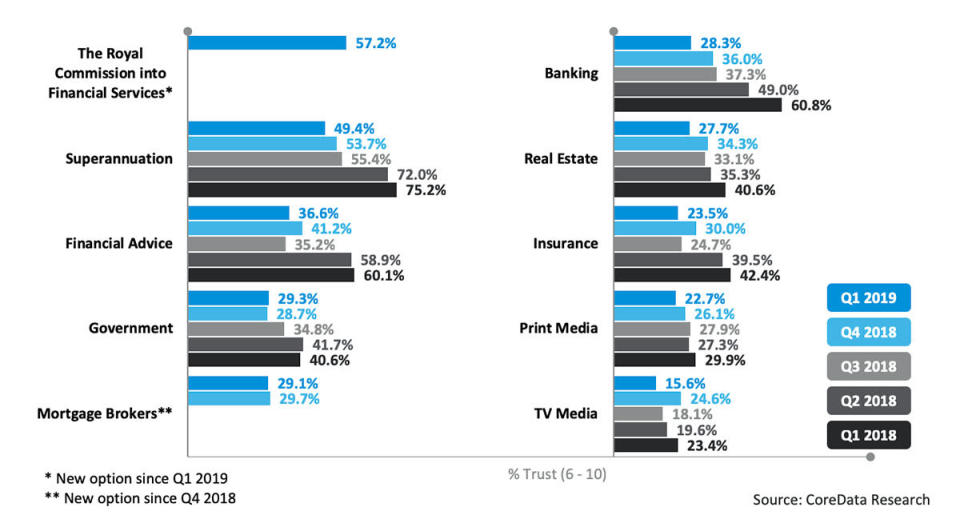

Chart: The banking Royal Commission has damaged trust in much more than just financial services

The shockwaves from the banking Royal Commission have been more far-reaching than expected.

Financial services professionals were found to have been charging dead customers, billing Aussies for services that were never provided, manipulating vulnerable Australians and – worst of all – often doing this while knowing it was wrong.

It’s left a major dent in trust in what are meant to be some of the country’s strongest and most reliable institutions.

But the damage to trust hasn’t just been confined to just the financial services industry: the real estate industry has also been caught in the crossfire, and the government has emerged worse-off amid criticism that it had initially aimed to block the inquiry.

Interestingly, trust in both print and TV media – which were extensively covering the Royal Commission – also dropped over the course of the last year.

According to data from Core Data, this is how much trust in various Australian sectors have fallen since the Royal Commission:

The business intelligence firm began to track trust in financial services before the Royal Commission began, said Core Data head of market insight Simon Hoyle.

“We anticipated a drop-off in trust across the board, but I think the extent was still a bit of a surprise,” he told Yahoo Finance.

“It has rolled off pretty consistently right across the year, across all sectors.

“The apparent bounce in trust that financial advice enjoyed at the end of 2018 was short-lived; it has since fallen back to close to its Q3 2018 low,” Hoyle added.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Now read: Royal Commission Final Report: Here’s what the experts think

Now read: Banking Royal Commission: What do the findings mean for you?

Yahoo Finance

Yahoo Finance