Canopy Growth may have just made its most ambitious claim yet — can it deliver?

Answering questions on Canopy Growth’s (CGC) earnings call a day after the company reported disappointing results sending shares tumbling 8%, CEO Bruce Linton shared one particularly eye-catching goal for the world’s largest cannabis company.

In response to a question about what results investors should expect in the first year of Canopy Growth’s CBD push, Linton answered, “We think with what we're doing we should end up with a leading market share.” The response shouldn’t come as a surprise, given Canopy Growth’s growing investment in cultivating hemp across multiple U.S. states with the plan of offering CBD products, but Linton set the bar very high for what that effort could amount to since the company is doing zero in CBD sales now.

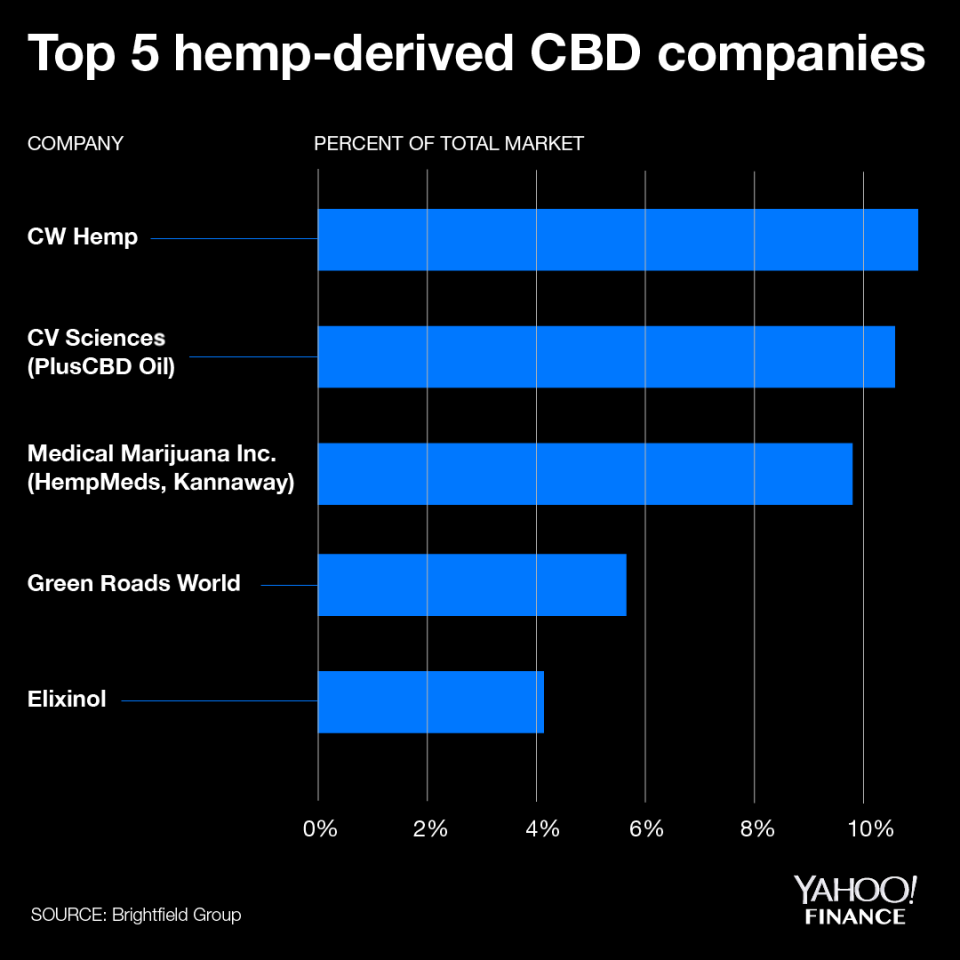

Months following the passing of the farm bill, which made hemp and CBD legal on a federal level in the U.S., multiple companies have jumped on the opportunity to capitalize on the touted health benefits of the non-psychoactive cannabis compound to quickly grow sales. Some of those leading companies, like Boulder, Colorado-based CW Hemp and Las Vegas-based CV Sciences have maintained their leading market share despite newer entrants. Combined, the two companies control more than 20% of total CBD sales, according to data from cannabis research firm Brightfield Group.

Undeterred, Linton explained how Canopy Growth is well positioned to bull compete CBD companies aside by massively investing in supply chain and quality control.

“Our platform is designed so that if a big box or a large [convenience] store wants to actually have something that’s going to stay in stock, be certain to be true in terms of its branding, efficacy and its dosage, then we’re the choice,” he told Yahoo Finance. “What we looked at when we sat down with the big players [was] what success would look like if you’re running a big chain. Success looks like a diversified set of SKUs that would be maintained in stock and actually have research to produce the outcome you want.”

Meanwhile, some CBD-focused companies have already landed contracts with big retailers. CV Sciences, for example, revealed its leading line of CBD products would be sold through limited Kroger branded stores. Curaleaf (CURLF), a cannabis company that also sells marijuana products, announced it notched a deal in March to sell CBD products through more than 800 CVS locations.

So, if competitors are already on big box retailers’ shelves, Canopy Growth will have to differentiate itself and its products at least in some way to deliver on Linton’s ambitious promise of taking top CBD market share within the next year. Part of that process is already underway with Canopy Growth paying more than $50 million for British cosmetics company This Works with plans to add CBD to certain lotions and sleep products. The company also partnered with Martha Stewart to develop CBD-infused lines of animal products, foods and cosmetics. Either effort could be enough to differentiate Canopy Growth in a crowded field, according to Brightfield Group Managing Director Bethany Gomez.

What is Canopy Growth’s secret weapon

“Coming in out of nowhere and being able to hit a leading market share is definitely ambitious,” Gomez told Yahoo Finance. “Strong brand positioning, celebrity endorsements, things like that will benefit them, certainly … There’s very weak consumer brand awareness in the market right now, so it is possible.”

Along the same line, getting on the shelf at a large retailer is not the final inning. Provided Canopy Growth can ink similar deals with big box stores, provide a better price point or have fewer supply issues could be enough to yank shelf space from competitors.

The fact that Canopy Growth is licensed to cultivate CBD from hemp at scale in seven states across the country could be an added secret weapon that could help the company compete, especially if regulatory changes spook retailers into working exclusively with larger, individually state-licensed operators.

“My position is I think the big guys are on the sidelines until a competent large company can deliver to them the certainty they want,” Linton said. “What we’re doing is we’re state licensing — I’m not sure most are. And we’re trying to follow the federally intended rules and we’re doing it at scale where we can actually confirm the source origin and controls on CBD.”

In the end, to reach the level of the established CBD companies, Canopy Growth will need to ramp sales quickly from zero to more than $50 million a year. In 2018, CW Hemp posted $69.5 million in total annual revenue as the mark to beat.

Considering there continues to be a reordering of market share for the players in the CBD industry, Gomez said there’s a good chance Linton can deliver on his promise.

“In this industry I think anything’s possible,” she said.

Zack Guzman is the host of YFi PM as well as a senior writer and on-air reporter covering entrepreneurship, startups, and breaking news at Yahoo Finance. Follow him on Twitter @zGuz.

Read the latest financial and business news from Yahoo Finance

Read more:

Why the Farm Bill could make 2019 the year of CBD

The Farm Bill could end the multimillion dollar industry of cockfighting

One of the largest CBD company’s CEO is stealthily backing a hemp plastics startup

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews,LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance