Chuck Royce Bolsters Position in GCM Grosvenor Inc

In a recent transaction, the investment firm led by Charles M. Royce has increased its stake in GCM Grosvenor Inc (NASDAQ:GCMG), a global alternative asset management firm. The acquisition of additional shares underscores the firm's confidence in GCM Grosvenor's potential as a value investment opportunity. This article delves into the specifics of the trade, the profile of Chuck Royce (Trades, Portfolio), and an overview of GCM Grosvenor Inc, providing investors with a comprehensive understanding of the transaction's implications.

Transaction Overview

On February 29, 2024, Chuck Royce (Trades, Portfolio)'s firm added 490,131 shares of GCM Grosvenor Inc to its portfolio, reflecting an 11.81% increase in the firm's holdings in the company. The transaction was executed at a price of $8.47 per share, bringing the total number of shares owned by the firm to 4,640,466. This addition has a modest impact of 0.04% on the portfolio, with the position now representing 0.36% of the firm's holdings and 10.79% of GCM Grosvenor's outstanding shares.

Chuck Royce (Trades, Portfolio)'s Investment Profile

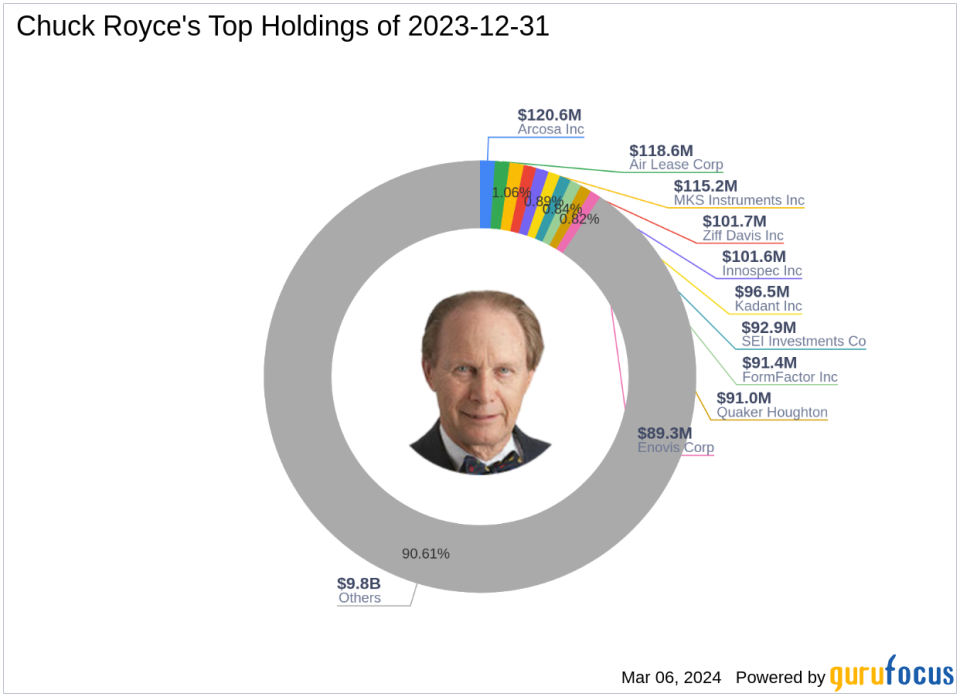

Charles M. Royce, a renowned figure in the investment community, has been at the helm of Royce Pennsylvania Mutual Fund since 1972. With a bachelor's degree from Brown University and an MBA from Columbia University, Royce's investment philosophy centers on small-cap companies, typically with market capitalizations up to $5 billion. The firm's value-oriented approach seeks out stocks trading below their estimated enterprise value, focusing on strong balance sheets, a history of business success, and future profitability potential. Royce's top holdings include Innospec Inc (NASDAQ:IOSP), Ziff Davis Inc (NASDAQ:ZD), and MKS Instruments Inc (NASDAQ:MKSI), with a significant presence in the industrials and technology sectors.

GCM Grosvenor Inc at a Glance

GCM Grosvenor Inc, with a market capitalization of $362.033 million, specializes in alternative investment strategies, including private equity, infrastructure, real estate, credit, ESG, and absolute return strategies. The company generates revenue through incentive fees, management fees, and other operating income. Since its IPO on November 18, 2020, GCM Grosvenor has been committed to delivering diversified investment solutions to its clients.

Impact of the Trade on Chuck Royce (Trades, Portfolio)'s Portfolio

The recent acquisition of GCM Grosvenor shares has slightly increased the firm's exposure to the asset management industry, aligning with its strategy of investing in companies with strong potential for value appreciation. The trade's impact on the portfolio, while modest, is a strategic move to capitalize on GCM Grosvenor's growth prospects.

Stock Performance and Valuation Insights

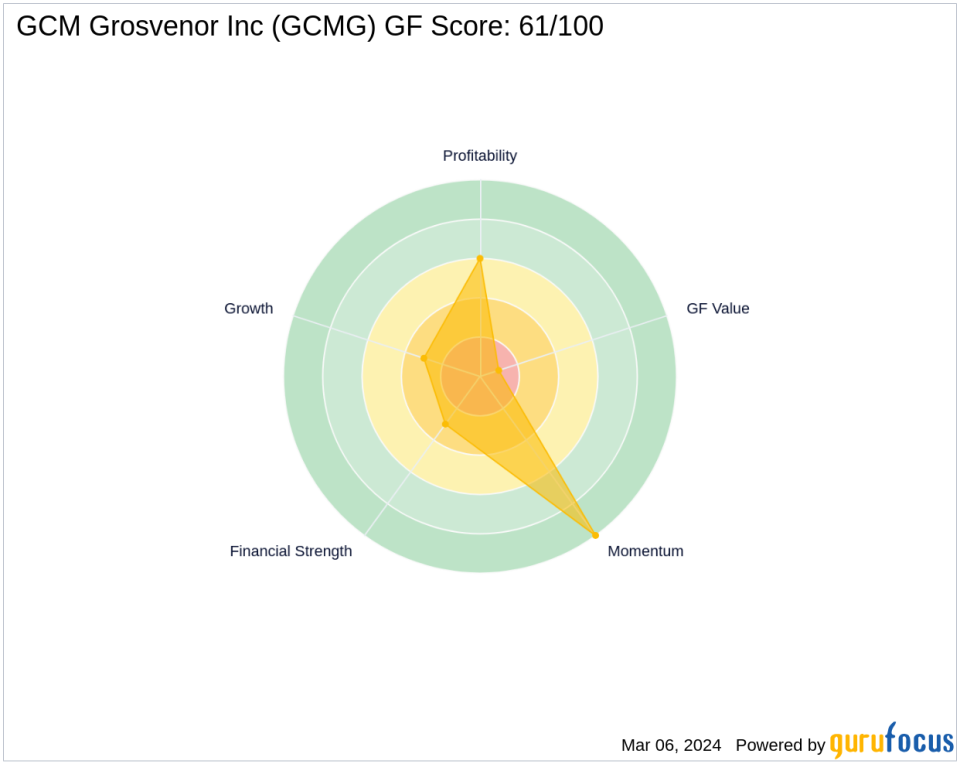

GCM Grosvenor's stock is currently trading at $8.42, slightly below the trade price of $8.47. The stock is considered modestly overvalued with a GF Value of $6.59 and a price to GF Value ratio of 1.28. Despite a year-to-date price decrease of 2.32% and a decline of 29.48% since its IPO, the company's GF Score of 61/100 suggests a potential for future performance improvement.

Comparative and Sector Analysis

Chuck Royce (Trades, Portfolio)'s firm has a history of investing in industrials and technology, with GCM Grosvenor's asset management industry fitting well within the firm's investment strategy. The company's financial health and growth prospects, however, are mixed. With a Financial Strength rank of 3/10 and a Profitability Rank of 6/10, GCM Grosvenor shows areas of concern but also potential. The largest guru shareholder in GCM Grosvenor is Ariel Investment, LLC, although their share percentage is not disclosed.

Concluding Thoughts on the Investment Move

The recent addition of GCM Grosvenor shares to Chuck Royce (Trades, Portfolio)'s portfolio is a calculated decision that aligns with the firm's value investing philosophy. While the stock's current valuation suggests it is modestly overvalued, the firm's increased stake indicates a belief in the company's long-term growth potential. Investors will be watching closely to see how this position plays out in the context of the firm's overall investment strategy.

The analysis of the transaction reveals a strategic enhancement to the firm's portfolio, with the potential for GCM Grosvenor to contribute to future gains. As the asset management industry continues to evolve, the firm's position in GCM Grosvenor may well prove to be a prudent investment in the dynamic financial landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance