Chinese stocks were the worst in the world in 2018, losing 27% — here's why

2018 was a year characterised by abysmal stock-market performances all over the world, but China took the biscuit.

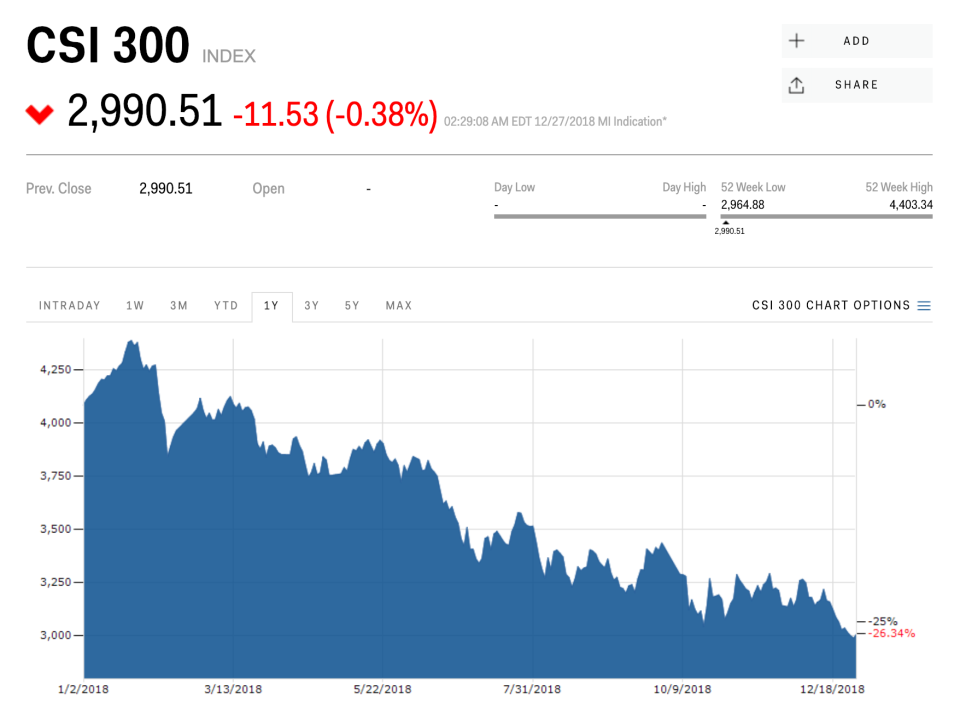

The CSI 300, China's benchmark share index, finished trading for the year on Friday, December 28, and at its close had lost nearly 27% of its value.

That was almost double the fall of its closest rival, Japan's Nikkei 225, which slid 14%.

Reasons for the slump in Chinese stocks include the trade war with Washington, fears about the health of the Chinese economy, and continued tightening of monetary policy globally.

2018 was a year characterised by abysmal stock-market performances all over the world. Europe had its worst year since the financial crisis, and in the USA, barring a drastic upswing on New Year's Eve, the same is likely to be true.

One nation's stock market, however, takes the crown as the world's worst in 2018: China.

TheCSI 300, China's benchmark share index, finished trading for the year on Friday, December 28, and at its close had lost roughly 27% of its value, almost double the fall of its closest rival, Japan's Nikkei 225, which slid 14%.

Here's the chart:

Reasons for the Chinese stock market's slump are numerous, with global factors such as the continued tightening of monetary policy in developed nations and the ongoing trade dispute between Washington and Beijing helping to subdue stocks in the country.

Read more: A star economist says these 30 risks will define markets in 2019

Chinese investors, however, have also been forced to contend with a whole other set of concerns.

Investors realised the blockbuster growth China has enjoyed over the last decade is on the decline, and that things are likely to slow down to a strong, but not stellar, rate.

That view was exacerbated by the rise of the trade war between the US and China, which has seen the world's two largest economies exchange tit-for-tat tariffs, which now apply to goods totaling close to a cumulative $US300 billion.

Many economists see the trade war having a major negative impact on Chinese growth, with JPMorgan in October saying a full-blown trade war could have a 1% shrinking effect on the economy. Tensions may have thawed a little after the Xi-Trump summit in Argentina, but 2019 could see the fight kick off once again.

Not only is the trade war helping to subdue the Chinese economy, there are also fears that something much more devastating is lurking beneath the surface. Numerous major institutions have warned of worrying trends, with the ratings agency S&P Global in October highlighting a hidden debt pile in the country worth as much as $US6 trillion.

Yahoo Finance

Yahoo Finance