CenterPoint Energy (CNP) Rewards Shareholders With Dividend Hike

CenterPoint Energy (CNP) Rewards ShareholdersWith Dividend Hike

Teaser- CenterPoint Energy, Inc. (CNP) announces a 6.3% hike in its quarterly dividend effective from Decemeber 2021.

CenterPoint Energy, Inc. (CNP) recently announced that its board of directors has approved a hike in its quarterly dividend to 17 cents per share, reflecting an increase of 6.3% from the prior payout.

With the current hike, the company will now pay an annual dividend of 68 cents per share, effective from December 2021. This represents an annual dividend yield of 2.76% based on its share price worth as of Sep 30. This compares favorably withthe Zacks S&P 500 composite’s yield of 1.42%.

Can CenterPoint Sustain Dividend Hikes?

The hike in dividend payout highlights company’s financial strength and its expection of generating enough earnings and distributable cash flow to reward shareholders’ with increased payouts. This is evident from its recent projections for the business.

CenterPoint is projecting a utility EPS growth rate of 8% for 2021 and five-year annual growth for the same is projected in the range of 6%to8%.At this growth rate, the company expects to double its earnings and will be able share profits with shareholders asdividends.

The company has increased its planned investment in growth projects from $16 billion to $18 billion over the period of 2021-2025. It expects to generate a CAGR of 10% from its planned investment. An additonal $40 billion capital investment was announced by the company for a 10-year period.

Going forward, the company aims to control cost and reinvest the excess money generated through its efforts in growth projects. All these initiatives will result in a steady performance and enable management to continue with dividend declaration.

Other Utilities Increasing Dividends

Utilities are less susceptible to economic fluctuations, which shielded these companies from the COVID-19 induced market turmoil.Thus,these companies have sufficient cash flows to reward shareholders’ with dividend hikes and shares buybacks.Supported by consistency in cash flows, other utilities have also been rewarding shareholders with solid dividend hikes.

Recently, Public Service Enterprise Group Incorporated (PEG) announced that its board of directors has approved a hike in its common stock dividend for 2022 by 12 cents per share to 54 cents per share.

OGE Energy Corp.(OGE) announced that its board of directors has approved a hike in its quarterly dividend to 41 cents per share, reflecting an increase of 1.9% from the prior payout.

Likewise In February 2021, NextEra Energy (NEE) announced a 10% hike in its quarterly dividend, reflecting the revised dividend worth38 cents per share.

Price Movement

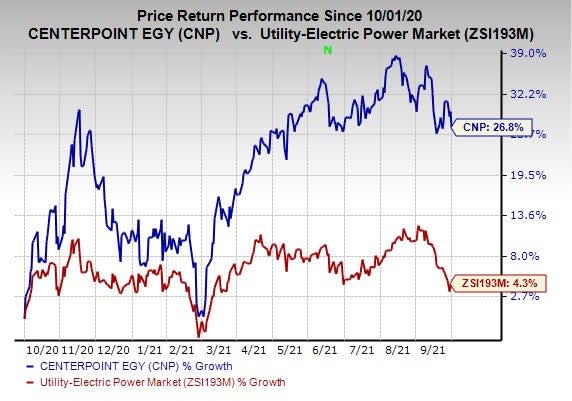

In the past one year, shares of the company have gained 26.8% compared with the industry’s growth of 4.3%.

Zacks Rank

CenterPoint carries a Zacks Rank of #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

CenterPoint Energy, Inc. CNP recently announced that its board of directors has approved a hike in its quarterly dividend to 17 cents per share, reflecting an increase of 6.3% from the prior payout.

With the current hike, the company will now pay an annual dividend of 68 cents per share, effective from December 2021. This represents an annual dividend yield of 2.76% based on its share price worth as of Sep 30. This compares favorably withthe Zacks S&P 500 composite’s yield of 1.42%.

Can CenterPoint Sustain Dividend Hikes?

The hike in dividend payout highlights company’s financial strength and its expection of generating enough earnings and distributable cash flow to reward shareholders’ with increased payouts. This is evident from its recent projections for the business.

CenterPoint is projecting a utility EPS growth rate of 8% for 2021 and five-year annual growth for the same is projected in the range of 6%to8%.At this growth rate, the company expects to double its earnings and will be able share profits with shareholders asdividends.

The company has increased its planned investment in growth projects from $16 billion to $18 billion over the period of 2021-2025. It expects to generate a CAGR of 10% from its planned investment. An additonal $40 billion capital investment was announced by the company for a 10-year period.

Going forward, the company aims to control cost and reinvest the excess money generated through its efforts in growth projects. All these initiatives will result in a steady performance and enable management to continue with dividend declaration.

Other Utilities Increasing Dividends

Utilities are less susceptible to economic fluctuations, which shielded these companies from the COVID-19 induced market turmoil.Thus,these companies have sufficient cash flows to reward shareholders’ with dividend hikes and shares buybacks.Supported by consistency in cash flows, other utilities have also been rewarding shareholders with solid dividend hikes.

Recently, Public Service Enterprise Group Incorporated PEG announced that its board of directors has approved a hike in its common stock dividend for 2022 by 12 cents per share to 54 cents per share.

OGE Energy Corp.OGE announced that its board of directors has approved a hike in its quarterly dividend to 41 cents per share, reflecting an increase of 1.9% from the prior payout.

Likewise In February 2021, NextEra Energy NEE announced a 10% hike in its quarterly dividend, reflecting the revised dividend worth38 cents per share.

Price Movement

In the past one year, shares of the company have gained 26.8% compared with the industry’s growth of 4.3%.

Image Source: Zacks Investment Research

Zacks Rank

CenterPoint carries a Zacks Rank of #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

Public Service Enterprise Group Incorporated (PEG) : Free Stock Analysis Report

OGE Energy Corporation (OGE) : Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance