The CEO leading ‘Korea’s Google’ in its battle against Big Tech

Internet firm Naver has earned its nickname—Korea’s Google—by pulling off an improbable feat: It dominates South Korea’s search market, having defended its turf from Google, the world’s top search engine, whose revenue is 40 times as large as Naver’s.

As of September 2023, Naver controlled 59% of Korea’s search market to Google’s 31%.

Naver is perhaps “the only company in the world that has survived competition against Google and Amazon,” says Choi Soo-yeon, Naver’s CEO since 2022.

Naver is hardly a household name outside Korea. But it operates a sprawling portfolio that pits the $22-billion-in-market-cap firm against other Big Tech giants on multiple fronts.

It has a controlling stake in both Yahoo Japan—the most popular website in Japan, according to Nielsen—and the Japanese messaging app Line—a WhatsApp rival—through a joint venture with SoftBank.

It runs Korea’s No. 2 e-commerce service, behind Coupang. (Amazon’s platform ranks fourth.) Naver’s $1.2 billion purchase last year of Poshmark, the U.S.-based clothing-resale site, expanded its retail reach.

In the streaming wars era, Naver has amassed content platforms of its own. It owns Webtoon, which hosts mobile-friendly comic strips that are popular across Asia. (Naver is reportedly planning a U.S. IPO for Webtoon later this year.) Naver bought Wattpad, a Canada-based platform for user-submitted fiction, for $600 million in 2021.

Naver is perhaps “the only company in the world that has survived competition against Google and Amazon.”

Choi Soo-yeon, Naver CEO

Naver also has a small but growing cloud-computing business—a category in which Amazon, Google, and Microsoft reign supreme—and it’s launched a series of AI projects to contend with the release of OpenAI’s viral chatbot, ChatGPT.

In recent quarters, Naver’s many business lines have notched record revenues and operating profits, but Choi sees Naver’s mission as extending beyond its own bottom line.

Despite Naver’s small size, she casts the firm as a counterpoint in a global tech scene in which power is concentrated among a gargantuan few.

“It’s becoming a world where there are only one or two search companies and one or two commerce companies,” Choi said in a recent wide-ranging interview—her first with the international press—at Naver headquarters in Seongnam, just outside Seoul. (Choi gave her answers in Korean, which were later translated into English.) Naver “is a company that constantly fights against such a world and strives to preserve diversity,” she says.

Investors question whether Naver can go toe-to-toe with cash-rich rivals. Still, Choi’s goal is ambitious—perhaps even noble—and belies the role she was appointed to fill: that of a caretaker CEO brought on to steady a company in turmoil.

Choi, 42, was an unconventional pick to run the company. A Harvard-educated M&A lawyer, she joined Naver in 2019 as head of global business support to help lead the firm’s expansion. Three years later, the board named Choi as CEO to show it was prepared to overhaul its culture after a series of crises.

In May 2021, a senior Naver developer died by suicide after accusing the company of fostering a toxic work culture. A labor union probe found he’d been bullied by executives for years. A later government survey found that over half of employees felt they were bullied at least once in a six-month period.

In the aftermath, Naver said “there were some acts of workplace harassment by some executives.” Choi’s predecessor as CEO, Han Seong-sook, stepped down, as did Naver’s COO, and Naver tapped Choi. At the time, she told shareholders her most urgent task was “to recover Naver’s corporate culture based on trust and autonomy.”

But a second tragedy struck early in Choi’s tenure. In September 2022, another employee died by suicide while on maternity leave, local media reported. Months later, her family claimed she’d been mistreated at work. A Naver internal investigation did not uncover evidence of harassment, and Korea’s labor ministry could not confirm the family’s claims, a company spokesperson said.

South Korea has the highest rate of suicide of all Organization for Economic Cooperation and Development countries, and South Koreans work 200 hours more per year than the global average.

“There was a lack of trust in the systems, leadership, and board,” Choi says of Naver’s previous culture. One big change Choi made was to reintroduce remote work, a rarity in post-COVID South Korea. The option gives employees “the choice of what kind of working environment they can be most productive and create the most innovation in.”

The suicides were the biggest scandal to rock Naver in its 25-year history. Naver launched in 1999, when founder Lee Hae-jin turned an internal Samsung project into an independent company. By the mid-2000s, Naver had passed rivals like web portal Daum to dominate Korea’s search market.

Naver and fellow internet firm Kakao (founded by an ex-Naver executive) have made South Korea one of a handful of countries where homegrown search engines outperform U.S. search giants without government intervention.

Naver got a head start on tailoring a search engine that met the tastes of the South Korean market, says Bokyung Suh, a Korea analyst at Bernstein Research. Naver hooked users early with its busy homepage that was heavy on icons, links, and animations. Google launched a bare-bones search engine in Korean in 2000, but it didn’t catch on. Google updated its site to a feature-rich format six years later.

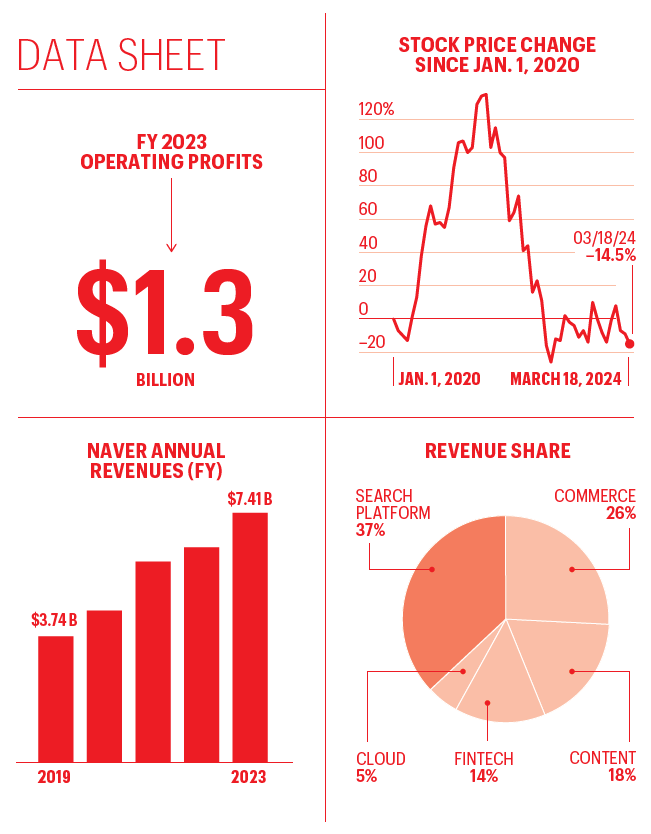

Naver earned 9.6 trillion won ($7.41 billion) in revenue in 2023, a record. Search and e-commerce generated 37% and 26% of sales, respectively. It made $1.3 billion in operating profit, also a record.

Yet shares are currently trading about 60% below a COVID-era high. Investors are concerned about slowing revenue from search (up 0.6% in 2023), plummeting revenue from display ads (down 10% last year), and the lack of a “punchy, clear growth strategy,” Suh says.

Naver’s lack of a punchy, clear growth strategy is especially worrisome in the AI age, when Naver faces U.S. companies that are investing billions in the technology.

As U.S. giants dominate English-based AI, Naver may be able to establish an edge in systems based in Korean and other languages, Choi says.

Naver has a chatbot, CLOVA X, and an AI-powered search engine, Cue. Both are built on its Korean-language large-language model, HyperCLOVA X, which outperforms OpenAI’s GPT in Korean, recent studies say. Naver has claimed that HyperCLOVA, an earlier version of its model, was trained on 6,500 times as much Korean data as GPT-3.0, which underpins OpenAI’s ChatGPT. Naver is also partnering with Saudi Aramco on an Arabic large-language model.

Choi is especially interested in what she calls “sovereign AI,” or a model that’s tailored to an individual user. “We focus on what companies and governments that want to use AI would want, and what needs Big Tech can’t fulfill,” she says. As AI becomes more common, “each group will need an AI model that best understands” its unique traits.

Much like her rivals at Google and Microsoft, Choi is also grappling with how to integrate AI—with its penchant to hallucinate false information—into Naver’s search product. “People need accurate information through search,” she says, though she hopes AI’s tendency to make stuff up will become “nearly negligible in the near future.”

At the same time, she also sees room for a traditional search engine—with its list of links to choose from—amid the generative AI revolution. “Not all questions in the world have a single correct answer,” she says. “There is still a need for exploration.”

Naver’s base in South Korea, a chip powerhouse, is an advantage in the AI race, especially its homegrown manufacturers “that support the Korean language,” Choi says. Naver’s chip partners include Korea’s Samsung and the U.S.’s Intel.

“It’s not healthy to rely on just one company,” Choi says. Is that a coded reference to Nvidia? Yes, she says in English, with a smile.

Just four of South Korea’s top 100 firms by revenue had women CEOs last year, according to global headhunter UnicoSearch. Just 6% of executives at the companies were women.

Choi, whose CEO contract expires in 2025, expresses some unease at often being a “sole woman” in business: “Simply because I am a woman, there are expectations for me to demonstrate skills such as effective communication, adept conflict resolution, and the ability to nurture people.”

Korea’s internet sector got a little more diverse when Kakao appointed its first female CEO, Shina Chung, in March.

“I’m not alone anymore!” Choi says.

Fortune Korea contributed additional reporting and translation assistance.

This article appears in the April/May 2024 issue of Fortune.

This story was originally featured on Fortune.com

Yahoo Finance

Yahoo Finance