Carlyle (CG) Q4 Earnings Beat on Lower Expenses, AUM Rises

The Carlyle Group Inc. CG reported fourth-quarter 2022 post-tax distributable earnings per share of $1.01, surpassing the Zacks Consensus Estimate of 96 cents. However, the bottom line declined from $2.01 in the year-ago quarter.

While an increase in assets under management (AUM) balance and lower expenses supported the results. However, a decrease in revenues was a major headwind.

Net income available to common stockholders (GAAP basis) was $127.2 million or 35 cents per share, down significantly from $647.6 million or $1.77 per share in the prior-year quarter.

In 2022, post-tax distributable earnings of $4.34 per share beat the Zacks Consensus Estimate of $4.29 but decreased 13.4% year over year. Also, net income available to common stockholders (GAAP basis) of $1.23 billion or $3.35 per share declined from $2.98 billion or $8.20 per share in 2021.

Revenues & Expenses Fall

Segmental revenues were $1.06 billion in the quarter under review, decreasing 44.1% from the year-ago quarter. However, the top line beat the Zacks Consensus Estimate of $1.03 billion.

Segment revenues decreased 11.1% to $4.40 billion in 2022. However, the top line surpassed the Zacks Consensus Estimate of $4.37 billion.

Fee revenues in the fourth quarter increased 8.1% year over year to $559.2 million. A rise in fund management fees and fee-related to performance revenues resulted in the uptick. Realized performance revenues plunged 64.8% to $459.7 million.

Total segmental expenses amounted to $626 million, down 36.9%. The decrease was primarily due to a decline in total compensation and benefits expenses.

AUM Increases

As of Dec 31, 2022, total AUM was $372.69 billion, up 23.8% from the prior-year quarter. This was primarily led by an increase in fundraising activity across the platform, specially in Global Credit arising from the strategic advisory services agreement with Fortitude and the CBAM acquisition partially offset by the realization activity.

Fee-earning AUM for the reported quarter was $266.58 billion, jumping 38.1%.

Conclusion

Carlyle’s efforts to expand operations by entering business avenues are encouraging. Going ahead, an increase in AUM balance and fund management fees is likely to support its organic growth. However, elevated expenses are expected to deter bottom-line growth.

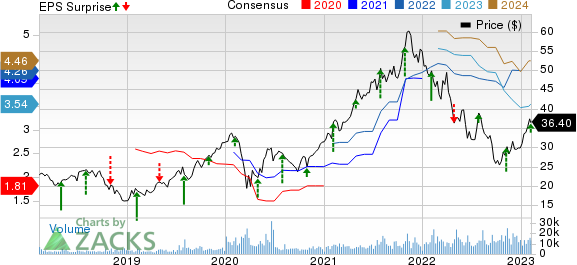

Carlyle Group Inc. Price, Consensus and EPS Surprise

Carlyle Group Inc. price-consensus-eps-surprise-chart | Carlyle Group Inc. Quote

Currently, CG carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Finance Stocks

BlackRock, Inc.’s BLK fourth-quarter 2022 adjusted earnings of $8.93 per share surpassed the Zacks Consensus Estimate of $7.99. The figure, however, reflects a decrease of 16.4% from the year-ago quarter.

The quarterly results of BLK benefited from a decline in expenses. However, lower revenues and AUM balance were major headwinds.

Invesco’s IVZ fourth-quarter 2022 adjusted earnings of 39 cents per share surpassed the Zacks Consensus Estimate of 36 cents. The bottom line, however, plunged 54.7% from the prior-year quarter. Our estimate for earnings was 33 cents.

The results of IVZ benefited from a decline in operating expenses. However, lower AUM balance and long-term outflows hurt revenues.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

Carlyle Group Inc. (CG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance