HVAC, plumbing, and electrical contracting services, has shown remarkable growth, particularly in its mechanical services segment, which constitutes the bulk of its operations. The company's projects span across commercial, industrial, and institutional buildings, focusing heavily on both new installations and maintenance services for existing facilities.

Operational Highlights and Strategic Achievements

The company's financial success in the quarter was highlighted by a substantial increase in its backlog, which rose from $5.16 billion at the end of 2023 to $5.91 billion by March 31, 2024. This growth indicates strong future revenue potential and reflects the company's effective market strategies and customer satisfaction. President and CEO Brian Lane commented on the results:

"Our expert and dedicated employees achieved superb execution for our customers this quarter, and our newly acquired companies are off to a great start. First quarter results were extraordinary, with per share earnings more than a dollar above the same quarter last year, increased backlog, and over $140 million in cash flow."

The increase in both the mechanical and electrical segments' profitability underscores the company's operational efficiency and ability to capitalize on favorable market conditions.

Financial Analysis

The income statement details reveal a gross profit of $297.363 million, up from $205.405 million in the previous year, with a gross margin improvement from 17.5% to 19.3%. This margin enhancement is primarily due to effective cost management and higher revenue generation. Operating income also saw a significant jump to $135.460 million from $70.885 million, reflecting robust operational execution.

The balance sheet remains strong with an increase in total assets from $3.305 billion at the end of 2023 to $3.902 billion by March 31, 2024. This growth is supported by a healthy cash flow from operations, which stood at $146.557 million, up from $126.909 million in the prior year. The company's strategic investments and acquisitions are evident from the increased cash used in investing activities, which totaled $221.648 million, compared to $68.945 million in the previous year.

Market Outlook and Forward Strategies

Comfort Systems USA's outlook for 2024 remains optimistic, with continued demand across its service segments. The strategic acquisitions made in recent times are expected to integrate smoothly and contribute positively to the companys growth trajectory. The management's focus will likely remain on enhancing operational efficiencies, exploring new market opportunities, and maintaining a strong backlog that secures future revenues.

Investors and stakeholders may look forward to sustained growth and profitability as Comfort Systems USA continues to leverage its market position and operational strengths in a buoyant economic environment.

Explore the complete 8-K earnings release (here) from Comfort Systems USA Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance