Chemed (CHE) Lags Q1 Earnings Estimates, Reaffirms 2024 View

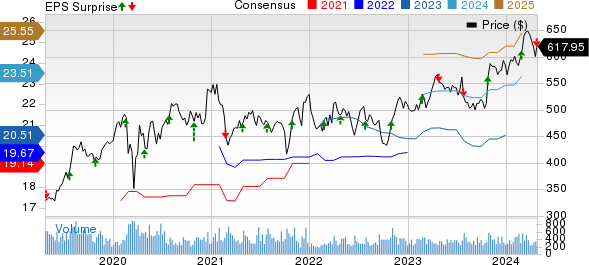

Chemed Corporation CHE reported adjusted earnings per share (EPS) of $5.20 in the first quarter of 2024, up 21.5% year over year. However, the figure missed the Zacks Consensus Estimate by 4.9%.

The company’s GAAP EPS was $4.24, up 18.4% from last year’s reported figure.

Revenues in Detail

Revenues in the reported quarter improved 5.2% year over year to $589.2 million. The metric topped the Zacks Consensus Estimate by 0.3%.

Chemed Corporation Price, Consensus and EPS Surprise

Chemed Corporation price-consensus-eps-surprise-chart | Chemed Corporation Quote

Segmental Details

Chemed operates through two wholly owned subsidiaries — VITAS (a major provider of end-of-life care) and Roto-Rooter (a leading commercial and residential plumbing plus drain cleaning service provider).

VITAS

In the first quarter, net revenues totaled $354 million, up 14% year over year.

The rise in revenues was primarily due to an 11.5% increase in days of care and a rise in the geographically weighted average Medicare reimbursement rate of nearly 2.6%.

Roto-Rooter

The segment reported sales of $235.2 million in the first quarter, down 5.8% year over year.

Total Roto-Rooter branch commercial revenues decreased 10.5% from the last year. This consisted of a 9.9% decline in drain cleaning revenues, an 11.9% fall in plumbing, a 13% drop in excavation and a 2.5% decrease in water restoration.

Total Roto-Rooter branch residential revenues registered a decrease of 3.5% over the prior-year period. This aggregate residential revenue decline consisted of drain cleaning decreasing 5.6%, plumbing decreasing 1.1%, excavation expanding 1.5% and water restoration decreasing 8.5%.

Margins in Detail

The gross profit increased 7.7% year over year to $204.1 million in the first quarter of 2024. The gross margin expanded 82 basis points (bps) year over year to 34.6% despite a 3.9% increase in the cost of products and services.

The adjusted operating profit fell 1.3% from the year-ago period to $88.2 million. The adjusted operating margin contracted 98 bps to 15% on an increase of 15.8% in adjusted operating expenses.

Liquidity & Capital Structure

Chemed exited the first quarter with cash and cash equivalents of $313.4 million compared to $264 million at 2023-end. The company did not have any long-term debt at the quarter end.

The cumulative net cash provided by operating activities at the end of the first quarter of 2024 was $84.5 million compared with $60.5 million in the year-ago comparable period.

During the quarter, the company repurchased 50,000 shares of Chemed stock for $32.3 million, which equates to a cost per share of $646.87. As of Mar 31, 2024, there was approximately $281.7 million of remaining share repurchase authorization under its plan.

Chemed has a consistent dividend-paying history, with the five-year annualized dividend growth being 5.87%.

2024 Guidance

Chemed reiterated its financial outlook for 2024, which it originally provided during the 2023 fourth-quarter earnings call.

The company anticipates 2024 revenues from VITAS, prior to Medicare Cap, to increase in the range of 9%-9.8% from the prior year (unchanged). Roto-Rooter is expected to achieve 2024 revenue growth in the range of 3.5%-4% (unchanged).

For 2024, the Zacks Consensus Estimate for total revenues is pegged at $2.42 billion, which suggests 7% growth from the 2024 reported figure.

For the full-year 2024, the adjusted EPS is estimated in the range of $23.30-$23.70 (same as earlier). The Zacks Consensus Estimate for the metric is pegged at $23.51, which implies 15.8% growth over the 2023 adjusted figure.

Our Take

Chemed ended the first quarter of 2024 with earnings missing and revenues beating estimates. Both Commercial and Residential revenues at Roto-Rooter registered a decline in the quarter, along with its operational metrics. The dip in the adjusted operating margin in the quarter is also disappointing.

On a positive note, both Chemed’s top and bottom lines showed improvement year over year in the quarter under review. VITAS’ revenue growth is driven by an increase in days of care and a geographically weighted average Medicare reimbursement rate. The segment recently expanded its operations by acquiring hospice assets and an assisted living facility of Covenant Health and Community Services, Inc. in Florida and Alabama.

Zacks Rank and Key Picks

Chemed currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Inspire Medical Systems INSP, Insulet PODD and Exact Sciences EXAS.

Inspire Medical Systems, sporting a Zacks Rank #1 (Strong Buy), reported a fourth-quarter 2023 EPS of 49 cents, which beat the Zacks Consensus Estimate of a loss of 4 cents. Revenues of $192.5 million topped the consensus estimate by 0.1%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Inspire Medical Systems has an estimated earnings growth rate of 51.4% in 2024 compared with the industry’s 19.4%. The company’s earnings surpassed estimates in each of the trailing four quarters, the average being 353.6%.

Insulet, carrying a Zacks Rank #2 (Buy), reported a fourth-quarter 2024 adjusted EPS of $1.40, which surpassed the Zacks Consensus Estimate by 108.9%. Revenues of $509.8 million outpaced the Zacks Consensus Estimate by 10.8%.

PODD has an estimated long-term earnings growth rate of 18.1% compared to the industry’s 11.4%. The company surpassed earnings estimates in each of the trailing four quarters, the average being 100.1%.

Exact Sciences, carrying a Zacks Rank #2, reported a fourth-quarter 2024 loss of 27 cents per share, narrower than the Zacks Consensus Estimate of a loss of 53 cents. Revenues of $646.9 million topped the Zacks Consensus Estimate by 2.4%.

EXAS has an estimated earnings growth rate of 23.9% in 2024 compared with the industry’s 13% growth. The company’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 51.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Insulet Corporation (PODD) : Free Stock Analysis Report

Chemed Corporation (CHE) : Free Stock Analysis Report

Exact Sciences Corporation (EXAS) : Free Stock Analysis Report

Inspire Medical Systems, Inc. (INSP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance