China’s Exports Surge More Than Expected in Economic Boost

(Bloomberg) -- China’s exports climbed more than expected in May, boosting hopes that the world’s second-biggest economy can maintain its momentum by relying on foreign markets even in the face of new tariff threats.

Most Read from Bloomberg

Real Estate Investors Are Wiped Out in Bets Fueled by Wall Street Loans

Billionaire-Friendly Modi Humbled by Indians Who Make $4 a Day

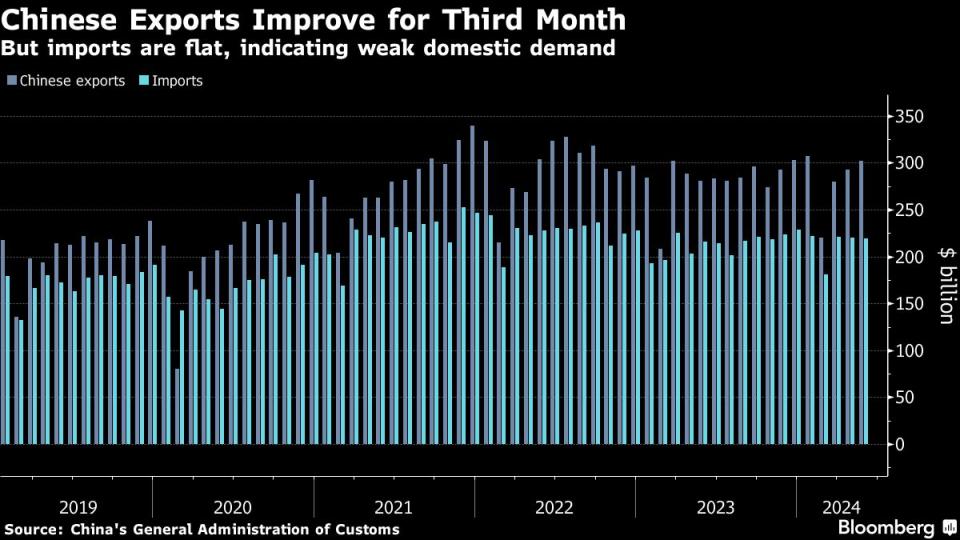

Exports rose 7.6% in dollar terms from a year earlier, while imports increased 1.8%, the customs administration said Friday. That left a trade surplus of almost $83 billion for the month. Economists had forecast that exports would expand by 5.7% and imports by 4.3%.

Beijing is relying on sales abroad to offset weak consumer spending at home, where a real estate slump has led households to tighten their belts. Friday’s numbers indicate that the strategy is paying off so far this year, helped by strong global demand that’s provided a tailwind for other Asian trading nations too. South Korean exports hit the highest in almost two years in May, led by semiconductor sales.

“China’s competitive goods are commanding a bigger share in the global market,” said Bruce Pang, chief economist for Greater China at Jones Lang LaSalle Inc. The momentum is likely to continue, he said, helped by a strong dollar as well as price cuts by exporters.

Still, Chinese firms face growing obstacles that could make it harder to rely on the export engine for economic growth. In high-tech industries like electric vehicles, for example, advanced economies including the US and European Union are erecting trade barriers.

That hasn’t hit China’s auto exports yet. The value of sales abroad in May was the second-highest on record, down only slightly from April’s $10.7 billion, Friday’s data showed. But the large European market is about to get harder to access, with new tariffs on Chinese EVs expected next month.

For now, Chinese exporters are “continuing to front-load shipments or re-route exports via a third country” to avoid tariffs, said Pang.

Exports to the US rose 4.8% from a year earlier, the most in three months, while shipments to countries in the Asean bloc of Asian nations jumped 25% and those to the EU fell 0.7%.

What Bloomberg Economics Says...

Firmer overseas demand is likely to continue to drive shipments in the coming months, with favorable base effects flattering the readings. Even so, the lift probably won’t be strong enough to offset weakness in domestic demand, which was underlined by disappointing imports.

— Eric Zhu, economist

Read full note here

Steel exports posted their second-highest monthly total since 2016 when measured by volume, with 9.6 million tons sold last month. The value of shipments continued to decline. Data for May isn’t available yet, but iron and steel export prices have been falling since late 2022, along with the price of many other goods.

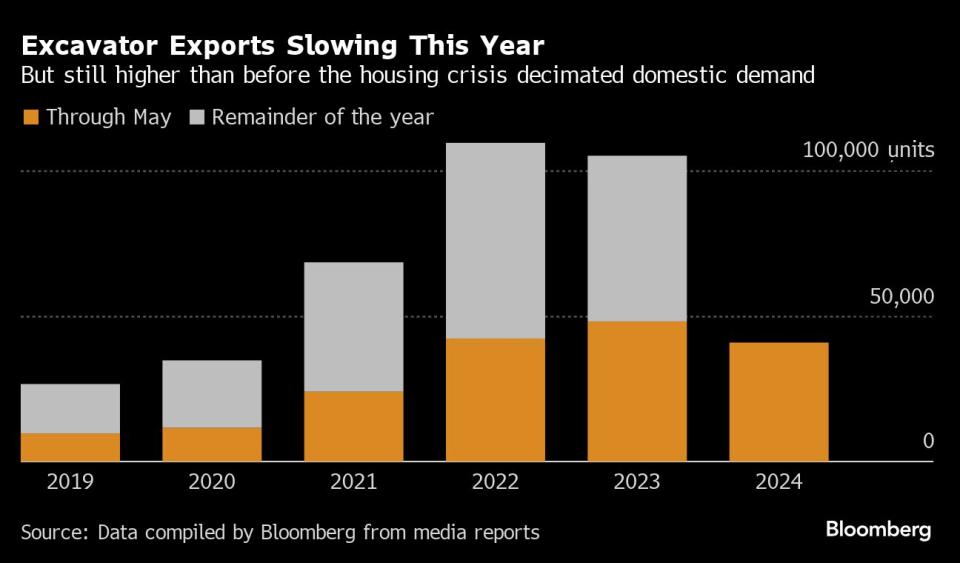

Weak domestic demand has encouraged many Chinese producers to look abroad for markets, including in industries like steel and building equipment that lost customers at home when the housing bubble burst and construction stalled.

That shift has boosted exports of lower-value goods in addition to the high-tech industries that are Beijing’s priority. It threatens to generate a new backlash from trade partners, including emerging-market economies as well as developed ones, seeking to protect their own industries.

Still, impending tariffs “are unlikely to immediately threaten exports,” according to a report by Zichun Huang at Capital Economics. “If anything, they may boost exports at the margin as firms speed up shipments to front-run the duties.”

Chinese equities largely held on to their earlier losses after the trade data. The onshore benchmark CSI 300 Index lost 0.7% as of the midday break, while a gauge of Chinese stocks listed in Hong Kong was down as much as 0.9%.

--With assistance from Zhu Lin and Yujing Liu.

(Updates throughout)

Most Read from Bloomberg Businessweek

Sam Altman Was Bending the World to His Will Long Before OpenAI

David Sacks Tried the 2024 Alternatives. Now He’s All-In on Trump

Legacy Airlines Are Thriving With Ultracheap Fares, Crushing Budget Carriers

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance