Catalyst (CPRX) Down on TEVA's FDA Filing for Firdapse Generic

Shares of Catalyst Pharmaceuticals CPRX were down 29.0% on Jan 24 after management announced that it had received a notice letter stating that Teva Pharmaceuticals TEVA filed an abbreviated new drug application ("ANDA") to the FDA for a generic version of Firdapse, Catalyst’s sole marketed drug.

The notice letter, issued by Teva to the company, states that the former intends to market a generic version of Firdapse before Catalyst’s patents covering Firdapse expire. Teva alleges that Catalyst’s patents are neither valid nor enforceable. In the notice, Teva also states that the commercial manufacturing, use or sale of its own generic formulation of Firdapse will not infringe any of Catalyst’s patents.

Catalyst is currently assessing the notice letter and has 45 days from the date of receipt of the notice to decide whether to commence a patent infringement lawsuit against Teva for approving the ANDA.

The FDA approved Firdapse in November 2018 as a treatment for Lambert-Eaton Myasthenic Syndrome (LEMS) in adults. Last September, the drug received label expansion from the regulatory agency for treating LEMS in children aged six through 17 years.

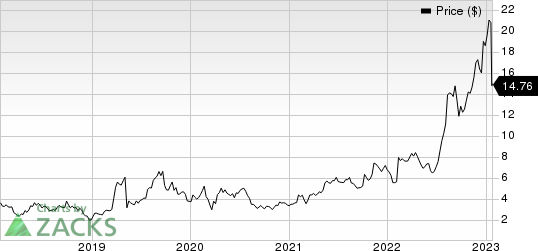

Shares of Catalyst have skyrocketed 161.2% against the industry’s 14.0% fall.

Image Source: Zacks Investment Research

LEMS is an extremely rare autoimmune disease characterized by muscle weakness of the limbs. CPRX is presently well-positioned in the lead, with almost no competitors. Management is also focused on expanding the commercialization of Firdapse in the United States.

Catalyst also made substantial advancements to protect Firdapse’s exclusivity and commercial potential in the target market, which also boosted the company’s share prices.

In this regard, we remind investors that Catalyst settled its long-term patent infringement dispute with Jacobus Pharmaceuticals and PANTHERx Rare in July 2022. The dispute has been going on since 2019 when the FDA approved Jacobus’ drug Ruzurgi (amifampridine) for treating pediatric LEMS patients. However, Catalyst contested this in a lawsuit claiming that the regulatory body’s approval for Ruzurgi violated the orphan drug status granted to Firdapse for LEMS.

Per the settlement, Catalyst obtained the rights to develop and commercialize Ruzurgi in the United States and Mexico and other intellectual property rights. In return, CPRX dismissed all claims related to the litigation between the companies. Catalyst will make a cash payment to Jacobus. Jacobus is also eligible to receive low single-digit royalties on U.S. net sales of amifampridine.

To reduce its overdependence on Firdapse, management entered into an agreement with Eisai ESALY for the latter’s rare epilepsy drug, Fycompa, in December 2022. Per the terms of the agreement, Catalyst will acquire the U.S. rights to Fycompa from Eisai. In consideration of granting these rights, Eisai will receive an upfront payment of $160 million from CPRX and will also be entitled to potential milestone payments and royalties. In addition, Eisai has also granted Catalyst an exclusive option period to evaluate and negotiate the acquisition of a rare epilepsy compound in its pipeline.

Catalyst Pharmaceuticals, Inc. Price

Catalyst Pharmaceuticals, Inc. price | Catalyst Pharmaceuticals, Inc. Quote

Zacks Rank & Stock to Consider

Catalyst currently carries a Zacks Rank #1 (Strong Buy). Some better-ranked stocks in the overall healthcare sector include Eton Pharmaceuticals ETON, which carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, estimates for Eton Pharmaceuticals’ 2022 loss per share have narrowed from 44 cents to 38 cents. During the same period, the earnings estimates per share for 2023 have risen from 1 cent to 6 cents. Shares of ETON have risen by 2.0% in the past year.

Earnings of Eton Pharmaceuticals missed estimates in three of the last four quarters while beating the mark on one occasion, witnessing a negative earnings surprise of 115.63%, on average. In the last reported quarter, Eton Pharmaceuticals’earnings beat estimates by 20.00%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Teva Pharmaceutical Industries Ltd. (TEVA) : Free Stock Analysis Report

Eisai Co. (ESALY) : Free Stock Analysis Report

Catalyst Pharmaceuticals, Inc. (CPRX) : Free Stock Analysis Report

Eton Pharmaceuticals, Inc. (ETON) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance