Cisco (CSCO) to Now Shell Out $4.5B for Acacia Acquisition

Cisco CSCO recently announced an amended merger agreement to acquire Acacia Communications ACIA. Per the new terms of the deal, Cisco will now pay $115 per share in cash, totaling to $4.5 billion, net of cash and marketable securities.

The acquisition, subject to regulatory and shareholder approvals, is expected to conclude in the first quarter of 2021. Post completion of the deal, Acacia will become a part of Cisco’s Optics unit.

Cisco’s latest acquisition price represents a massive jump of 73.1% over the initial purchase price. In July 2019, Cisco announced its intent to purchase Acacia for $2.6 billion net of cash and marketable securities.

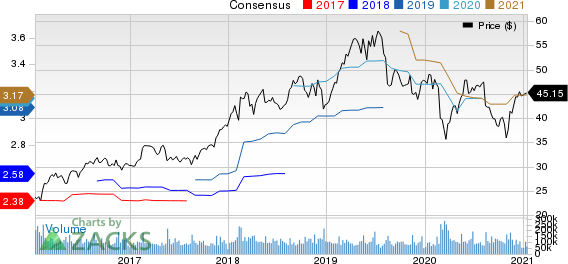

Cisco Systems, Inc. Price and Consensus

Cisco Systems, Inc. price-consensus-chart | Cisco Systems, Inc. Quote

However, the deal witnessed a hurdle when Acacia announced its decision to end the merger with immediate effect on Jan 8, 2021. The company cited that China's regulatory authority State Administration for Market Regulation’s (SAMR) approval for closing the deal was not obtained within the timeframe as noted in the agreement. Hence, Acacia wielded its right to cancel the transaction.

Subsequently, Cisco sought court order to bar Acacia from revoking the proposed buyout until the matter was settled by court. The networking giant also added that it had received SAMR’s approval for progressing with the acquisition from SAMR on Jan 7, 2021.

Acacia then filed counterclaim against Cisco stating that its cessation of the merger was valid as the approval was not received within the timeframe as referred in the original merger agreement.

Following the bid raise by Cisco, the company’s shares dropped 0.5% and closed at $45.15 on Jan 14. Nevertheless, Acacia’s stock soared 31.5% and closed at $113.64 on the same day.

Cisco’s Acacia Buyout to Boost its Optical Solutions Portfolio

With Acacia buyout, Cisco aims to expand optical systems portfolio, especially coherent optical solutions to support its “Internet for the Future” strategy. The increasing need for optics to address emerging network infrastructure demands of power and density deserves a special mention.

Acacia is an optical networking technology company that is involved in design, development, manufacturing and marketing of communication equipment. It offers coherent optical interconnect products mostly for content and communication service providers as well as cloud infrastructure operators across Americas, Asia Pacific, Europe, Middle East and Africa.

According to a report available on ReportLinker, coherent optical equipment market, worldwide, is projected to witness a CAGR of 10.07% between 2019 and 2028.

Cisco’s Acacia buyout will bolster its routing, switching and optical networking offerings amid rapid proliferation of optical interconnect technologies.

The integration of Acacia’s optical technology with Cisco’s network and cloud security platforms is likely to augment Cisco’s reach in the coherent technology and pluggable optics solutions’ domain.

Zacks Rank and Key Picks

Currently, Cisco carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader sector are Silicon Motion Technology Corporation SIMO, and Micron Technology MU. Both the stocks flaunt a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Silicon Motion and Micron Technology is currently pegged at 8% and 12.7%, respectively.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

Silicon Motion Technology Corporation (SIMO) : Free Stock Analysis Report

Acacia Communications, Inc. (ACIA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance