Cleveland-Cliffs Inc. (CLF) Q1 2024 Earnings: Misses EPS Estimates Amidst Strategic Shifts

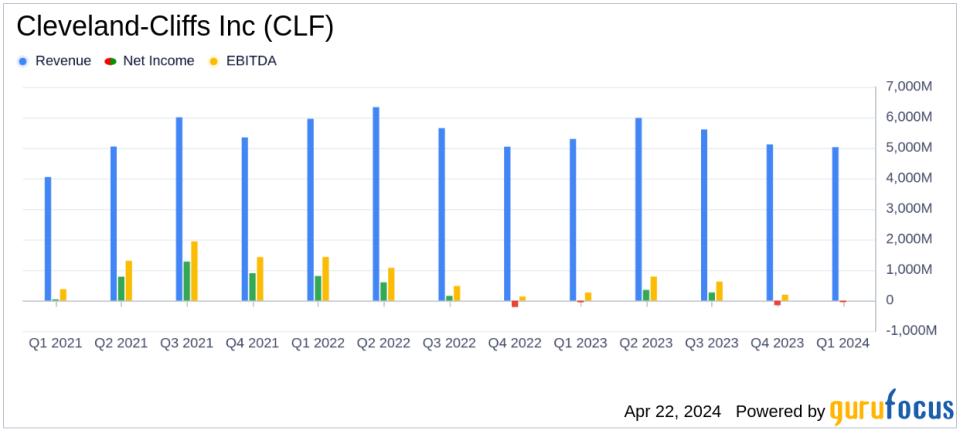

Revenue: $5.2 billion, slightly above the estimated $5.346 billion.

Adjusted Net Income: $87 million, significantly below the estimated $114.03 million.

Adjusted EPS: $0.18, falling short of the estimated $0.22.

Adjusted EBITDA: $414 million, showing a 70% improvement year-over-year and a 48% increase quarter-over-quarter.

Share Repurchase: Completed a $1 billion program by repurchasing 30.4 million shares; announced a new $1.5 billion share repurchase program.

Liquidity: Reported $4.0 billion in liquidity as of the end of the quarter.

Operational Highlights: Steel shipments totaled 3.9 million net tons during the quarter.

Cleveland-Cliffs Inc (NYSE:CLF), a leading flat-rolled steel producer and iron ore pellet manufacturer in North America, released its 8-K filing on April 22, 2024, detailing its financial performance for the first quarter ended March 31, 2024. The company reported revenues of $5.2 billion, closely aligning with the previous quarter's $5.1 billion and slightly missing analyst expectations of $5.346 billion. Despite the robust revenue, CLF recorded a GAAP net loss of $53 million and an adjusted net income of $87 million, resulting in an adjusted EPS of $0.18 per diluted share, which fell short of the estimated $0.22.

Company Overview

Cleveland-Cliffs Inc operates primarily through its Steelmaking segment, with a significant presence in the automotive industry in North America. The company is vertically integrated, handling everything from mined raw materials to steelmaking and downstream finishing. Its operations span across the United States and Canada, with the majority of its revenue generated domestically.

Operational Highlights and Strategic Initiatives

The first quarter saw Cleveland-Cliffs repurchase 30.4 million shares, completing its $1 billion share repurchase program, and announcing a new $1.5 billion program. This aggressive return of capital to shareholders underscores management's confidence in the company's valuation. Additionally, CLF's focus on green steel production was notably recognized with significant federal grants aimed at decarbonization projects, reflecting its commitment to sustainability in steel production.

Financial Performance Analysis

The quarter's financial results were impacted by several challenges, including a $202 million charge related to the idle of the Weirton tinplate facility and loss on extinguishment of debt. These factors significantly affected the net income figures. However, the company's adjusted EBITDA of $414 million marks a substantial improvement both year-over-year and sequentially, indicating underlying operational efficiency and resilience despite market volatility.

Market and Future Outlook

CEO Lourenco Goncalves highlighted the resilience in the automotive sector, which has helped offset challenges from other market segments. Looking ahead, Cleveland-Cliffs anticipates benefiting from reduced costs and strong demand in the automotive sector, with increasing orders and rising spot pricing from service center customers.

Financial Statements and Liquidity

The company ended the quarter with $4.0 billion in liquidity and a net debt of $3.6 billion, maintaining a strong balance sheet. The targeted net debt to adjusted EBITDA ratio remains well below the threshold, providing flexibility for ongoing and future initiatives.

Conclusion

While Cleveland-Cliffs faced some financial strains in Q1 2024, its strategic initiatives, particularly in shareholder returns and sustainability, align with long-term value creation. The company's robust liquidity position and strategic focus on key growth areas, including green steel production, position it well to navigate future industry cycles and leverage market opportunities.

For more detailed information, investors and stakeholders are encouraged to review the full 8-K filing and tune into the upcoming earnings call scheduled for April 23, 2024.

Explore the complete 8-K earnings release (here) from Cleveland-Cliffs Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance