Chinese investors are investing less in Australian property: this is what it means for you

Chinese investors have become less interested in snapping up Australian properties, and it’s had a part to play in the downturn of the national housing market.

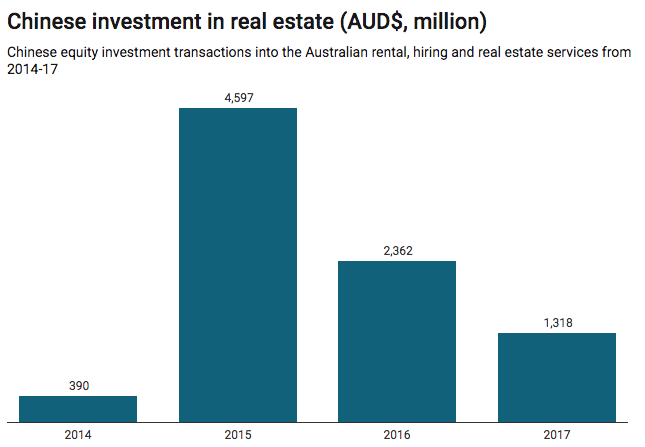

Between 2014 and 2015, Chinese investment in the rental, hiring and real estate services sector shot up dramatically – 1,178.7 per cent, to be exact.

Also read: 7 tips to avoid losing a fortune in a property slump

But investment has since cooled from its peak of nearly $4.6 billion three years ago, dropping by nearly half (49 per cent) to $2.36 billion in 2016 and then down to $1.3 billion last year.

Why has investment dropped?

According to AMP Capital’s chief economist, Shane Oliver, a number of factors contributed to the pullback in transactions, such as tightened restrictions on Chinese capital outflows.

“So it’s a combination: it’s become harder for Chinese to get their capital out of China, and it’s because the Chinese themselves have started to see the Australian property market as somewhat less favourable,” Oliver told Yahoo Finance.

Furthermore, he pointed out that 2017 saw greater political pressure to place tougher rules for foreign buyers that made foreign investment more difficult, including for Chinese investors.

Does this affect me?

It depends who you are.

Good news if you’re looking to buy; bad news if you’ve bought in the last few years, or if you’re a seller.

If you’ve recently bought into the property market, it’s likely a “downer” for you. “It mainly applies to buyers who bought in the last few years – they may not feel so good.”

And if you’re a property developer, life might get a bit tougher for you too.

“The biggest negative impact is for people who want to sell. [But for] the big property investors or first home buyers or people trying to get into the property market, there’s less buyers out there,” Oliver said.

Also read: 20 worst crash predictions about the Aussie property market

This means less competition at auctions, making properties that little bit more affordable.

But the chief economist was quick to qualify this point: property prices are only down by 5 or 6 per cent in Sydney and Melbourne from their peaks.

“Affordability has improved but is still fairly poor,” Oliver cautioned. “The real impact is it just makes it a bit easier for first home buyers to get in.”

It also depends where you live.

“Depending on what part of the market you’re in, [foreign/Chinese buying] can be fairly significant or totally irrelevant,” he said.

Those living in Melbourne and Sydney’s western suburbs, such as Campbelltown, will feel “very little impact”.

Nor will those living in Sydney’s northern beaches.

“But if you’re talking about the eastern suburbs of Sydney [and] lower north shore, particularly around Chatswood and Hunter’s Hill, then [there’s] bigger impact.”

Will investment pick back up any time soon?

Oliver says anecdotes he’s heard suggests it will continue to weaken.

However, demand will still remain “fairly strong” given property is nonetheless cheaper for Chinese investors than Chinese property is.

“I think for the short term, this year and probably next, it’s going to remain fairly depressed.

“Capital controls in China are quite tight, so it is harder to get money out of China, and at the same time, I think the Chinese will be a bit put off by the fact that prices have been falling in Australia, particularly [in] Sydney and Melbourne.

“So I would suspect that these figures will probably weaken this year and will remain fairly soft next year,” Oliver said.

Yahoo Finance

Yahoo Finance