Canadian Natural (CNQ) Q2 Earnings & Sales Beat Estimates

Canadian Natural Resources Limited CNQ reported second-quarter 2022 adjusted earnings per share of $2.55, beating the Zacks Consensus Estimate of $2.08 and the year-ago quarter’s earnings of $1.01. This outperformance is primarily attributable to higher commodity price realizations due to surging commodity prices and increased year-over-year production.

Moreover, total revenues of $8.99 billion beat the Zacks Consensus Estimate of $7.84 billion due to a year-over-year rise in sales volumes. The top line also improved from $5.31 billion a year ago.

During the quarter under review, Canadian Natural, which is committed to adding shareholder value, returned C$900 million (C$0.9 billion) via dividends.

CNQ’s board of directors announced a quarterly cash dividend on its common shares of 75 Canadian cents per common share. The dividend will be payable on Oct 5, 2022 to shareholders of record at the close of the business on Sep 16, 2022.

In good news for investors, Canadian Natural’s board declared a special cash dividend on its common shares of C$1.50 per common share. The dividend will be payable on Aug 31, 2022 to shareholders of record at the close of the business on Aug 23, 2022.

Production & Prices

Canadian Natural reported the quarterly production of 1,211,147 barrels of oil equivalent per day, up about 6% from the prior-year quarter’s level. The oil and NGL output (accounting for almost 71% of total volumes) declined to 860,338 barrels per day (Bbl/d) from 872,718 Bbl/d a year ago.

The crude oil and NGL production from operations in North America, including the synthetic crude oil production of 356,953 Bbl/d and the bitumen output of 249,938 Bbl/d, totaled 606,891 Bbl/d, comparing unfavorably with the year-ago quarter’s 620,258 Bbl/d.

Natural gas volumes recorded a 30.4% year-over-year rise from 1,614 million cubic feet per day (MMcf/d) to 2,105 MMcf/d in the quarter. Production in North America summed at 2,089 MMcf/d compared with 1,594 MMcf/d in the prior year.

Canadian Natural’s realized natural gas price surged 120.4% to C$5.95 per thousand cubic feet from the year-ago level of C$2.70. Moreover, the realized oil and NGL price jumped 88.3% to C$115.26 per barrel from C$61.20 in the second quarter of 2021.

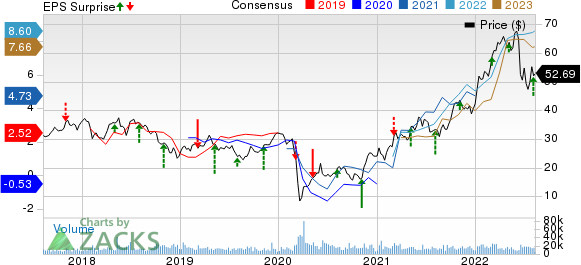

Canadian Natural Resources Limited Price, Consensus and EPS Surprise

Canadian Natural Resources Limited price-consensus-eps-surprise-chart | Canadian Natural Resources Limited Quote

Costs & Capital Expenditure

Total expenses incurred in the quarter were C$6,943 million, higher than the C$4,528 million recorded a year ago. An increase in production expenses, along with transportation, blending and feedstock costs, and an increase in share-based compensations escalated the overall cost.

In the reported quarter, the capital expenditure totaled C$1,450 million.

Balance Sheet

As of Jun 30, Canadian Natural had C$233 million of cash and cash equivalents and long-term debt of C$11,317 million, representing debt to total capital of about 22.3%.

Guidance

Canadian Natural's 2022 base capital will now be targeted at approximately $3,845 million, an increase of approximately $200 million over the original guidance, largely due to forecast inflationary pressures in all operating areas for items, such as steel, manufactured goods, services and labor.

CNQ’s production annual guidance now stands in the 1,295,000 BOE/d-1,335,000 BOE/d range from the earlier range of 1,270,000 BOE/d-1,320,000 BOE/d.

Zacks Rank & Key Picks

Canadian Natural Resources currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks from the energy space that warrant a look include Cenovus Energy CVE, Equinor EQNR and BP BP, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Cenovus Energy’s 2022 earnings is pegged at $3.41 per share, up 321% from the year-ago earnings of 81 cents.

The Zacks Consensus Estimate for CVE’s 2022 earnings has been revised about 20.5% upward over the past 60 days from $2.83 per share to $3.41.

Equinor beat the Zacks Consensus Estimate for earnings in all the trailing four quarters, the average being around 7.3%.

The Zacks Consensus Estimate for EQNR’s 2022 earnings stands at $6.09 per share, up about 97.7% from the year-ago earnings of $3.08.

The Zacks Consensus Estimate for BP’s 2022 earnings is pegged at $8.26 per share, which is an increase of about 116.2% from the year-ago earnings of $3.82.

BP beat the Zacks Consensus Estimate for earnings in all the trailing four quarters, the average being around 15.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP) : Free Stock Analysis Report

Cenovus Energy Inc (CVE) : Free Stock Analysis Report

Canadian Natural Resources Limited (CNQ) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance