Comcast Corp (CMCSA) Q1 2024 Earnings: Steady Growth Amid Market Challenges

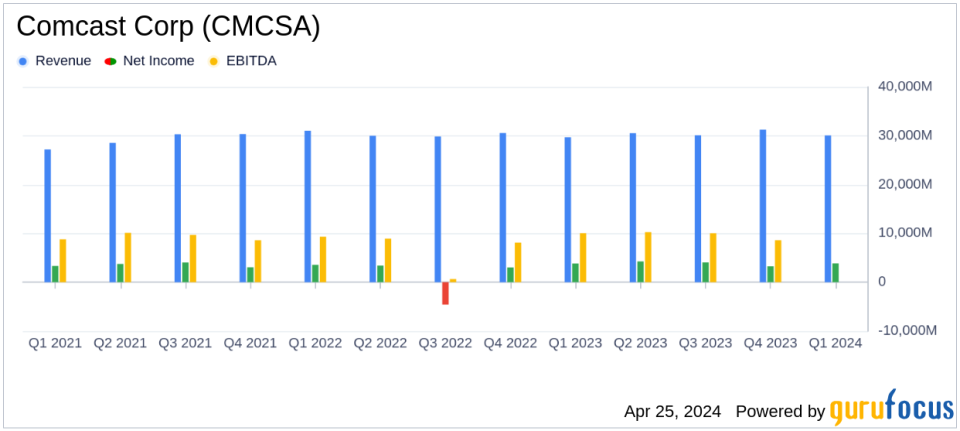

Revenue: Reported at $30,058 million, up 1.2% year-over-year, slightly above estimates of $29,811.50 million.

Net Income: Achieved $3,857 million, a modest increase of 0.6% from the previous year, slightly below the estimated $3,896.10 million.

Earnings Per Share (EPS): Recorded at $0.97, up 6.5% year-over-year, falling short of the estimated $0.99.

Adjusted Earnings Per Share (EPS): Increased by 13.9% to $1.04, reflecting strong operational performance.

Free Cash Flow: Grew significantly by 19.4% to $4,538 million, highlighting efficient capital management and operational efficiency.

Dividends and Share Repurchases: Returned a total of $3.6 billion to shareholders through $1.2 billion in dividends and $2.4 billion in share repurchases.

Peacock Performance: Peacock's paid subscribers surged by 55% year-over-year to 34 million, with revenue jumping 54% to $1.1 billion.

On April 25, 2024, Comcast Corp (NASDAQ:CMCSA) disclosed its financial results for the first quarter ended March 31, 2024, through its 8-K filing. The company reported a slight revenue increase and a more substantial rise in adjusted earnings per share (EPS), showcasing resilience in a competitive landscape.

Comcast, a global media and technology conglomerate, operates through three primary segments: its core cable business, NBCUniversal, and Sky. The company's extensive network services nearly half of U.S. homes, with significant stakes in broadcast and cable television, film production, and theme parks.

Financial Performance Overview

For Q1 2024, Comcast reported a revenue of $30,058 million, a 1.2% increase year-over-year, aligning closely with analyst expectations of $29,811.50 million. The company's net income slightly rose to $3,857 million from $3,834 million in the previous year. Adjusted EPS saw a notable increase to $1.04, compared to $0.92 in Q1 2023, surpassing the estimated $0.99.

Operational Highlights and Strategic Moves

Comcast's connectivity and platforms segment demonstrated robust performance with a 1.5% increase in adjusted EBITDA to $8.2 billion. The company achieved a 4.2% rise in domestic broadband average rate per customer, driving revenue growth in this segment. Notably, Comcast's Peacock streaming service saw a 55% increase in paid subscribers, reaching 34 million, bolstered by strategic content additions like the Oscar-winning film 'Oppenheimer'.

Despite challenges in the video segment, where revenue declined by 6.9%, Comcast's focus on high-growth areas such as broadband and wireless continues to pay dividends. The company also highlighted its ongoing investments in theme parks, including the construction of the Epic Universe theme park in Orlando, set to open in 2025.

Capital Allocation and Shareholder Returns

Comcast remains committed to delivering shareholder value, as evidenced by $3.6 billion returned to shareholders through dividends and share repurchases. The company's disciplined capital allocation strategy supports its long-term growth objectives while maintaining a strong balance sheet.

Looking Ahead

As Comcast navigates the evolving market dynamics, the company's diversified business model and strategic investments position it well for sustained growth. Management's focus on enhancing broadband services, expanding its streaming platform, and investing in content and technology infrastructure underpins its competitive edge in the telecommunications and media sectors.

Overall, Comcast's first-quarter results reflect a solid start to 2024, with financial and operational metrics that support the company's long-term strategic goals. Investors and stakeholders may look forward to continued progress as Comcast further expands its digital and global footprint.

For detailed financial figures and segment-specific performance, please refer to the full earnings report on Comcast's Investor Relations website.

Explore the complete 8-K earnings release (here) from Comcast Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance