Cohen & Steers (CNS) Q4 Earnings Beat on Higher Revenues

Cohen & Steers’ CNS fourth-quarter 2019 adjusted earnings of 74 cents per share surpassed the Zacks Consensus Estimate of 67 cents. Also, the bottom line was 32.1% higher than the year-ago quarter figure.

Results benefited from an improvement in assets under management (AUM) and higher revenues. However, rise in expenses was a headwind.

Net income available to common stockholders (GAAP basis) was $36.7 million or 75 cents per share, up from $25.6 million or 54 cents per share in the prior-year quarter.

For 2019, the company reported adjusted earnings of $2.57 per share, which beat the Zacks Consensus Estimate of $2.50. Also, the bottom line was 7.1% higher than the previous year. Net income available to common stockholders (GAAP basis) for the year was $134.6 million or $2.79 per share, up from $113.9 million or $2.40 per share in 2018.

Revenues Improve, Expenses Rise

Quarterly revenues (GAAP basis) were $109.8 million, up 17% from the year-ago quarter. An increase in all three components of revenues drove the upside.

For 2019, revenues (GAAP basis) were $410.8 million, up 7.8% from 2018.

Total expenses (GAAP basis) amounted to $63.4 million, up 6.4% year over year. The increase resulted from a rise in all cost components.

Operating income (GAAP basis) was $46.5 million, up 35.4% year over year.

Total non-operating income was $1.4 million against non-operating loss of $3.3 million in the year-ago quarter.

AUM Improves

As of Dec 31, 2019, AUM was $72.2 billion, up 24.8% from the year-earlier quarter. The company witnessed net inflows of $1.6 billion in the quarter against outflows of $1.2 billion a year ago.

Also, average AUM totaled $71 billion, up 16.9%.

Our Take

While the company’s diverse product offerings and investment strategies will likely continue to support top-line growth, rising operating expenses (as witnessed in the fourth quarter) are likely to hurt bottom-line growth to an extent in the near term. Moreover, the company's high dependence on advisory revenues is a key near-term concern.

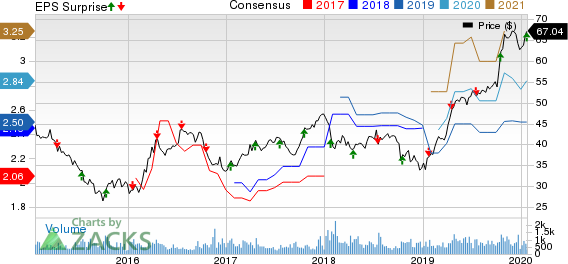

Cohen & Steers Inc Price, Consensus and EPS Surprise

Cohen & Steers Inc price-consensus-eps-surprise-chart | Cohen & Steers Inc Quote

Currently, Cohen & Steers carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Release Schedule of Other Investment Managers

Federated Investors, Inc. FII and Virtus Investment Partners, Inc. VRTS are scheduled to report results on Jan 30 and Jan 31, respectively. Ares Capital Corporation ARCC is scheduled to announce results on Feb 12.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Federated Investors, Inc. (FII) : Free Stock Analysis Report

Cohen & Steers Inc (CNS) : Free Stock Analysis Report

Virtus Investment Partners, Inc. (VRTS) : Free Stock Analysis Report

Ares Capital Corporation (ARCC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance