Central Petroleum Limited's (ASX:CTP) Shareholders Might Be Looking For Exit

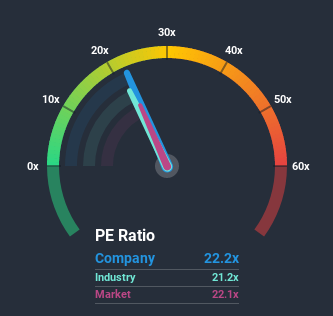

It's not a stretch to say that Central Petroleum Limited's (ASX:CTP) price-to-earnings (or "P/E") ratio of 22.2x right now seems quite "middle-of-the-road" compared to the market in Australia, where the median P/E ratio is around 22x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

While the market has experienced earnings growth lately, Central Petroleum's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Central Petroleum

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Central Petroleum.

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Central Petroleum's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 40% decrease to the company's bottom line. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 115% as estimated by the sole analyst watching the company. Meanwhile, the broader market is forecast to expand by 27%, which paints a poor picture.

With this information, we find it concerning that Central Petroleum is trading at a fairly similar P/E to the market. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Central Petroleum's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about these 4 warning signs we've spotted with Central Petroleum (including 2 which are significant).

If you're unsure about the strength of Central Petroleum's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance