Cathay General (CATY) Announces $125M New Share Buyback Plan

Cathay General Bancorp. CATY has announced a new share repurchase program. Under the plan, the board of directors authorized the buyback of $125 million worth of shares. There is no set expiration for the program.

Previously, CATY had announced a share repurchase program in May 2022, authorizing the buyback of up to $125 million worth of shares. The company completed this program in February 2023, with the repurchase of 2.9 million shares at an average cost of $43.14.

As of May 28, 2024, the company had roughly 72.8 million common shares outstanding.

Apart from the share repurchase program, the company also pays out dividends to its shareholders. Earlier this month, the company announced a dividend of 34 cents per share to be paid out on Jun 10, 2024, to shareholders of record as of May 30. CATY has increased its dividend once in the last five years, in November 2021, and has a payout ratio of 29%.

As of Mar 31, 2024, Cathay General’s total deposits were $19.8 billion, other liabilities were $327.4 million and cash and cash equivalents (primarily consisting of cash and due from bank and short-term investments and interest-bearing deposits) totaled $1.2 billion.

Given its strong balance sheet and liquidity position, Cathay General is expected to be able to sustain current capital distributions. This will keep enhancing shareholders’ wealth.

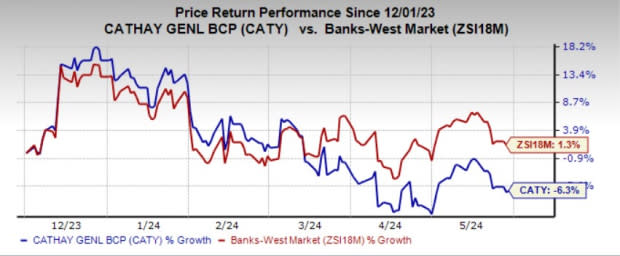

Shares of CATY have lost 6.3% over the past six months against the industry’s rally of 1.3%.

Currently, CATY carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Share Buyback Plans of Other Banks

Earlier this week, Robinhood Markets, Inc. HOOD announced a share buyback plan. The company announced that its board of directors approved a share repurchase program authorizing it to repurchase up to $1 billion of its outstanding common stock.

While the plan does not have an expiration date, HOOD expects to buy back shares over two to three years, starting from third-quarter 2024.

Similarly, last week, BayCom Corp. BCML announced its ninth stock repurchase program. Under the plan, the company’s board of directors authorized the buyback of 0.56 million shares.

This new program will start once BCML’s current plan either expires on Apr 21, 2025, or all the shares authorized have been repurchased. The company announced the eighth share buyback program, authorizing 0.59 million shares, in August 2023. As of May 24, 2024, 12,627 shares remained available under this plan.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cathay General Bancorp (CATY) : Free Stock Analysis Report

Bay Commercial Bank (BCML) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance