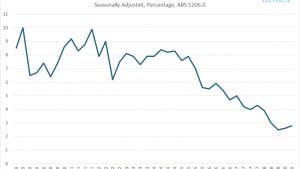

Australian economic growth hasn't been this slow since the GFC

Australian economic growth hasn't been this slow since the GFC.

According to the Australian Bureau of Statistics (ABS), the economy grew by 0.4% in March quarter in seasonally adjusted chain volume terms, a result that was in line with market expectations.

The modest result followed a 0.2% increase in the December quarter that was unchanged from the initial estimate.

Despite the modest acceleration in the economy to start the year, growth over the year still slowed to 1.8%, the weakest expansion since the September quarter of 2009, the tail-end of the GFC.

Image: BI

"The Australian economy continues to grow but more slowly than our long term average of 3.5%," said Bruce Hockman, Chief Economist at the ABS.

As was the case in the second half of last year, the main source of growth during the March quarter came from solid government demand.

"Government spending was the main contributor to growth, reflecting ongoing delivery of services in disability, health and aged care," the ABS said.

Government consumption contributed 0.2 percentage points to quarterly growth, the same contribution from international trade. Non-dwelling construction also added 0.1 percentage points.

The big story from the latest national accounts was weakness in household consumption, the largest part of the Australian economy at a little under 60%.

It contributed only 0.1 percentage points to the quarterly increase, impacted by weak income growth and a decreased wealth effect from falling home prices in many parts of the country.

"[This reflected] reduced spending on discretionary goods such as furnishing and household equipment, recreation and culture and hotels, cafes and restaurants," the ABS said.

This table from the ABS shows the contribution to growth by individual component over the past quarter and year using an expenditure approach to GDP. The column on the right indicates the contribution each component made to the quarterly GDP figure.

Image: ABS

During the March quarter, dwelling investment lopped 0.1 percentage points from growth, the same amount as inventories.

An adjustment to the expenditure measure of GDP helped to offset those pockets of weakness, reflecting that income and production measures of GDP were stronger during the quarter.

Contributing to the weakness in household consumption, Australians saved a greater proportion of their disposable income in the first three months of the year.

The household savings rate ticked up to 2.8%, continuing the modest rebound from the decade-lows in the September quarter last year.

Image: BI

"Household disposable income outpaced subdued growth in household spending," the ABS said.

Employee compensation also remained soft, growing 1.2% in aggregate during the quarter, or 0.4% per worker on average.

While the economy, as a whole, grew at a faster pace in the March quarter than three months earlier, output per person continued to go backwards, extending Australia's per capita recession into a third consecutive quarter

Per Capita GDP fell by a minuscule 0.03% in seasonally adjusted chain volume terms, following declines of 0.2% and 0.1% in the prior two quarters.

Over the year, per capita GDP grew by a paltry 0.1%, also the slowest increase since the GFC.

Image: BI

A per capita recession indicates that while the Australian economy has become larger as a whole, the share among individuals has actually become smaller, reflecting weak productivity.

Sluggish productivity has been a feature in Australian since the GFC, a factor that has acted to suppress growth in household incomes and spending, contributing to slowdown in the economy in recent quarters.

"The economy is off to a rough start in 2019, and we suspect that things won’t get better anytime soon," said Ben Udy, Economist at Capital Economics.

"Today’s data doesn’t inspire much confidence in the Australian economic outlook."

Sarah Hunter, Chief Economist for BIS Oxford Economics, was another to express little confidence about a swift turnaround in the economy anytime soon.

"The data confirms the economy started 2019 very softly," she said.

"Looking ahead, growth momentum is unlikely to accelerate significantly through the rest of this year. We expect the economy to expand by just 1.7% in 2019, with growth not rising above 2% per annum until early 2020."

More to follow...

Yahoo Finance

Yahoo Finance