CBIZ Inc (CBZ) Q1 2024 Earnings: Surpasses Revenue Forecasts and Aligns with EPS Projections

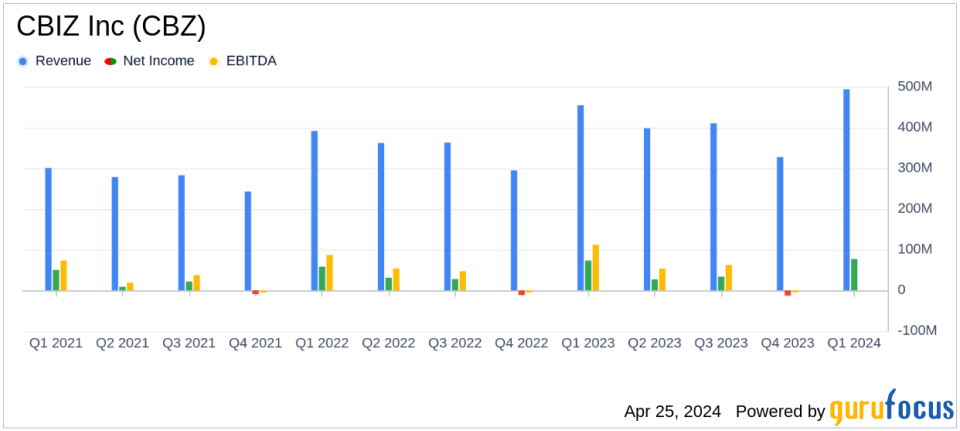

Revenue: Reported at $494.3 million, an increase of 8.7% from the previous year, surpassing the estimated $490.88 million.

Net Income: Achieved $76.9 million, slightly above the estimated $76.3 million.

Earnings Per Share (EPS): Recorded at $1.53 per diluted share, exceeding the estimate of $1.50.

Adjusted EBITDA: Rose to $118.8 million, marking a 4.8% increase year-over-year.

Same-Unit Revenue: Increased by 5.9% compared to the same period last year.

Acquisitions: Integrated operations from new acquisitions contributed $12.8 million to revenue growth.

Full-Year Outlook: Expects revenue growth of 7% to 9% and adjusted EPS growth of 12% to 14%, with targets of $2.70 to $2.75 per share.

On April 25, 2024, CBIZ Inc (NYSE:CBZ), a prominent provider of financial, insurance, and advisory services, disclosed its first-quarter financial results through its 8-K filing. The company reported a notable increase in revenue and adjusted earnings, surpassing revenue forecasts and aligning closely with earnings per share (EPS) estimates provided by analysts.

For the quarter ended March 31, 2024, CBIZ generated revenue of $494.3 million, marking an 8.7% increase from $454.6 million in the same period last year. This growth exceeded the estimated revenue of $490.88 million. Net income for the quarter was $76.9 million, or $1.53 per diluted share, compared to $73.2 million, or $1.44 per diluted share, a year earlier. Adjusted EPS was $1.54, closely aligning with the analyst estimate of $1.50.

Operational Highlights and Strategic Moves

CBIZ's revenue boost was partly fueled by the successful integration of newly acquired operations, which contributed $12.8 million. Notably, the acquisitions of Erickson, Brown & Kloster, LLC (EBK) and CompuData, Inc. played significant roles in this growth, enhancing the company's service offerings in technology solutionsa demand area that is increasingly sought after by CBIZ's clients.

President and CEO Jerry Grisko highlighted the strategic acquisitions and the robust start to the year, expressing confidence in the company's trajectory and its alignment with full-year guidance expectations. CBIZ anticipates a revenue growth rate of 7% to 9% for 2024 and projects GAAP fully diluted EPS to grow by 13% to 15%, reaching $2.70 to $2.75.

Financial Services Drive Growth

The Financial Services segment was a significant growth driver, contributing $372.63 million to the total revenue, up from $343.086 million in the previous year. This segment, along with Benefits and Insurance Services and National Practices, underscores CBIZ's diversified yet integrated approach to expanding its market footprint across the United States.

Analysis of Financial Statements

CBIZ's income statement reflects a healthy gross margin of 23.8%, although slightly down from 25.0% in the previous year, primarily due to increased operating expenses, which were up by 10.4%. The balance sheet remains robust with a strong liquidity position, evidenced by $147.9 million in unused borrowing capacity under the company's unsecured credit facility.

Adjusted EBITDA for the quarter rose by 4.8% to $118.8 million, compared to $113.3 million in the prior year, indicating effective cost management and operational efficiency. These financial metrics are crucial for investors as they provide insights into the company's profitability and cash flow stability.

Looking Forward

With a solid start to 2024, CBIZ is well-positioned to continue its growth trajectory through strategic initiatives and operational excellence. The company's focus on integrating cutting-edge technology solutions with its core financial services will likely continue to serve as a growth catalyst in the evolving market landscape.

Investors and stakeholders can anticipate continued progress as CBIZ executes its strategy, aiming to deliver enhanced value and robust financial performance in the upcoming quarters.

Explore the complete 8-K earnings release (here) from CBIZ Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance