Colfax (CFX) Meets Earnings Estimates in Q3, Lowers View

Colfax Corporation CFX reported mixed results for third-quarter 2021. Its earnings met estimates and sales surpassed the same by 1.57%. The in-line earnings results came after 23 consecutive quarters of an earnings beat.

The machinery company’s adjusted earnings in the reported quarter were 54 cents per share, meeting the consensus estimate. Also, the bottom line improved 31.7% from the year-ago figure of 41 cents on improved sales, driven by strengthening demand, and margin generation. Supply-chain woes and logistic issues played spoilsports in the quarter.

Revenue Details

In the quarter under review, Colfax’s net sales were $965.9 million, reflecting year-over-year growth of 19.9%. The results benefitted from 13.7% growth in the existing businesses and a 0.5% positive impact from movements in foreign currencies. Acquisitions boosted sales by 5.7% in the quarter.

The company’s revenues surpassed the Zacks Consensus Estimate of $951 million.

It currently reports under two business segments — Fabrication Technology and Medical Technology. The segmental information is briefly discussed below:

Revenues from Fabrication Technology totaled $606 million, rising 23.3% year over year. The results gained from 22.7% growth in existing businesses and a 0.5% contribution from foreign currency translation. Also, acquisitions boosted sales by 0.1% in the quarter. The segment contributed 62.7% to the quarter’s sales.

Revenues from Medical Technology totaled $359.9 million, reflecting year-over-year growth of 14.5%. The results gained from a 14.5% contribution from acquisitions and 0.4% from foreign currency translation. Existing businesses recorded a decline of 0.4% in the quarter.

On Mar 4, 2021, Colfax announced its plan to split its fabrication technology and medical technology businesses into separate companies. Notably, the separation, which is expected to close in the first quarter of 2022, is planned to be carried out following a tax-free method.

Post transaction completion, Colfax will adopt the name, Enovis.

Margin Profile

In the quarter under review, Colfax’s cost of sales increased 21.5% year over year to $561 million. It represented 58.1% of the quarter’s sales compared with 57.3% in the year-ago quarter. Gross profit increased 17.7% year over year to $404.9 million and as a percentage of sales, it was 41.9% versus 42.7% in the year-ago quarter.

Selling, general and administrative expenses expanded 20.3% year over year to $334.4 million. It represented 34.6% of revenues. Adjusted earnings before interest, tax and amortization (EBITA) in the quarter under review increased 22.2% year over year to $131.6 million. Also, the adjusted EBITA margin grew 0.2 percentage points year over year to 13.6%.

Interest expenses (net) in the quarter decreased 47% year over year to $13.5 million.

Balance Sheet and Cash Flow

Exiting the third quarter, Colfax had cash and cash equivalents of $177.5 million, up 184.9% from $62.3 million in the previous quarter. Its long-term debt balance was up 2.2% sequentially to $1,611.7 million.

The company repaid borrowings of $410 million under its revolving credit facilities and others in the first three quarters of 2021. It raised $515.7 million in cash through the same means. It also repaid senior notes worth $700 million. Proceeds from the issuance of shares totaled $738.2 million in the first three quarters of 2021.

In the first three quarters of 2021, Colfax generated net cash of $259.9 million from operating activities, up 50.1% from the year-ago comparable period. Capital used for purchasing property, plant and equipment was $73.6 million, reflecting a year-over-year decline of 9.8%.

Outlook

For 2021, Colfax anticipates adjusted earnings per share at the lower end of the previously mentioned $2.10-$2.20. The revision takes into account high taxes and the pandemic-led headwinds.

Free cash flow is likely to be $275 million for the year (maintained). The tax rate is expected to be 23-24% for the year. ESAB sales are predicted to increase 24-25% year over year, while that for MedTech is expected to increase 26-28%.

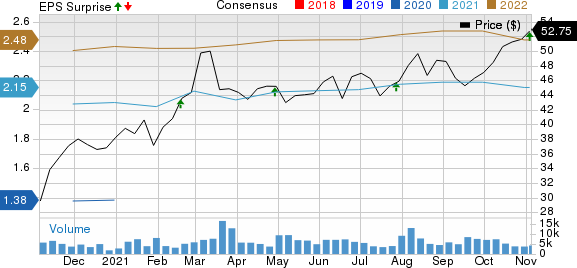

Colfax Corporation Price, Consensus and EPS Surprise

Colfax Corporation price-consensus-eps-surprise-chart | Colfax Corporation Quote

Zacks Rank & Stock to Consider

With a market capitalization of $7.5 billion, the company currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the industry are Applied Industrial Technologies, Inc. AIT, Kadant Inc. KAI, and Welbilt, Inc. WBT. All companies presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, earnings estimates for these companies improved for the current year. Further, earnings surprise for the last reported quarter was 14.29% for Applied Industrial, 20.12% for Kadant, and 40.00% for Welbilt.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Kadant Inc (KAI) : Free Stock Analysis Report

Colfax Corporation (CFX) : Free Stock Analysis Report

Welbilt, Inc. (WBT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance